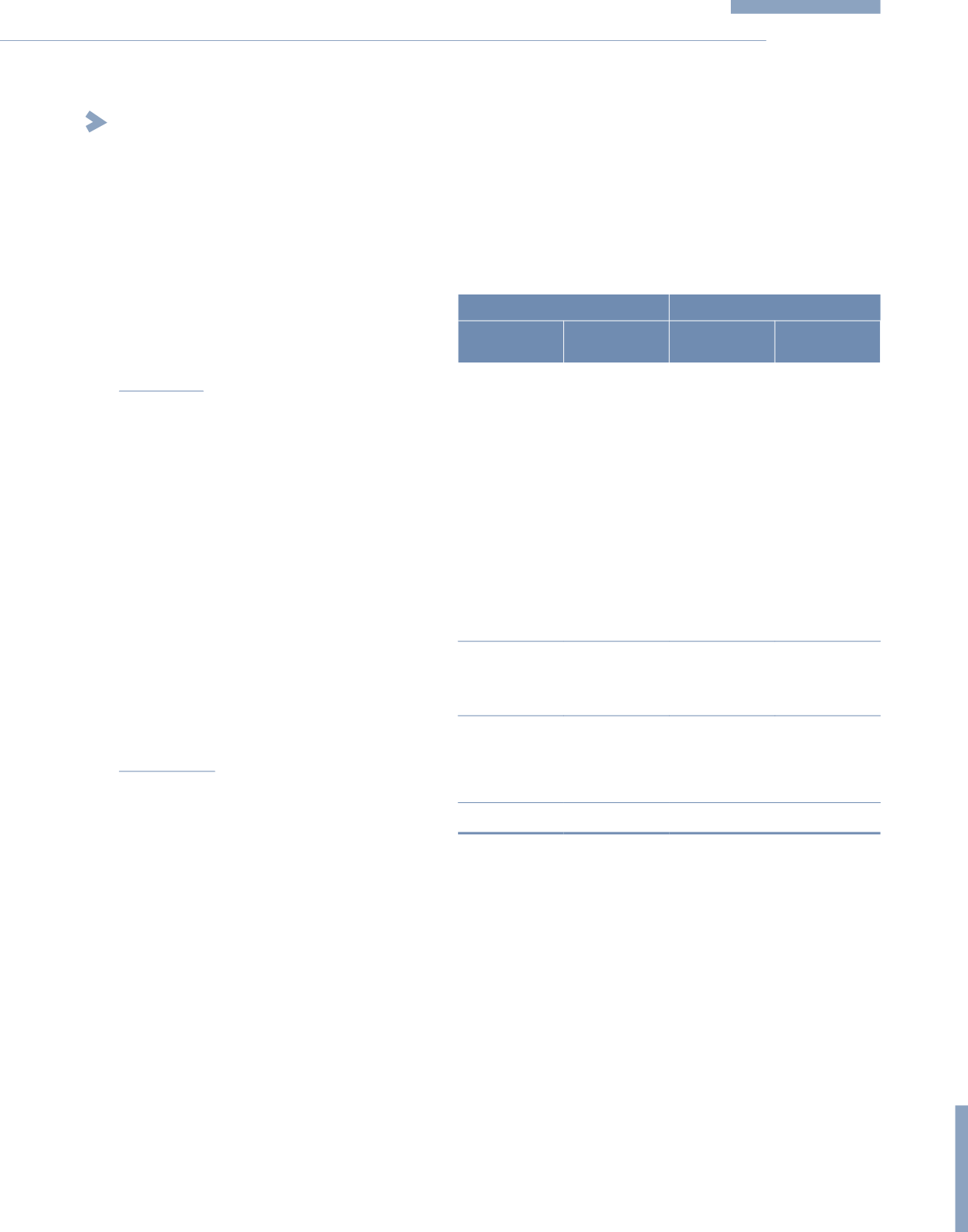

8 FINANCE INCOME AND COSTS

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Finance costs

Profit sharing from Islamic financing:

– Term loans

–

713

–

–

– Islamic Medium Term Notes

33,749

7,100

–

–

– Revolving credits

8,775

11,646

8,394

11,646

Interest expense from conventional financing:

– Bank overdrafts

84

369

–

–

– Interest on advances from subsidiaries

–

–

13,827

10,867

– Term loans

26,297

16,498

–

–

– Revolving credits

–

2,274

–

–

– Finance lease liabilities

3,192

2,779

–

–

– Others

2,125

3,235

404

6

74,222

44,614

22,625

22,519

Less: Interest expense capitalised in:

– Property, plant and equipment

(10,065)

(1,757)

–

–

64,157

42,857

22,625

22,519

Finance income

Profit sharing from deposits with licensed banks

13,731

12,982

–

–

Net finance costs

50,426

29,875

22,625

22,519

The capitalisation rate used to determine the amount of borrowing costs eligible for capitalisation was 5%.

269

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)