16 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

Revaluation of land and buildings

Land and buildings have been revalued on 31 December 2015 based on comparison method carried out by independent

firms of professional valuers in determining its fair value. These were based on recent sale transactions of comparable

properties with adjustments made to reflect location, visibility, size, tenure and age. The book values of the land and

buildings were adjusted to reflect the revaluation and the resultant surpluses were credited to revaluation reserve. These

were all Level 3 in the fair value hierarchy.

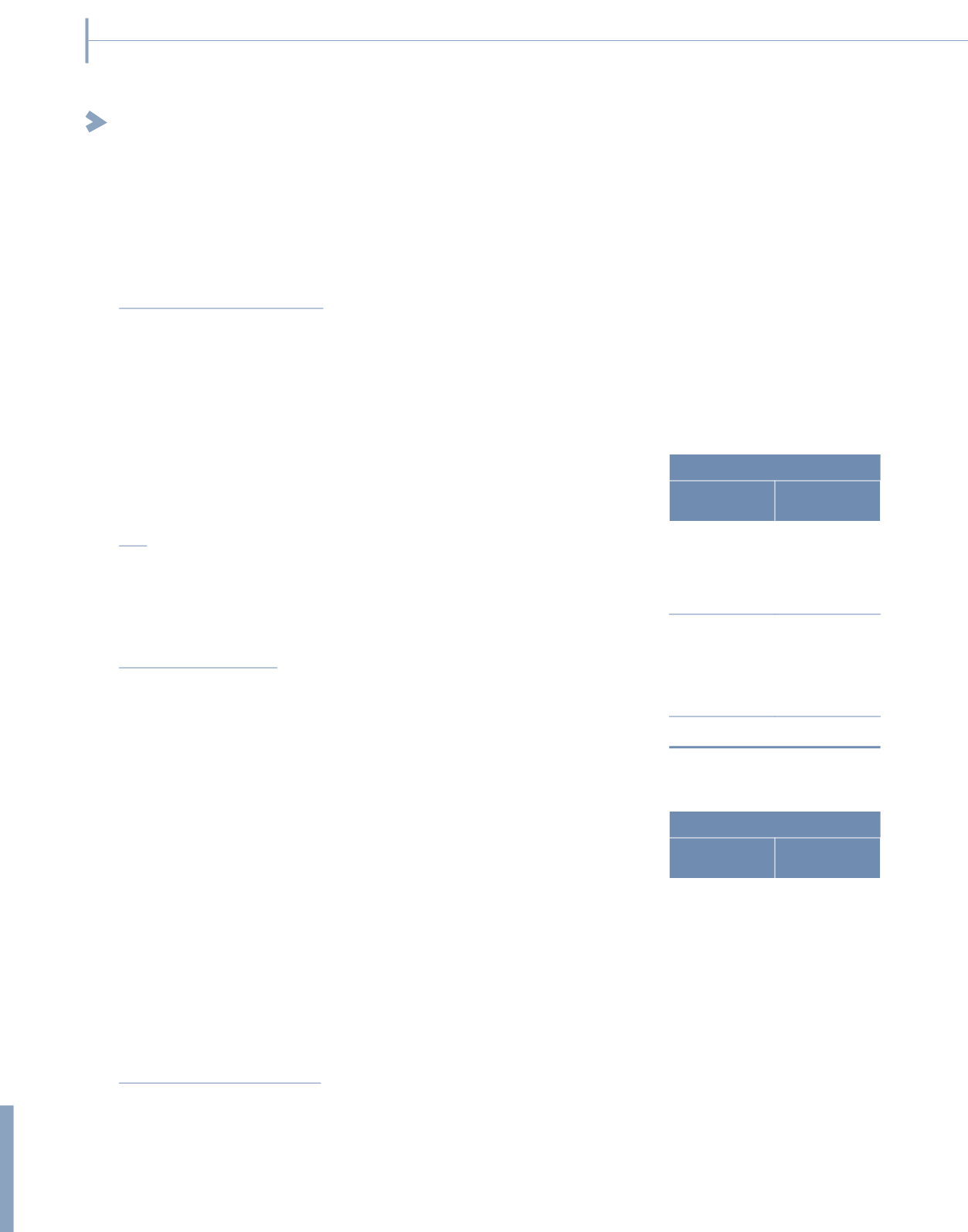

If the total amounts of the land and buildings had been determined in accordance with the historical cost convention, they

would have been included at:

Group

2015

RM’000

2014

RM’000

Cost

Freehold land

80,923

5,899

Leasehold land

35,580

33,080

Buildings

205,752

37,214

322,255

76,193

Accumulated depreciation

Leasehold land

(232)

(216)

Buildings

(4,115)

(6,030)

Net carrying amounts

317,908

69,947

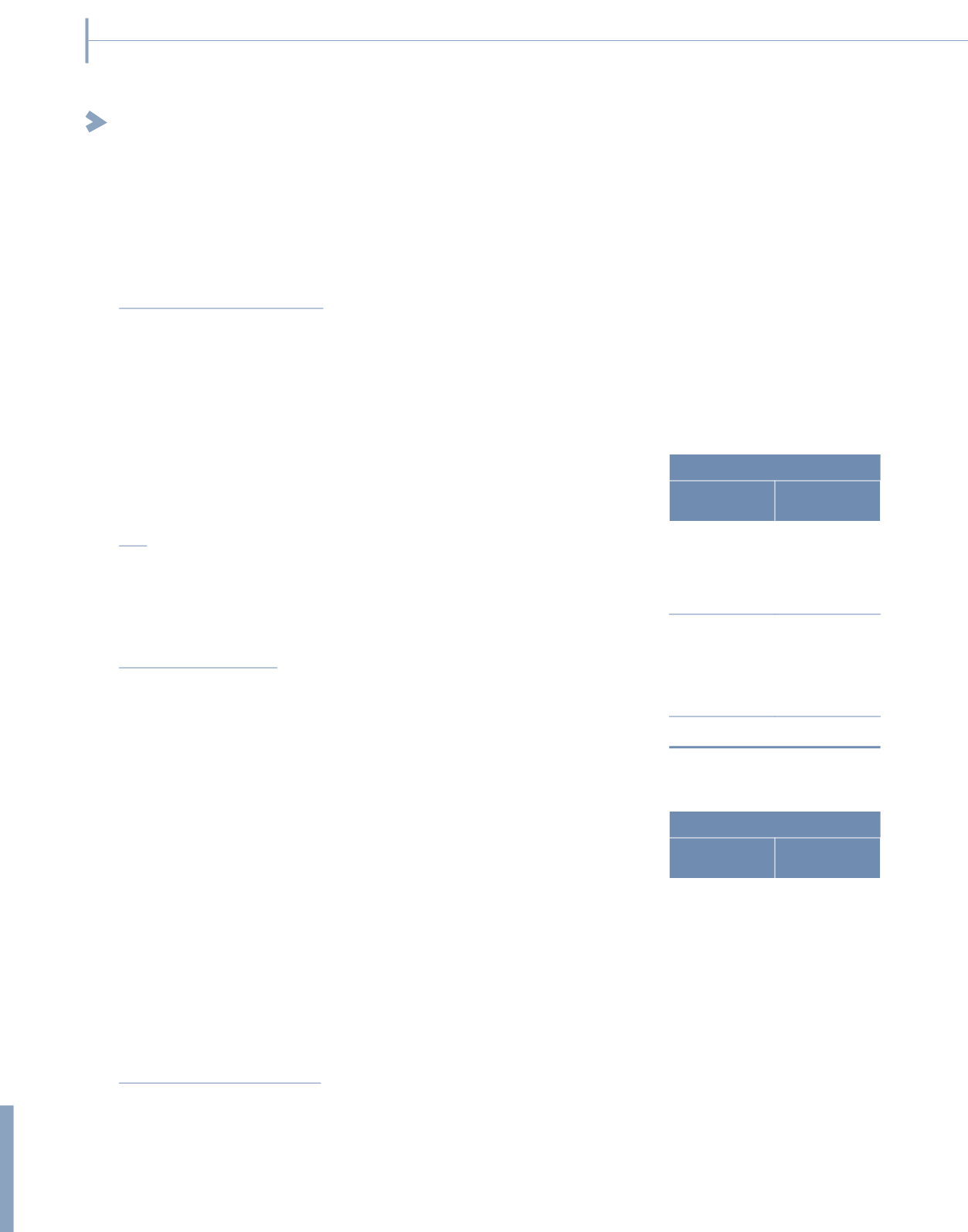

The additions and net book value of assets under hire purchase and finance leases are as follows:

Group

2015

RM’000

2014

RM’000

Assets under finance leases:

– Addition during the financial year

16,412

10,108

– Net book value at the end of financial year

60,239

78,201

The net book value of property, plant and equipment pledged for borrowing facility as at 31 December 2015 is RM372,332,000

(2014: RM425,992,000) as disclosed in Note 29.

During the year, a subsidiary received a government grant in relation to the purchase of assets amounting to RM1,245,000 (2014

: Nil). The amount has been set off against the cost of building.

Capitalisation of borrowing costs

The capital work-in-progress includes borrowing costs arising from general and specific borrowings. During the financial year,

borrowing costs capitalised as part of capital work-in-progress amounted to RM10,065,000 (2014: RM1,757,000).

280

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)