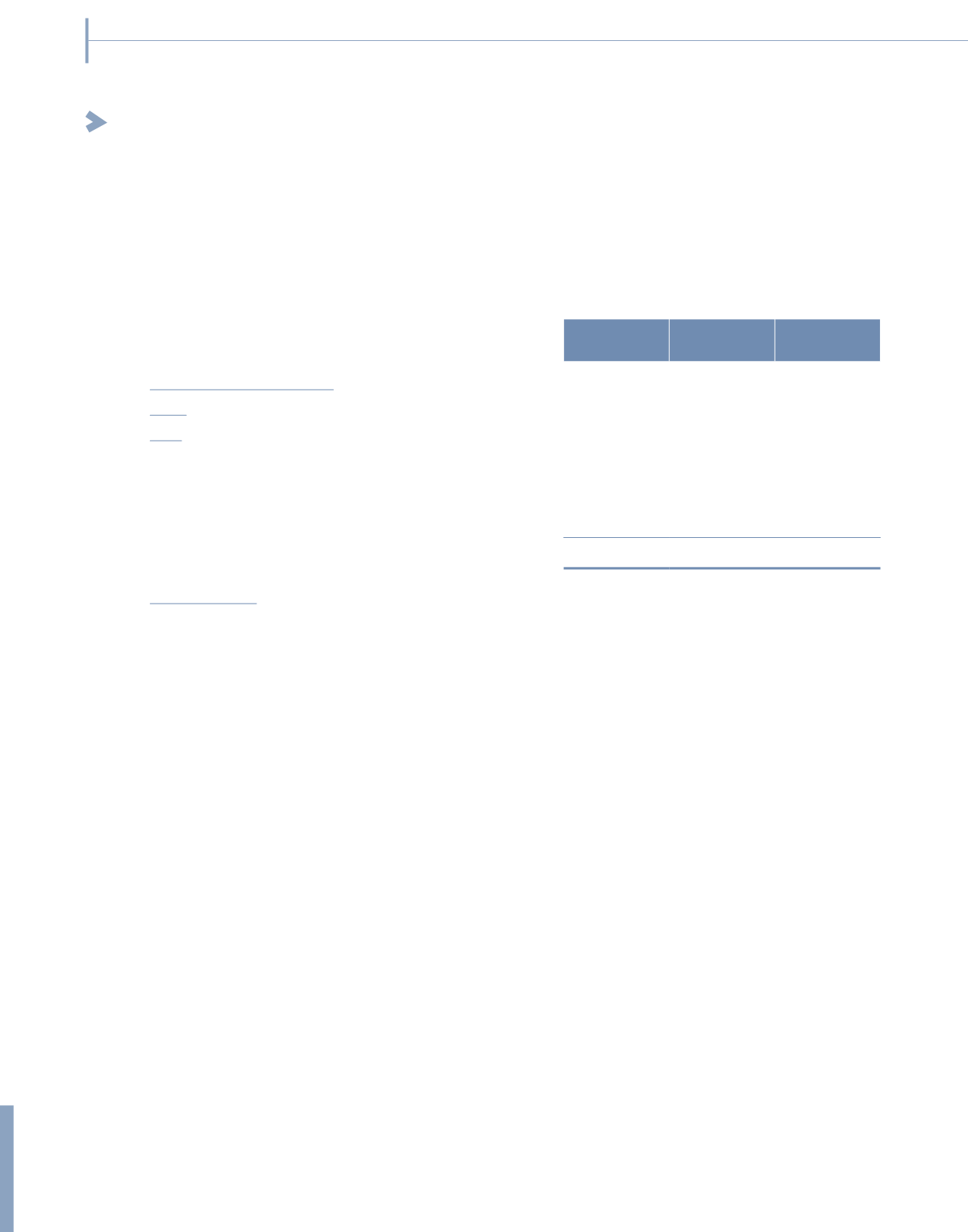

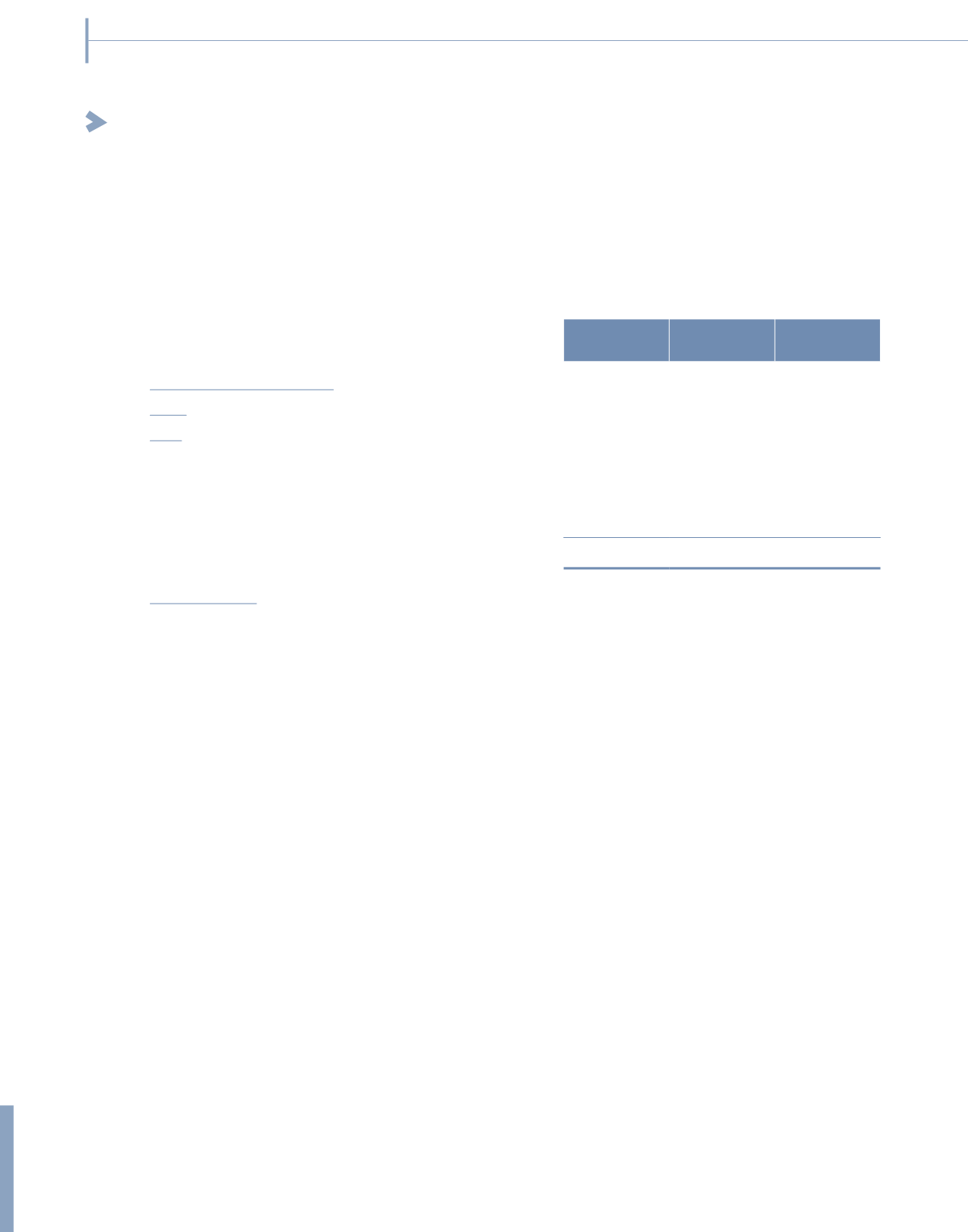

5 FAIR VALUE OF FINANCIAL INSTRUMENTS (CONTINUED)

(b) Fair value measurement (continued)

Level 2

RM’000

Level 3

RM’000

Total

RM’000

Assets measured at fair value

Group

2014

Property, plant and equipment (Note 16):

– Long leasehold land

43,093

–

43,093

– Buildings

12,685

20,647

33,332

Investment properties (Note 17)

62,342

205,408

267,750

118,120

226,055

344,175

Level 3 fair value

Level 3 fair value has been derived as described in Note 16 and 17. There were no material transfer between Level 2

and Level 3 during the financial year other than as described above.

The Group and Company do not have any financial liabilities carried at fair value nor any financial instruments classified

as Level 1 as at 31 December 2015 and 31 December 2014.

266

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)