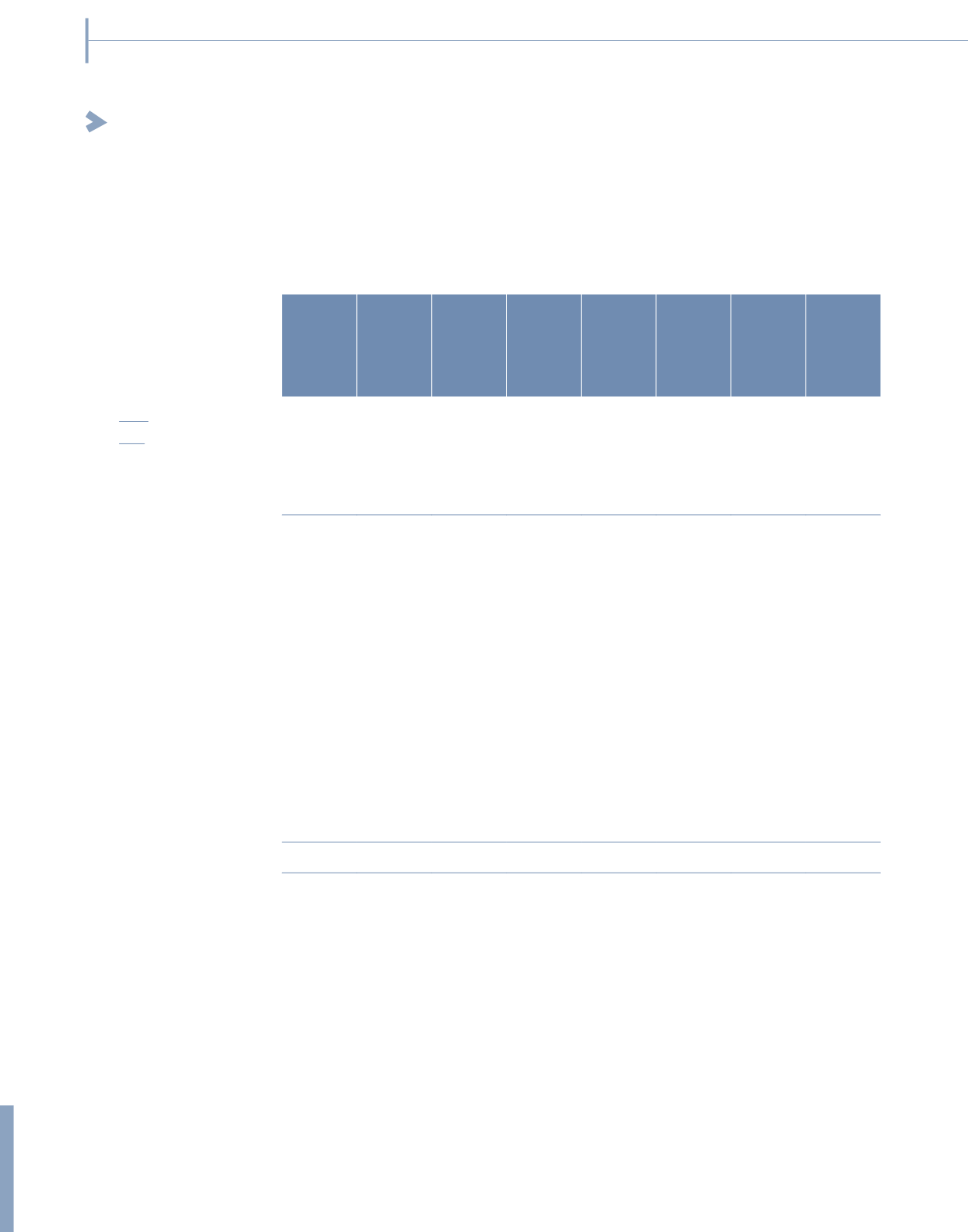

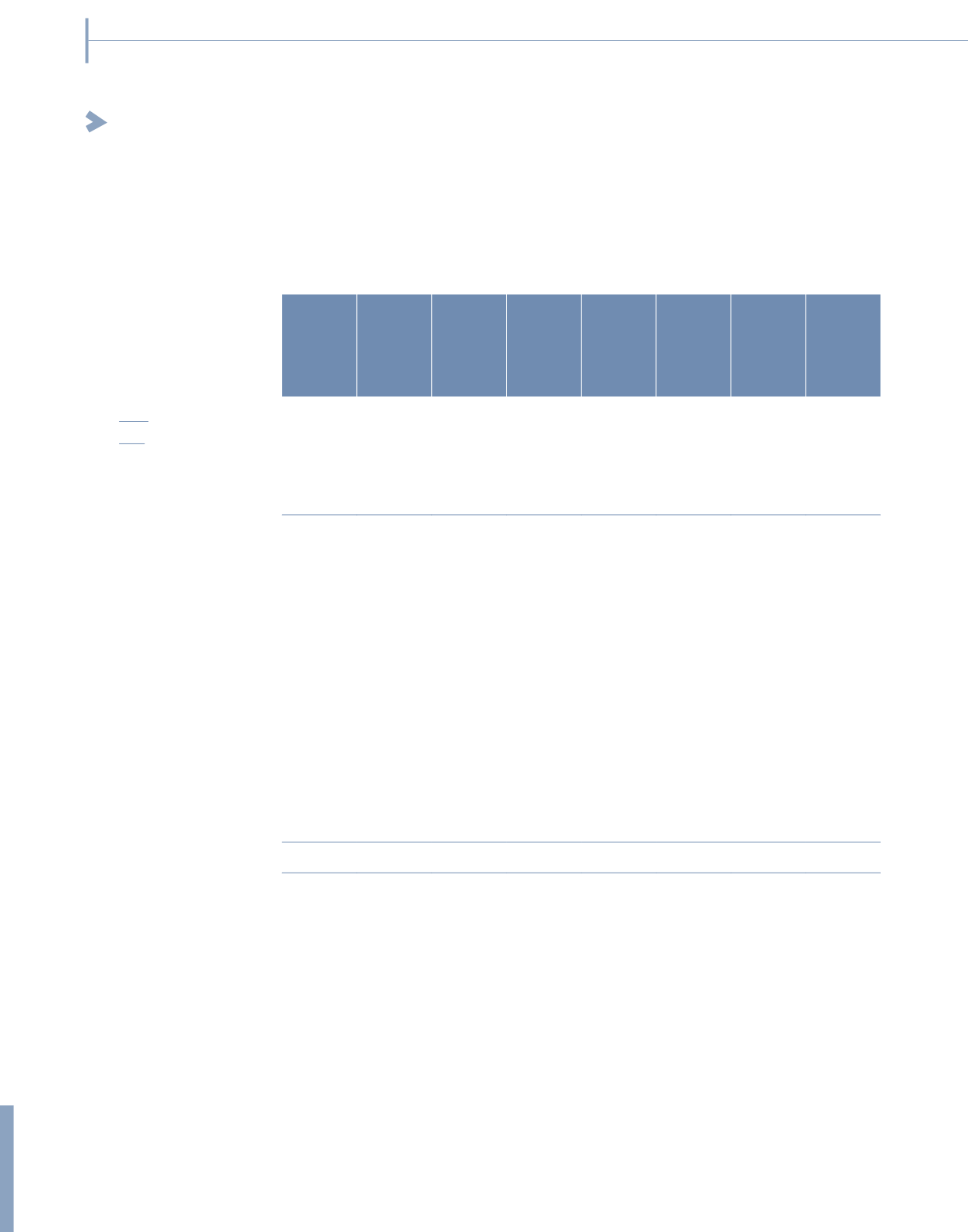

16 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

Freehold

land

RM'000

Long

leasehold

land

RM’000

Buildings

RM’000

Renovation

RM’000

Medical

and other

equipment

RM’000

Furniture,

fittings,

vehicles and

computers

RM’000

Capital

work-in-

progress

RM’000

Total

RM’000

Group

2014

At 1 January

– Cost

72,295

62,596

261,197

128,213

631,797

305,010

267,105 1,728,213

– Valuation

12,750

18,460

3,999

–

–

–

–

35,209

85,045

81,056

265,196

128,213

631,797

305,010

267,105 1,763,422

Exchange differences

(594)

(4)

88

(589)

741

(777)

(1,441)

(2,576)

Additions

3,100

6,652

27,952

22,965

83,330

45,016

193,510

382,525

Acquisition of a subsidiary

–

16,516

–

–

–

–

–

16,516

Revaluation surplus

–

2,100

7,047

–

–

–

–

9,147

Elimination of accumulated

depreciation on revaluation

–

(17)

(3,251)

–

–

–

–

(3,268)

Disposals

–

–

–

(69)

(5,661)

(5,778)

(172)

(11,680)

Written off

–

–

–

–

(1,760)

(202)

(230)

(2,192)

Reclassification – cost

46,620

–

105,143

7,271

2,841

(10,776)

(151,099)

–

Reclassification to non-current

assets held for sale

(9,872)

–

(48,745)

–

–

–

–

(58,617)

Transfer from investment

properties

2,400

–

855

–

–

–

–

3,255

Transfer to intangible assets

–

–

–

–

–

(9,210)

–

(9,210)

126,699

106,303

354,285

157,791

711,288

323,283

307,673 2,087,322

278

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)