3 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONTINUED)

(b) Liquidity risk

Liquidity risk is the risk that the Group or the Company will encounter difficulty in meeting financial obligations due to

shortage of funds. The Group's and the Company's exposure to liquidity risk arises primarily from mismatches of the

maturities of financial assets and liabilities.

Cash flow forecasting is performed by Group finance. Group finance monitors rolling forecasts of the Group’s liquidity

requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient headroom on its

undrawn committed borrowing facilities at all times so that the Group does not breach borrowing limits or covenants

on any of its borrowing facilities. Such forecasting takes into consideration the Group's debt financing plans, covenant

compliance and compliance with internal statements of financial position ratio targets.

Surplus cash held by the subsidiaries over and above balance required for working capital management are transferred

to the Group treasury. Group treasury invests surplus cash in financial instruments with appropriate maturities or

sufficient liquidity to provide sufficient headroom as determined by the abovementioned forecasts.

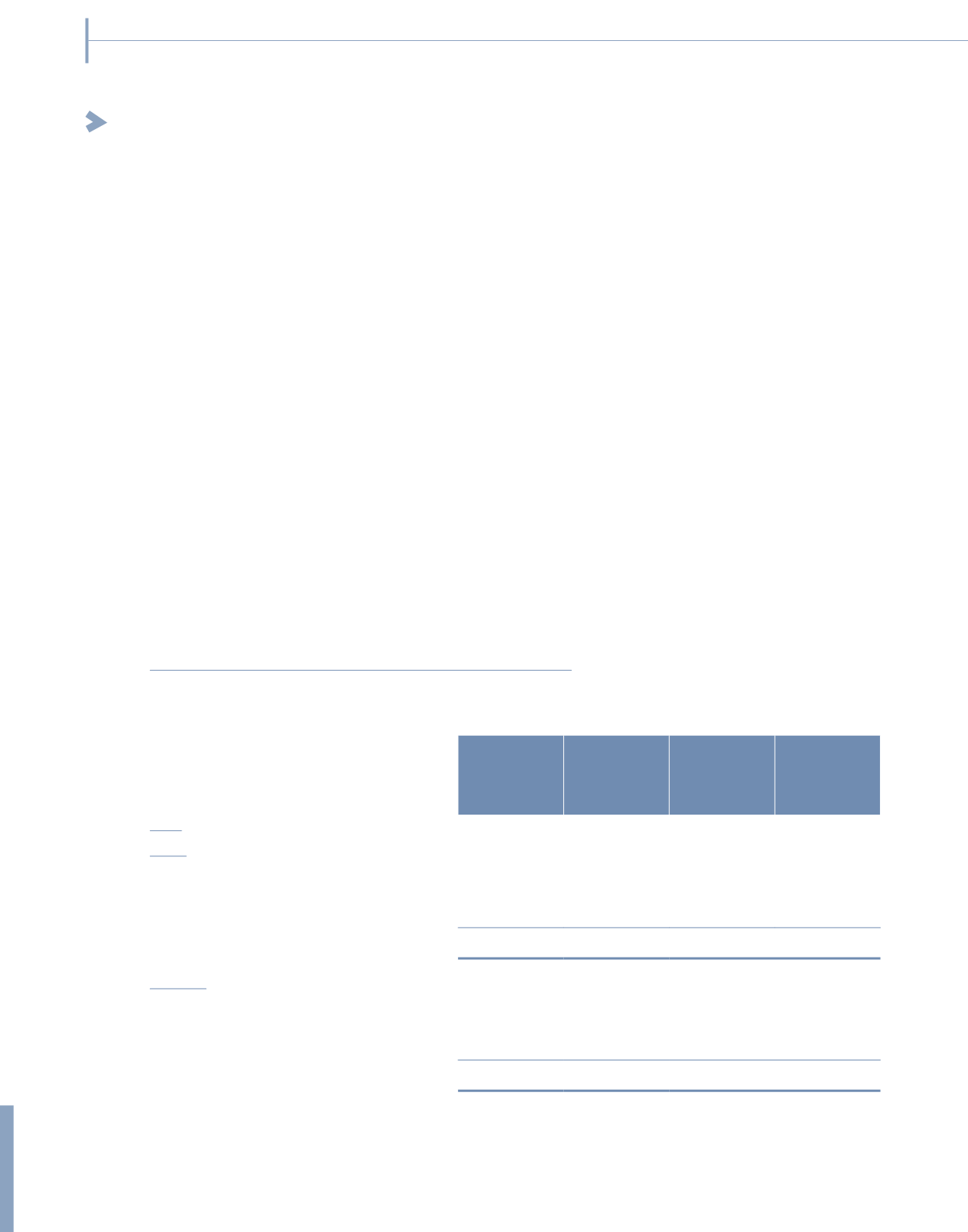

The table below analyses the Group’s financial liabilities into relevant maturity groupings based on the remaining period

at the reporting date to the contractual maturity date. The amounts disclosed in the table are the contractual

undiscounted cash flows.

Analysis of financial instruments by remaining contractual maturities

The table below summarises the maturity profile of the Group's and of the Company's liabilities at the reporting date

based on contractual undiscounted repayment obligations.

On demand

or within

1 year

RM’000

1 – 5 years

RM’000

Over

5 years

RM’000

Total

RM’000

2015

Group

Trade and other payables

616,883

–

–

616,883

Borrowings

359,149

334,702

888,071

1,581,922

Deposits

–

–

13,914

13,914

Total undiscounted financial liabilities

976,032

334,702

901,985

2,212,719

Company

Trade and other payables

207,093

258,599

–

465,692

Borrowings

130,120

–

–

130,120

Financial guarantee contracts*

800,000

–

–

800,000

Total undiscounted financial liabilities

1,137,213

258,599

–

1,395,812

* Related to Islamic Medium Term Notes (Note 29)

262

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)