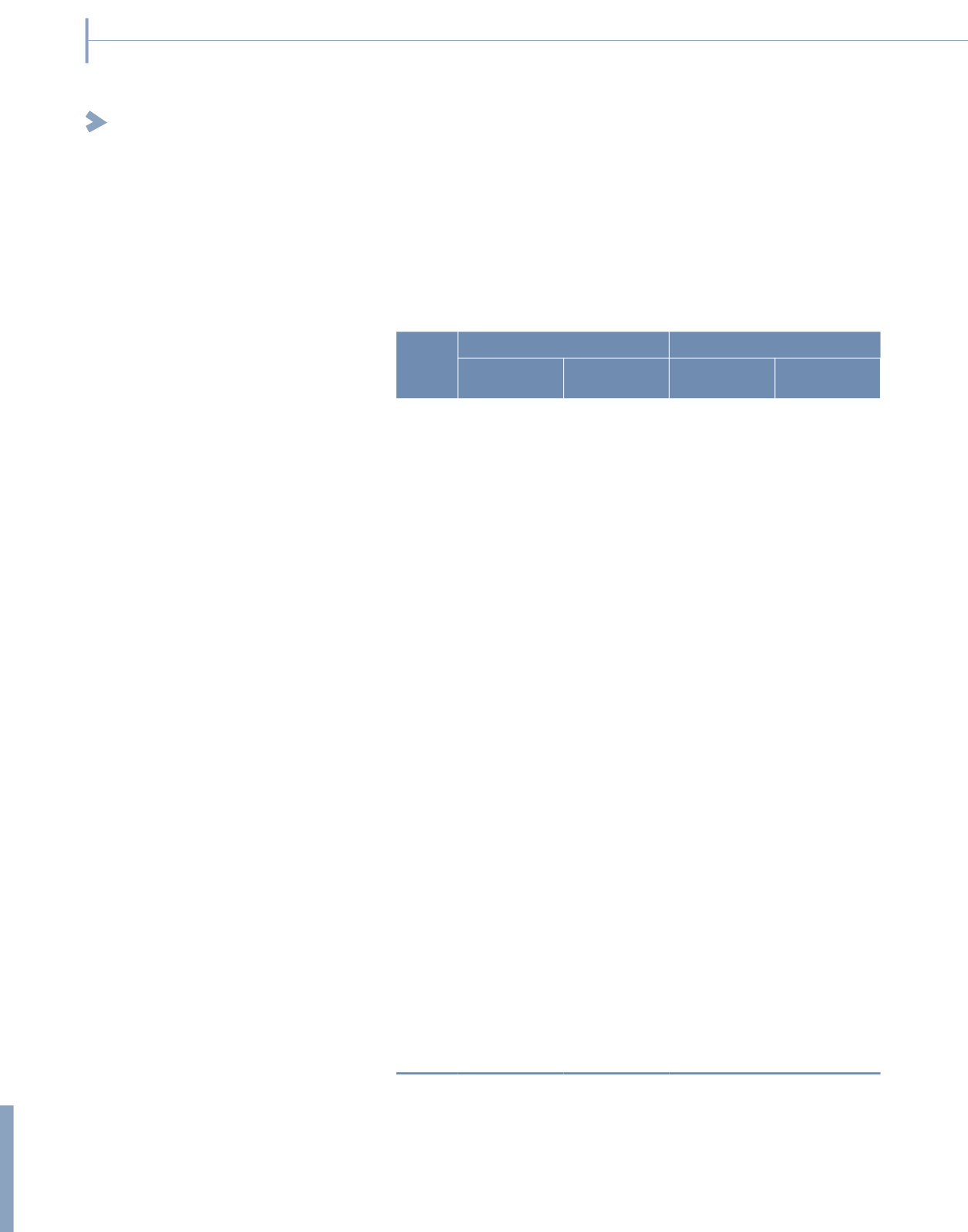

9 PROFIT BEFORE ZAKAT AND TAX

Profit before zakat and tax is arrived at after charging/(crediting):

Group

Company

Note

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Auditors’ remuneration:

– Statutory audits

2,207

1,822

260

98

– Other services

986

743

–

–

Trade receivables:

– Impairment charge for the year

25

5,814

6,843

–

–

– Reversal of impairment loss

25

(947)

(917)

–

–

Contribution to Klinik Waqaf An–Nur

3,120

3,120

–

–

Directors' remuneration

11

5,041

2,656

4,855

2,178

Consultants fees

701,864

647,769

–

–

Cost of medical supplies

712,328

657,426

–

–

External lab services

67,750

62,528

–

–

Inventories written off

120

96

–

–

Professional fees

2,712

5,771

1,234

1,990

Repair and maintenance

37,700

35,072

152

195

Direct operating expenses for investment

properties

8,900

2,959

–

–

Property, plant and equipment:

– Depreciation

16

118,713

108,268

–

–

– Write off

6,374

473

–

–

– Loss on disposal

154

266

–

–

– Reversal of impairment loss

–

(3,581)

–

–

Rental expense of land and buildings

115,398

104,907

3

2

Rental of equipment and vehicles

5,600

5,088

92

142

Employee benefits costs

10

641,510

567,173

24,352

24,101

Intangible assets:

– Impairment of goodwill

18

–

728

–

–

Available-or-sale financial assets

written off

22

6

266

–

–

Share based payment – restricted issue

34

7,004

–

–

–

Amortisation of software expenditure

18

456

1,140

–

–

Gain on fair value of investment properties

17

(11,421)

(14,461)

–

–

Gain on disposal of investment property

–

(166)

–

–

Gain on disposal of shares in an associate

(1,577)

(1,732)

–

–

Gain on disposal of non–current assets

27

(5,986)

(1,577)

–

–

270

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)