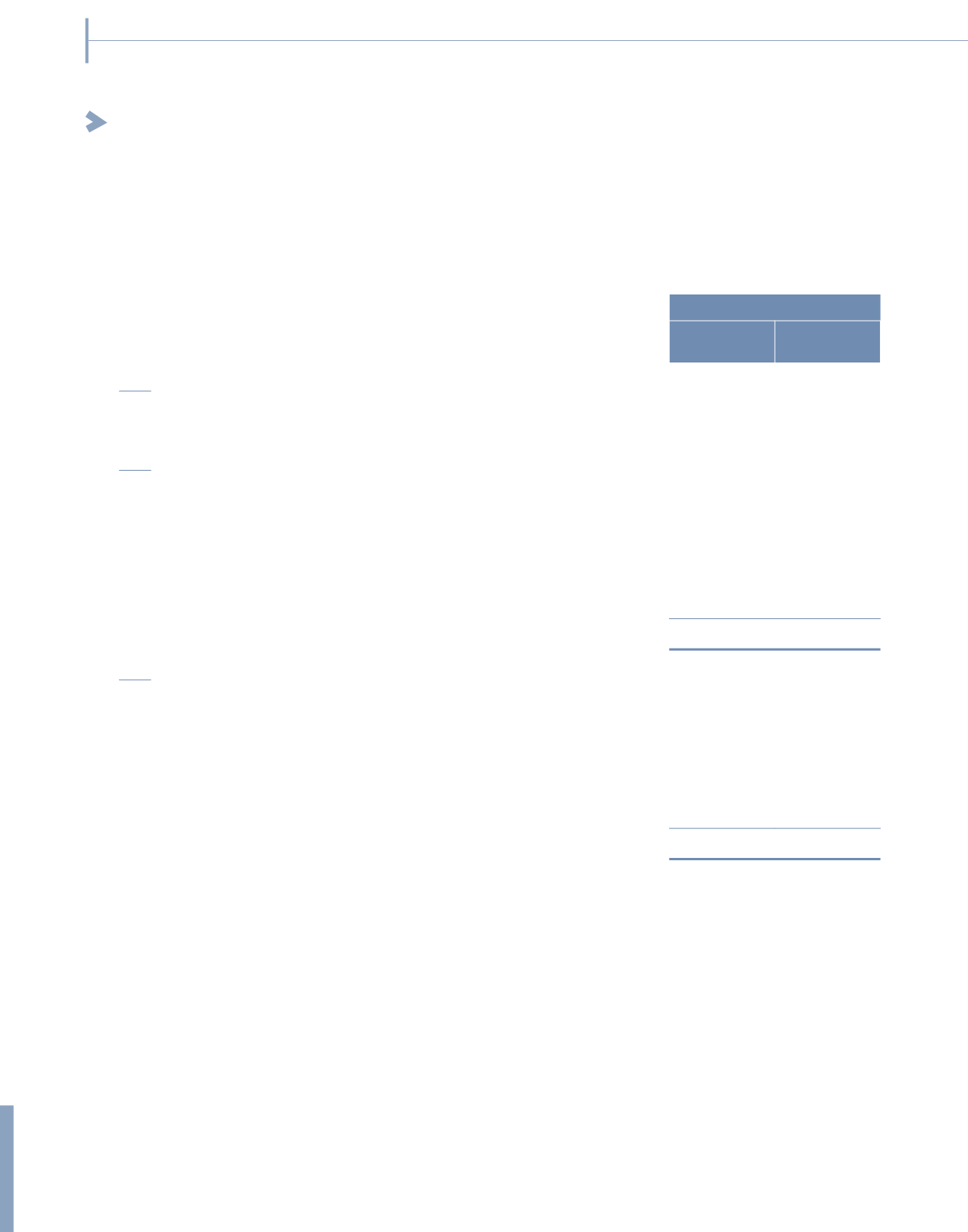

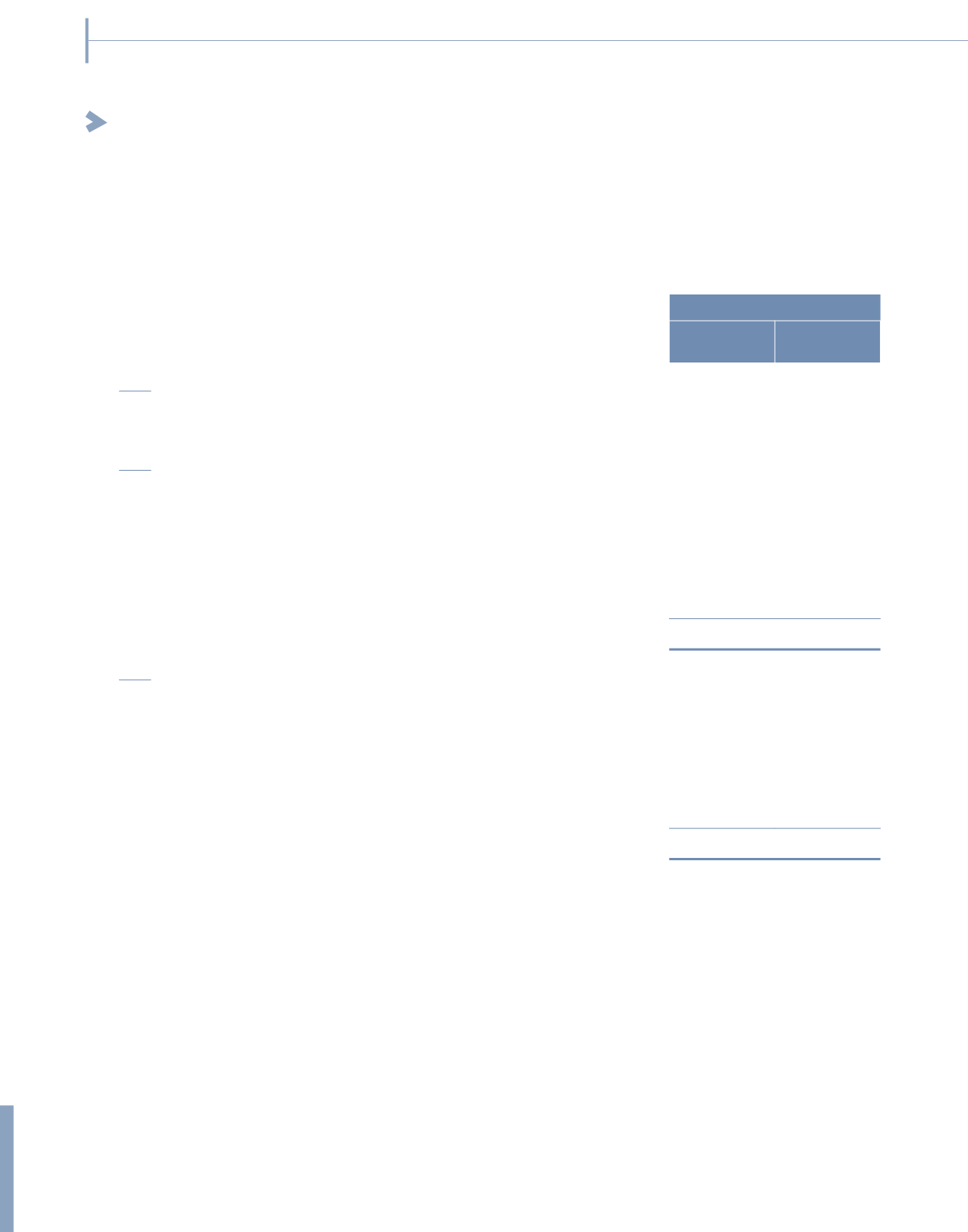

14 DIVIDENDS

Group and Company

2015

RM’000

2014

RM’000

2014

Fourth interim tax exempt (single tier) dividend of 5.2% for 2014

(2.6 sen per ordinary share) paid on 10 April 2015

26,906

–

2015

First interim tax exempt (single tier) dividend of 3.5% for 2015

(1.75 sen per ordinary share) paid on 14 July 2015

18,147

–

Second interim tax exempt (single tier) dividend of 2.9% for 2015

(1.75 sen per ordinary share) paid on 19 October 2015

18,171

–

Third interim tax exempt (single tier) dividend of 4% for 2015

(1.75 sen per ordinary share) paid on 15 January 2016

18,181

–

81,405

–

2014

First interim tax exempt (single tier) dividend of 2.9% for 2014

(1.45 sen per ordinary share) paid on 18 July 2014

–

14,826

Second interim tax exempt (single tier) dividend of 2.9% for 2014

(1.45 sen per ordinary share) paid on 21 October 2014

–

14,712

Third interim tax exempt (single tier) dividend of 4% for 2014

(2.0 sen per ordinary share) paid on 22 January 2015

–

20,303

–

49,841

On 29 February 2016, the Directors declared a fourth interim tax exempt (single tier) dividend of 1.75 sen per share on

1,038,902,605 ordinary shares amounting to RM18,181,000.

The Directors do not recommend any final dividend in respect of the financial year ended 31 December 2015.

274

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)