28. PROVISION FOR RETIREMENT BENEFITS (CONTINUED)

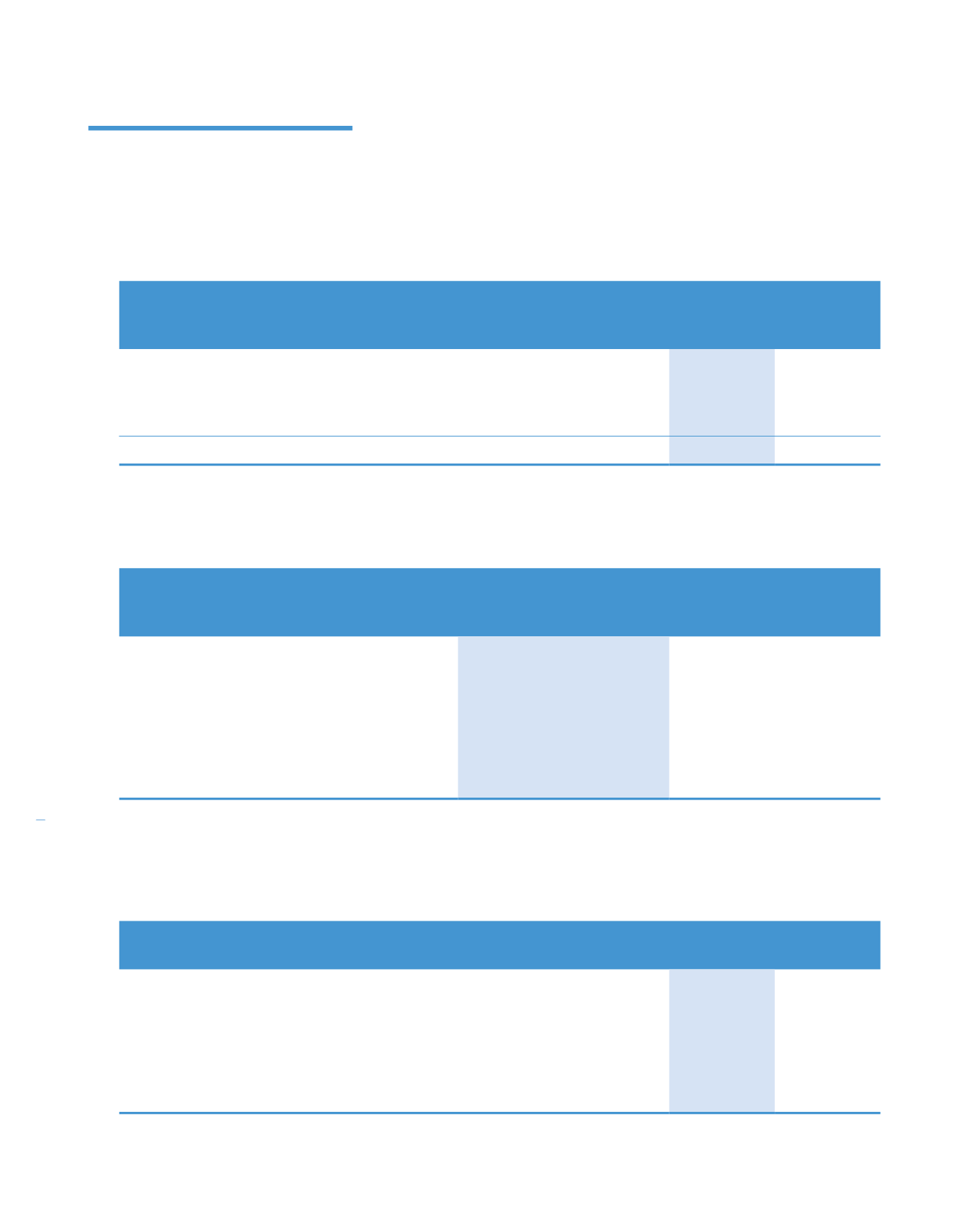

The amount recognised in profit or loss is as follows:

Group

2014

2013

RM’0

RM’000

RM’000

Current service cost

122

112

Interest cost on benefit obligation

109

98

Past service cost

–

96

Curtailments*

–

(32)

Total included in employee benefits costs

(Note 7)

231

274

* The curtailment gain was recognised in respect of several members who were no longer eligible for the retirement plan benefits from

1 January 2013.

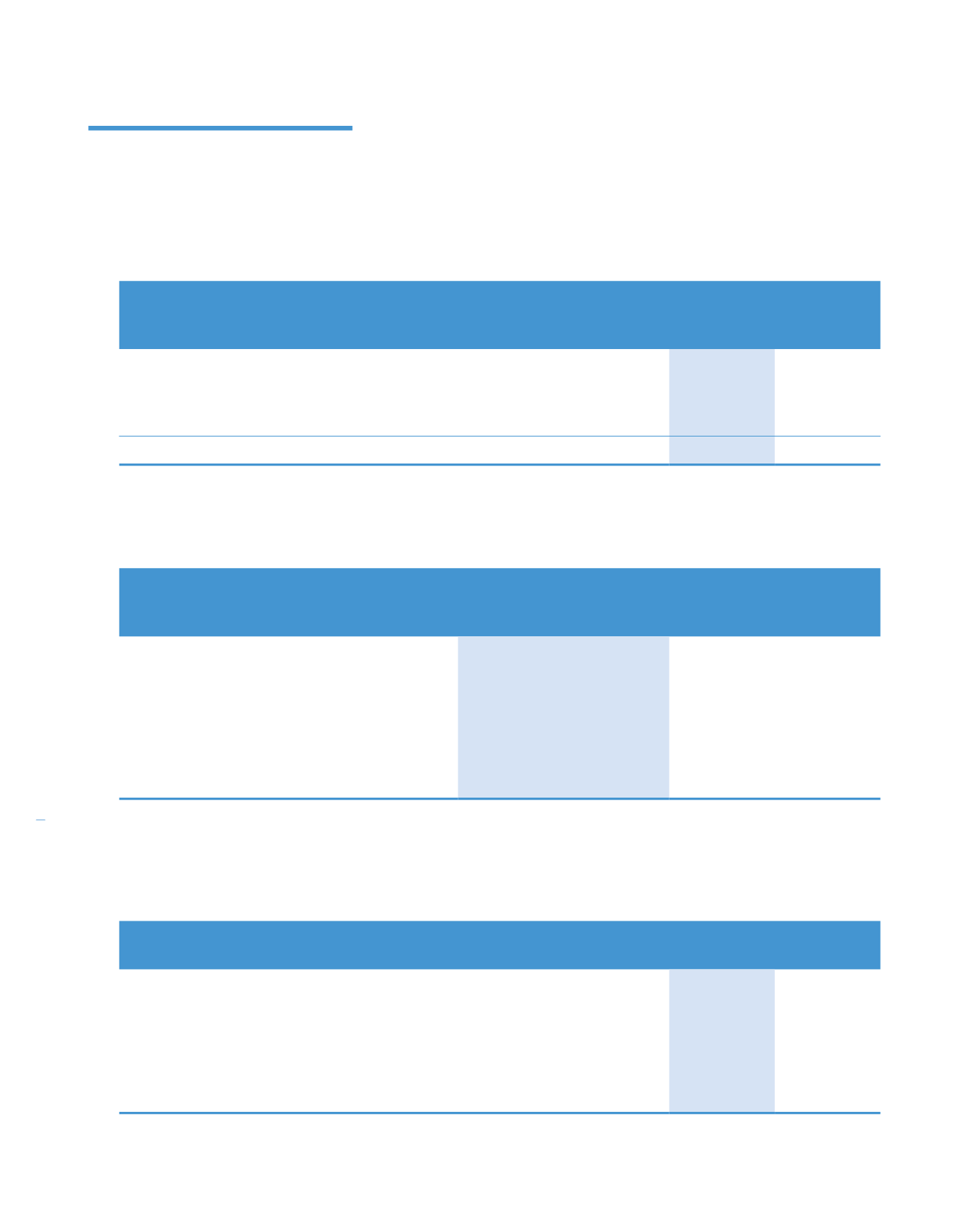

The principal assumptions used in respect of the defined benefit plan of the Group are as follows:

Group

2014

2013

%

%

Discount rate

1

5.4

5.4

Expected rate of salary increase

– Non-management staff

2

5.5

5.5

– Management staff

2

5.5

5.5

Turnover

3

Age related scale of 25% per

annum prior age 25,

gradually reducing to

0% per annum by age 50

Age related scale of 25% per

annum prior age 25,

gradually reducing to

0% per annum by age 50

1 Discount rate is reflective of 10 – 15 year yield for AAA rated bond.

2 Expected rate of salary increase is as per industry average.

3 Turnover rate is relatively influenced by average employees age.

The above assumptions derived from the latest actuarial valuation of the plan which was carried out on 6 February 2012.

2014

2013

RM’0

RM’000

RM’000

1.

A 1% increase in salary increment rate

a. Defined benefit obligation

2,262

2,041

b. Effect an increase of net defined liability

2

2

2.

A 1% decrease in discount rate

a. Defined benefit obligation

2,257

2,037

b. Effect a decrease of net defined liability

(2)

(2)

276

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)