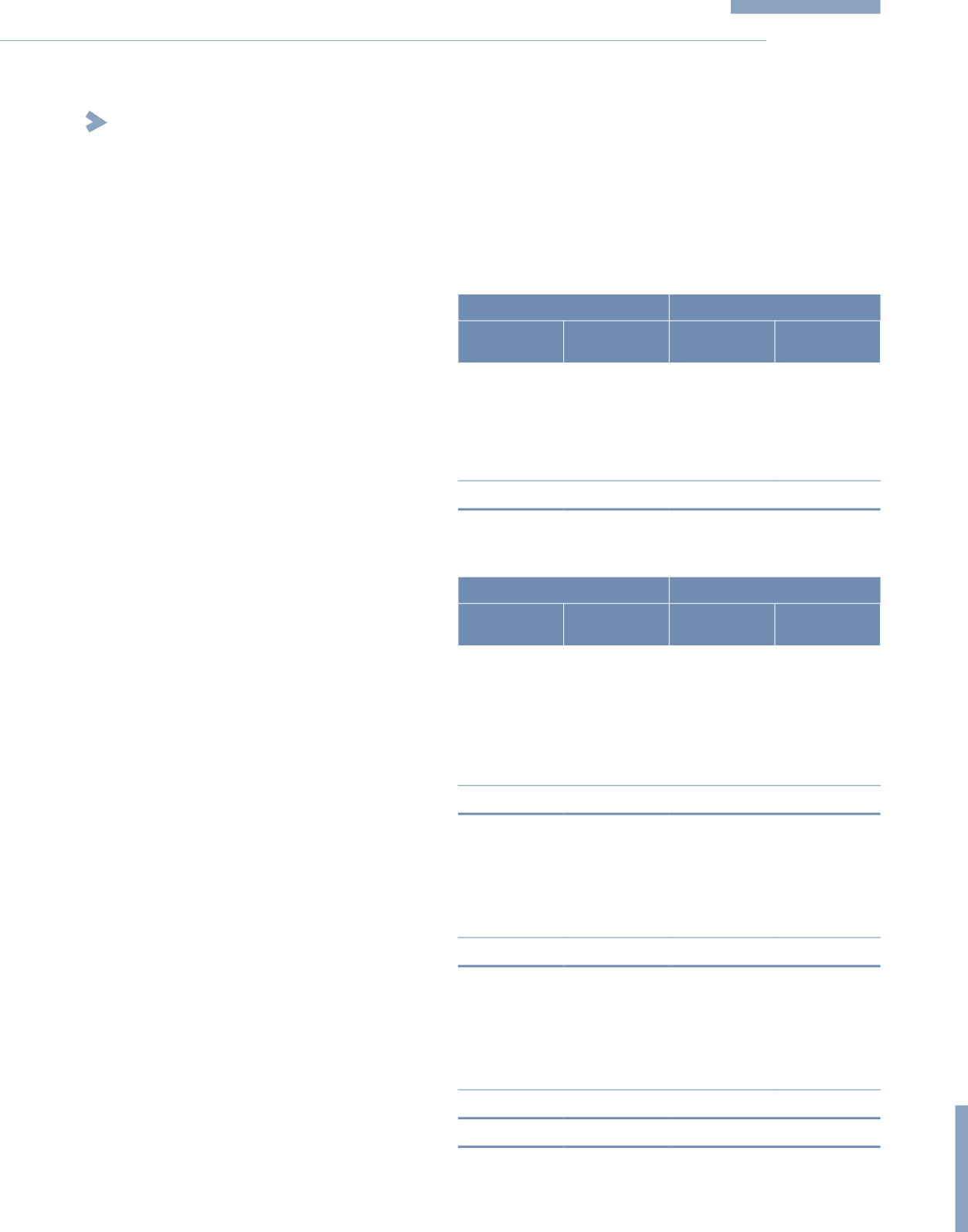

10 EMPLOYEE BENEFITS COSTS

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Staff costs (excluding Directors’ remuneration):

– Salaries, allowances and bonus

544,379

514,844

20,625

21,262

– Contribution to defined contribution plan

72,319

52,098

2,601

2,839

– Share-based payments

24,566

–

1,126

–

– Provision for retirement benefits

246

231

–

–

641,510

567,173

24,352

24,101

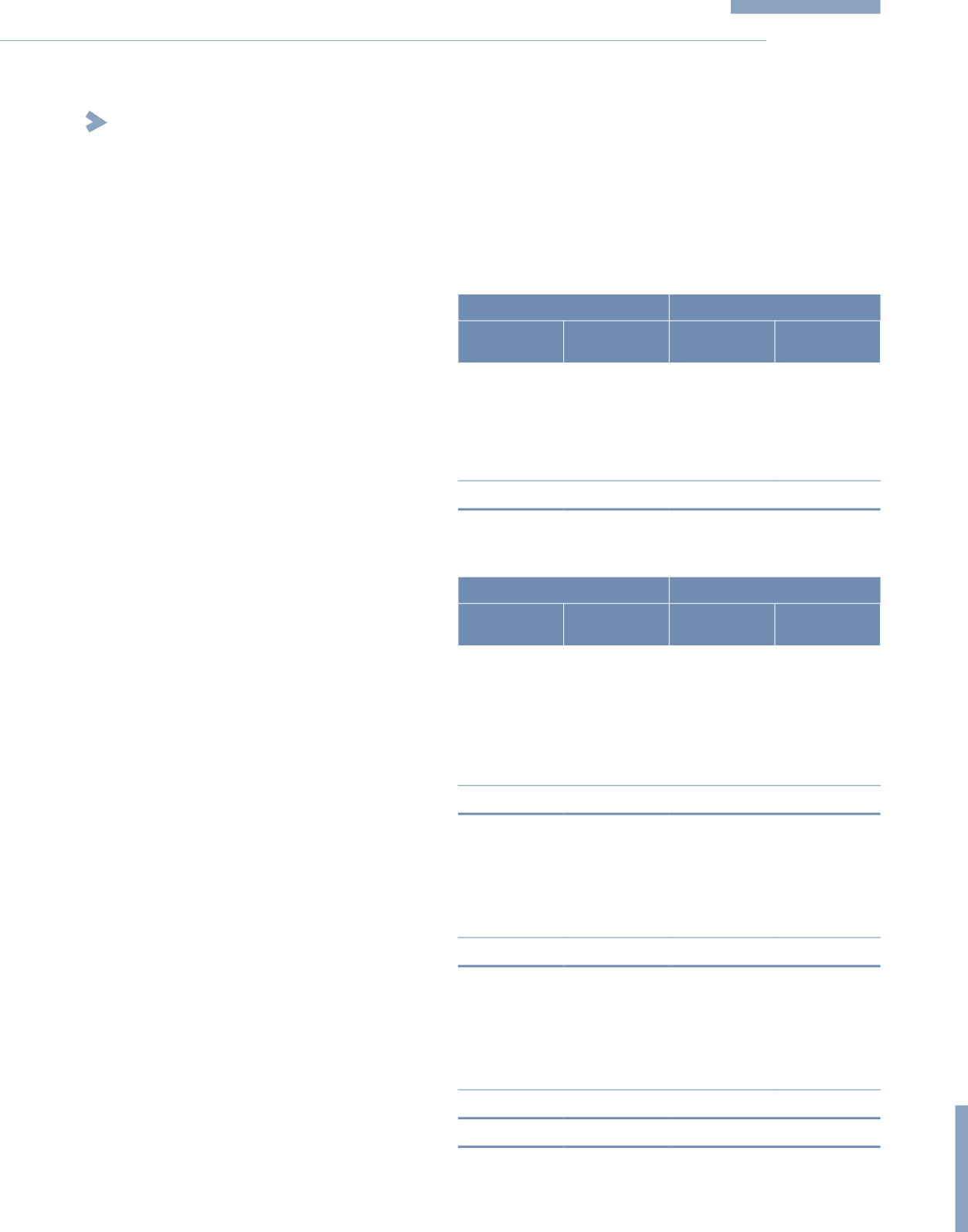

11 DIRECTORS’ REMUNERATION

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Executive Director:

– Fees

150

125

100

75

– Salaries, allowances and bonuses

1,112

947

1,112

947

– Contribution to defined contribution plan

148

140

148

140

– Share–based payments

503

–

503

–

– Benefits-in-kind

22

22

22

22

1,935

1,234

1,885

1,184

Non-Executive Directors:

– Fees

375

250

375

250

– Allowances

74

41

74

34

– Share-based payments

201

–

201

–

– Benefits-in-kind

–

–

–

–

650

291

650

284

Independent Non-Executive Directors:

– Fees

684

412

641

300

– Allowances

544

698

451

389

– Share-based payments

1,207

–

1,207

–

– Benefits-in-kind

21

21

21

21

2,456

1,131

2,320

710

5,041

2,656

4,855

2,178

271

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)