3 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONTINUED)

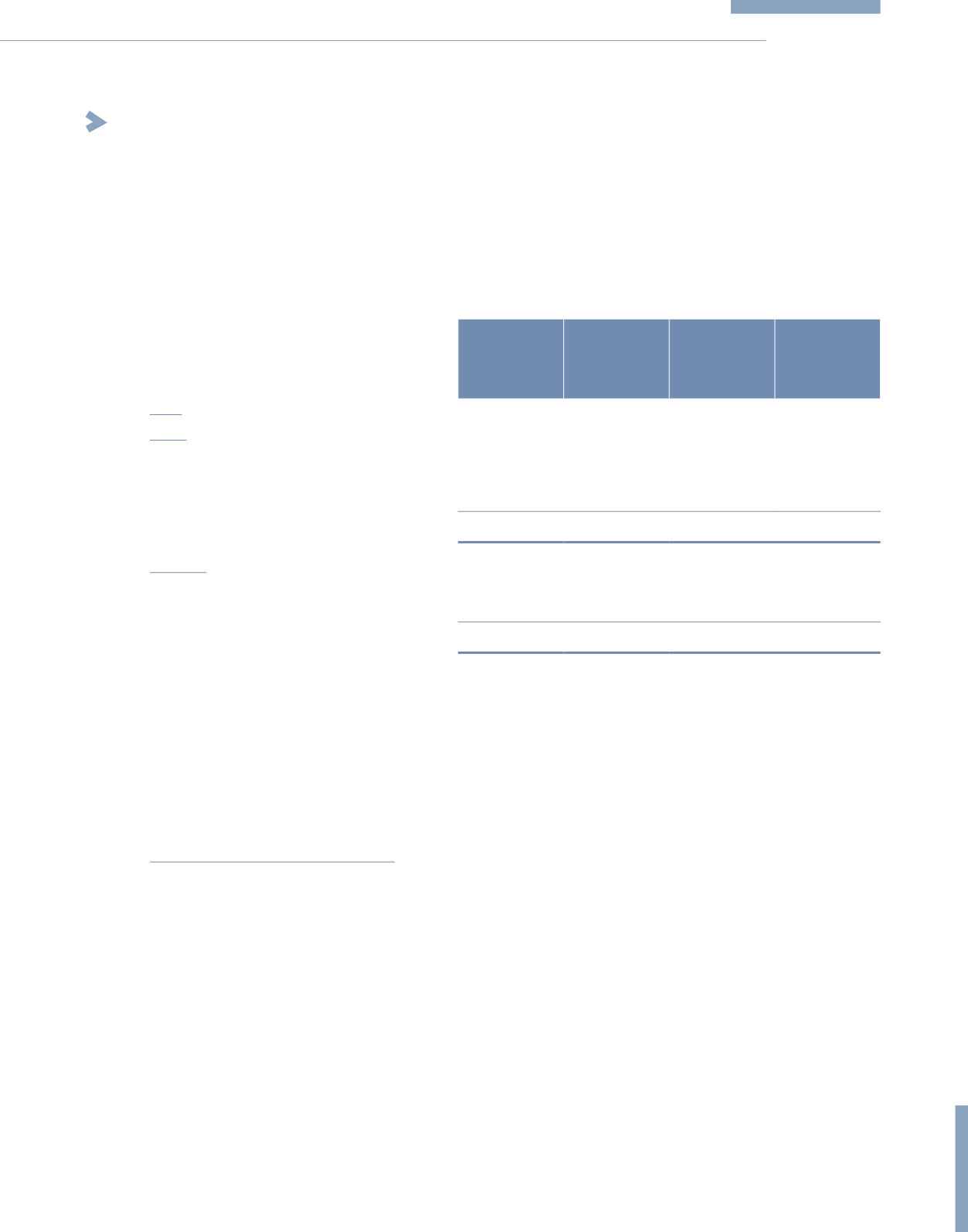

(b) Liquidity risk (continued)

On demand

or within

1 year

RM’000

1 – 5 years

RM’000

Over

5 years

RM’000

Total

RM’000

2014

Group

Payables

565,158

–

–

565,158

Borrowings

960,277

258,140

153,119

1,371,536

Deposits

17,996

–

–

17,996

Total undiscounted financial liabilities

1,543,431

258,140

153,119

1,954,690

Company

Payables

234,853

125,911

–

360,764

Borrowings

260,100

–

–

260,100

Total undiscounted financial liabilities

494,953

125,911

–

620,864

The Group has total undrawn borrowing facilities amounting to RM1.0 billion as at 31 December 2015.

(c) Interest rate risk

Interest rate risk is the risk that the fair value of future cash flows of the Group’s and of the Company’s financial

instruments will fluctuate because of changes in market interest rates.

The Group’s and the Company’s exposure to interest rate risk arises primarily from their borrowings. The Group’s policy

is to manage interest cost using a mix of fixed and floating rate debts.

Sensitivity analysis for interest rate risk

At the reporting date, if interest rates had been 10 basis points lower/higher, with all other variables held constant,

the Group’s profit for the financial year would have been RM51,901 (2014: RM724,000) higher/lower, arising mainly

as a result of lower/higher interest expenses on floating rate loans and borrowings. The assumed movement in interest

rate for interest rate sensitivity analysis is based on the currently observable market environment.

(d) Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because

of changes in foreign exchange rates. The Group does not face significant exposure from foreign currency risk.

(e) Offsetting financial assets and financial liabilities

There are no offsetting of financial assets and financial liabilities during the year for the Group and Company.

263

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)