17 INVESTMENT PROPERTIES

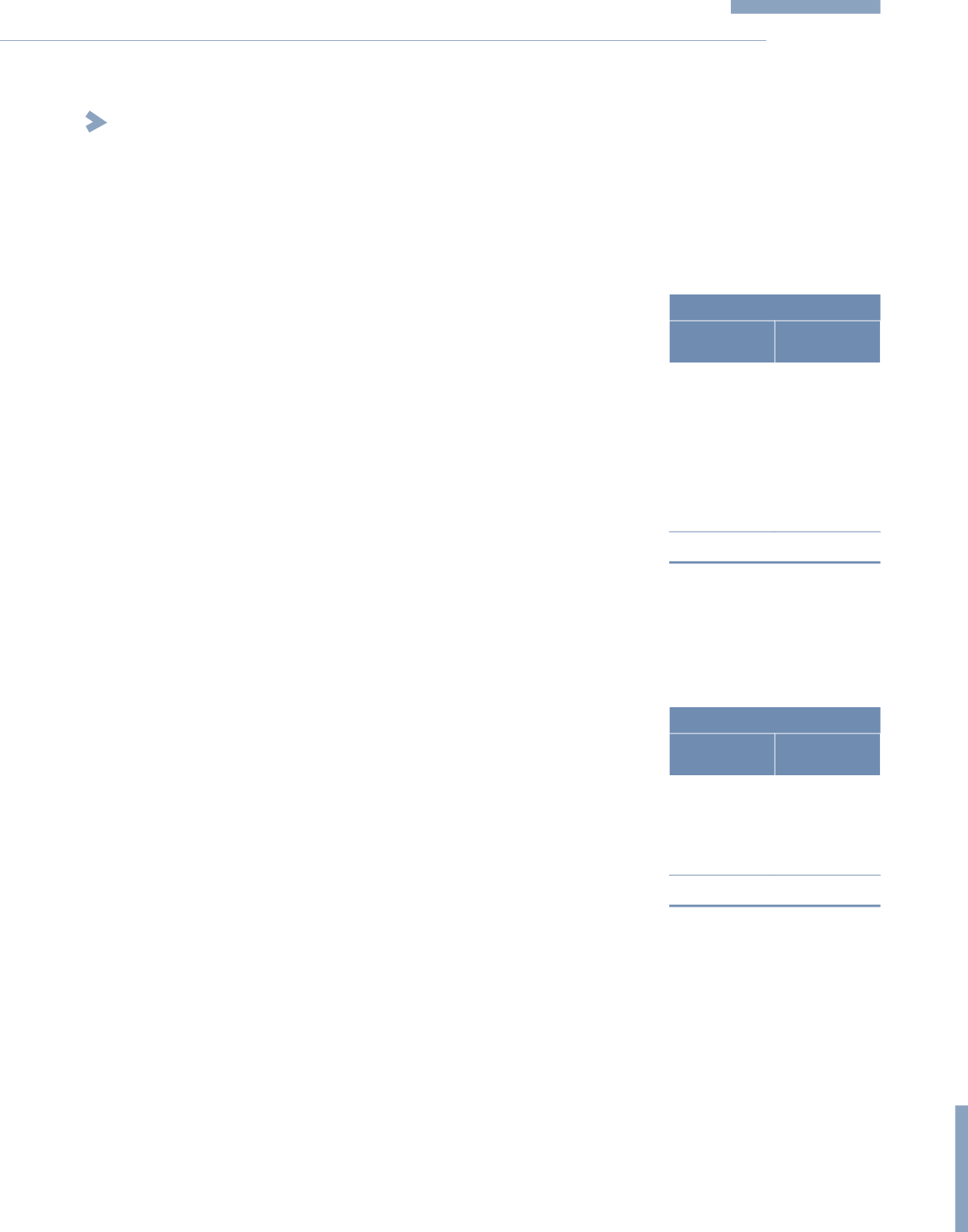

Group

2015

RM’000

2014

RM’000

At fair value:

At 1 January

267,750

62,746

Additions

130

195,218

Transfer to property, plant and equipment (Note 16)

–

(3,255)

Disposal

–

(1,209)

Exchange differences

532

(211)

Gain on fair value recognised in other income (Note 9)

11,421

14,461

At 31 December

279,833

267,750

The fair value of the properties was estimated at RM279,833,000 (2014: RM267,750,000) based on valuations performed by

independent professionally qualified valuers, using either the comparison or investment method as described below.

Fair value hierarchy disclosures for investment properties are in Note 5.

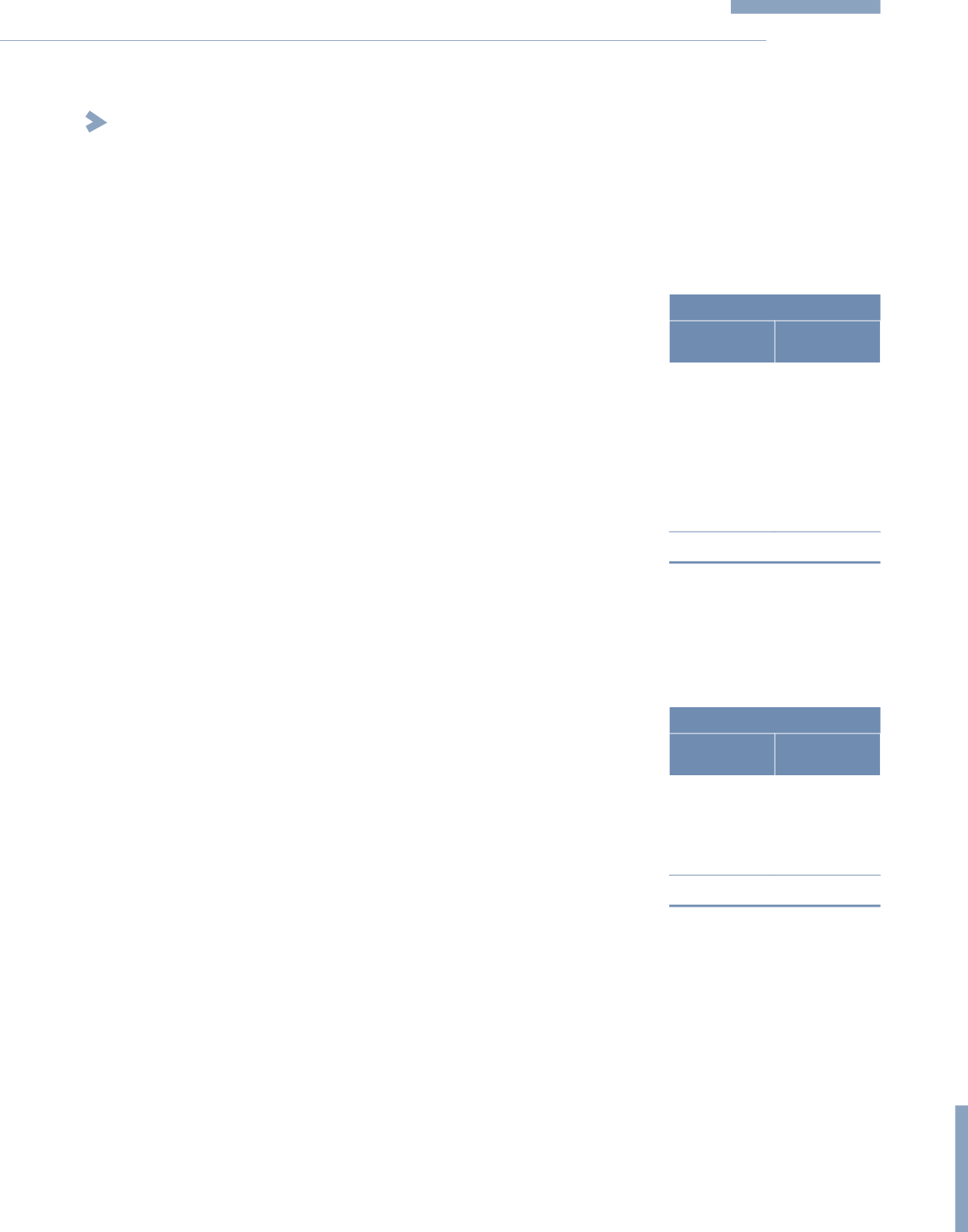

The following table shows a reconciliation of Level 3 fair value:

Group

2015

RM’000

2014

RM’000

At 1 January

205,408

–

Additions

–

192,875

Reclassification from Level 2

63,004

–

Re-measurement recognised in profit or loss

11,421

12,533

At 31 December

279,833

205,408

281

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)