5 FAIR VALUE OF FINANCIAL INSTRUMENTS

(a) Determination of fair value

Financial instruments that are not carried at fair value and whose carrying amounts are reasonable approximation of

fair value

The following are classes of financial instruments that are not carried at fair value and whose carrying amounts are

reasonable approximation of fair value:

Current asset/liability

Note

Trade and other receivables and amounts due from subsidiaries

25

Deposits, cash and bank balances

26

Trade and other payables and amounts due to subsidiaries

28

Borrowings

29

Deposits

32

The carrying amounts of these financial assets and liabilities are reasonable approximation of fair values, either due to

their short-term nature or that they are floating rate instruments that are re-priced to market interest rates on or near

the reporting date.

The fair values of long term receivables and payables, which primarily comprise advances to or from subsidiaries, are

estimated by discounting expected future cash flows at market incremental lending rate for similar types of lending,

borrowing or leasing arrangement at the reporting date.

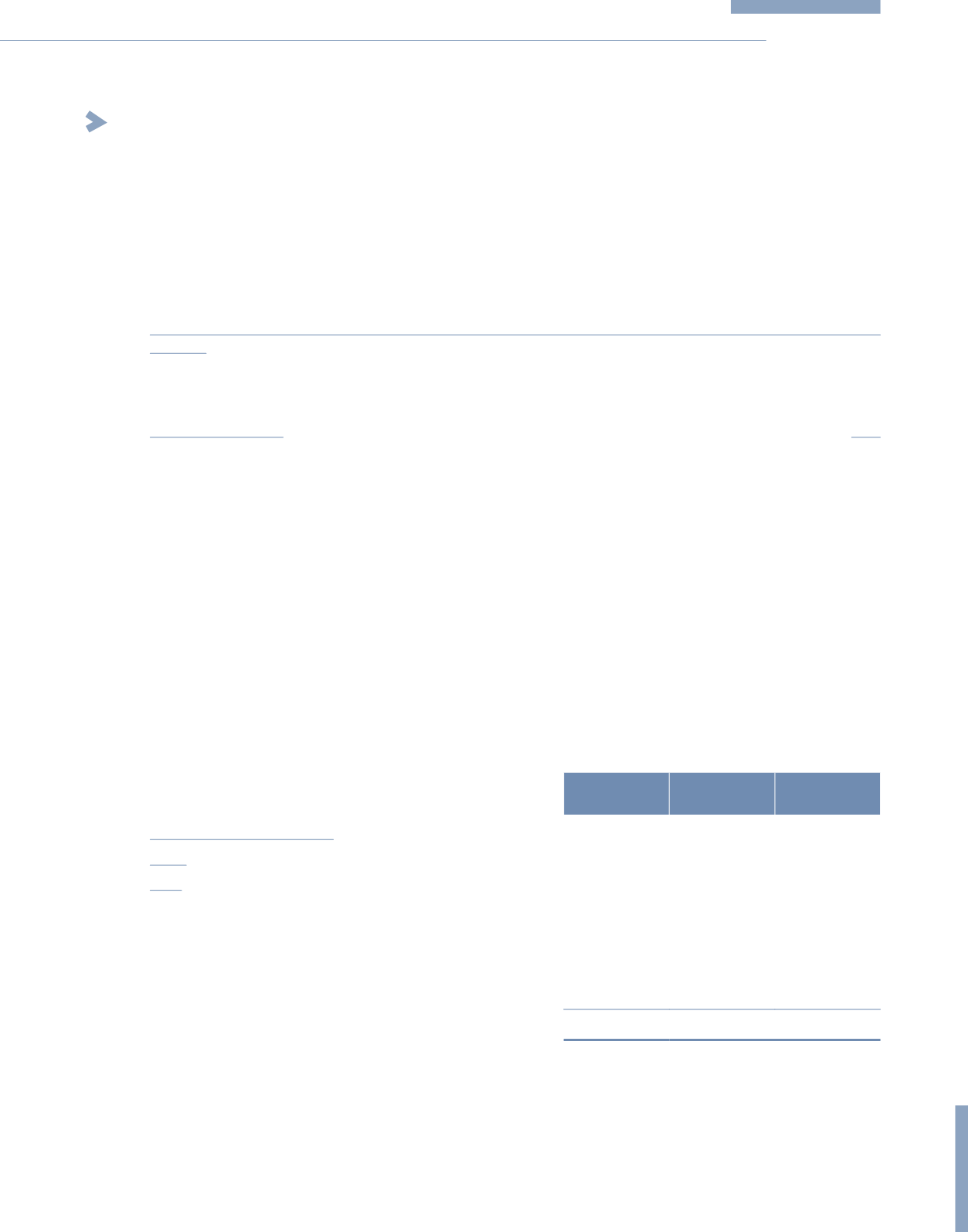

(b) Fair value measurement

Qualitative disclosures fair value measurement hierarchy for assets and liabilities are as follows:

Level 2

RM’000

Level 3

RM’000

Total

RM’000

Assets measured at fair value

Group

2015

Property, plant and equipment (Note 16):

– Freehold land

–

174,694

174,694

– Long leasehold land

–

124,226

124,226

– Buildings

–

499,563

499,563

Investment properties (Note 17)

–

279,833

279,833

–

1,078,316

1,078,316

265

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)