13 TAXATION

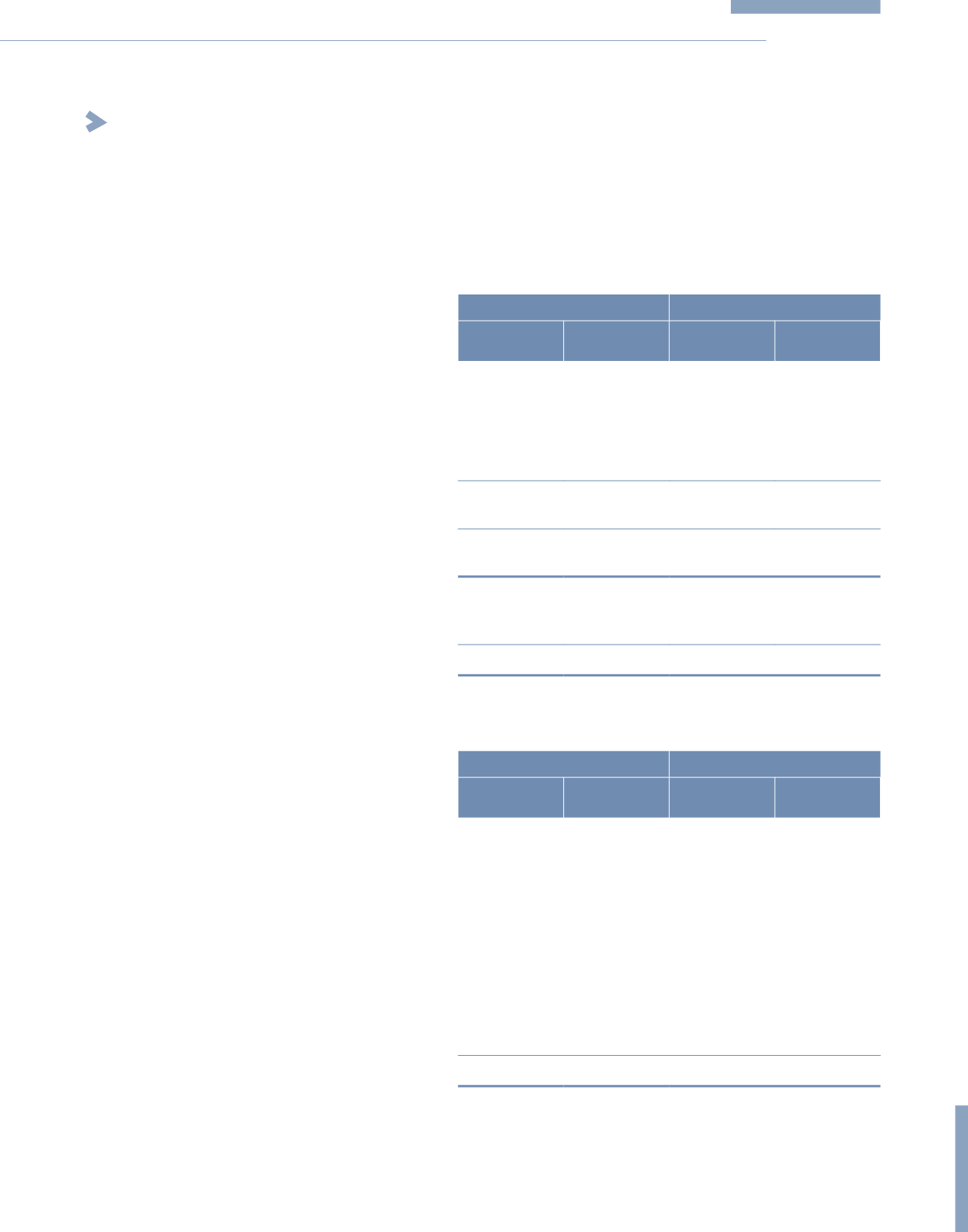

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Malaysian income tax:

– In respect of current financial year

42,782

81,712

454

–

– In respect of prior financial year

(5,369)

(4,871)

–

(1,103)

Foreign income tax:

– In respect of current financial year

26

21

–

–

37,439

76,862

454

(1,103)

Deferred tax (Note 23)

24,760

(8,296)

–

–

Income tax expense/(income)

recognised in profit or loss

62,199

68,566

454

(1,103)

Deferred tax related to other comprehensive income:

– Net surplus on revaluation of

land and buildings

10,629

1,105

–

–

10,629

1,105

–

–

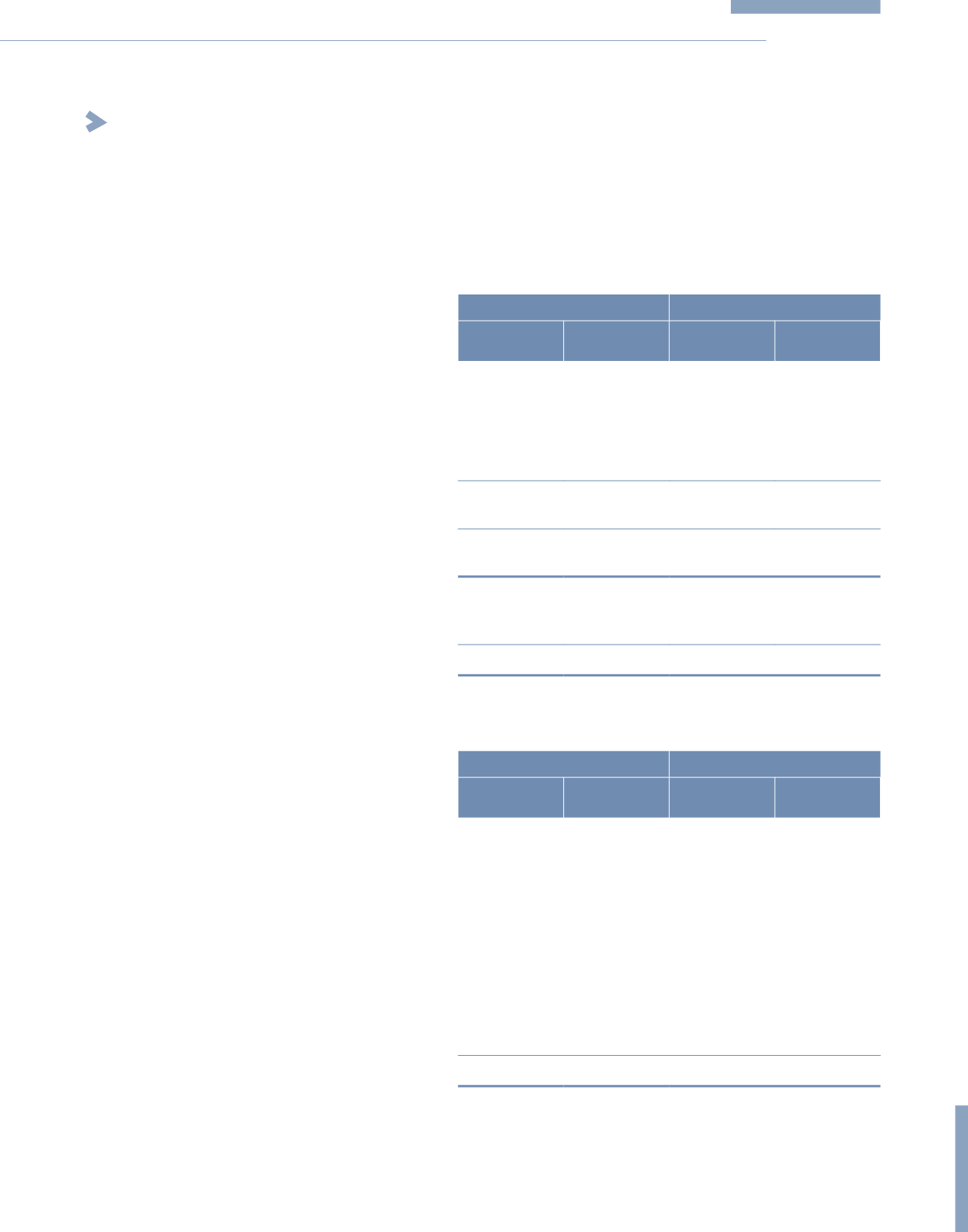

A reconciliation of income tax expense applicable to profit before taxation after zakat at the Malaysian statutory income tax

rate to income tax expense at the effective income tax rate of the Group and of the Company is as follows:

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Profit before tax after zakat

207,328

215,812

92,920

82,894

Tax at Malaysian statutory tax rate of

25% (2014: 25%)

51,832

53,953

23,230

20,724

Tax effect of:

– Different tax rates

(80)

(65)

–

–

– Income not subject to tax

(2,588)

(6,693)

(29,231)

(27,760)

– Expenses not–deductible for tax purposes

21,951

29,336

6,455

7,036

– Share of results of associates

(9,161)

(10,104)

–

–

– (Over)/under provision of income tax

(5,369)

(4,871)

–

(1,103)

– Temporary differences not recognised as

deferred tax assets

5,614

7,010

–

–

Income tax expense/(credit)

62,199

68,566

454

(1,103)

273

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)