22. RECEIVABLES (CONTINUED)

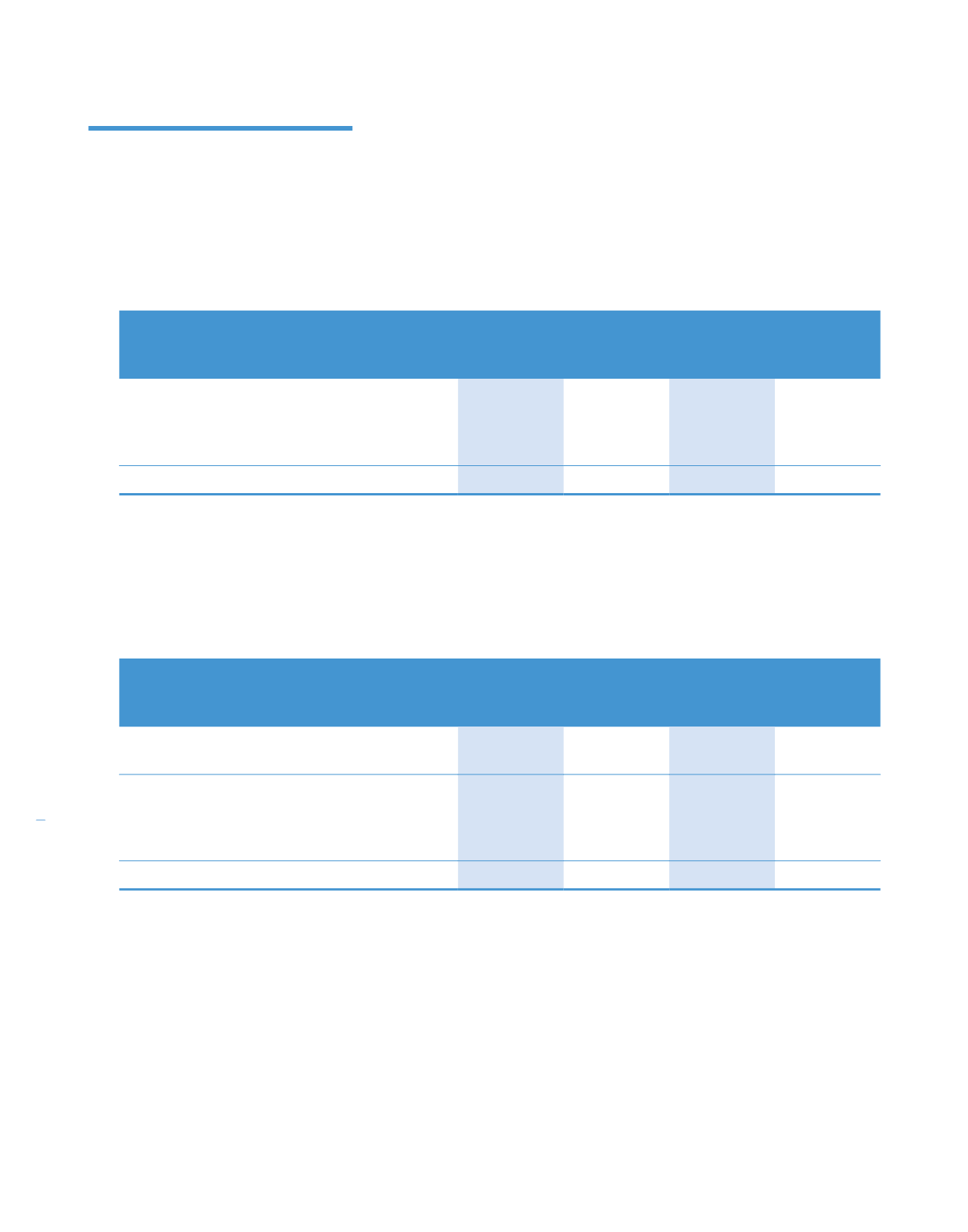

Ageing analysis of trade receivables (continued)

The currency exposure profile of the receivables and deposits (excluding prepayments) are as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Ringgit Malaysia

403,926

365,631

229,810

100,617

Singapore Dollar

1,126

5,071

–

–

Indonesian Rupiah

10,140

4,274

–

–

Australian Dollar

3,934

6,762

–

–

419,126

381,738

229,810

100,617

The other classes within trade and other receivables do not contain impaired assets.

The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivable mentioned above.

The Group does not hold any collateral as security.

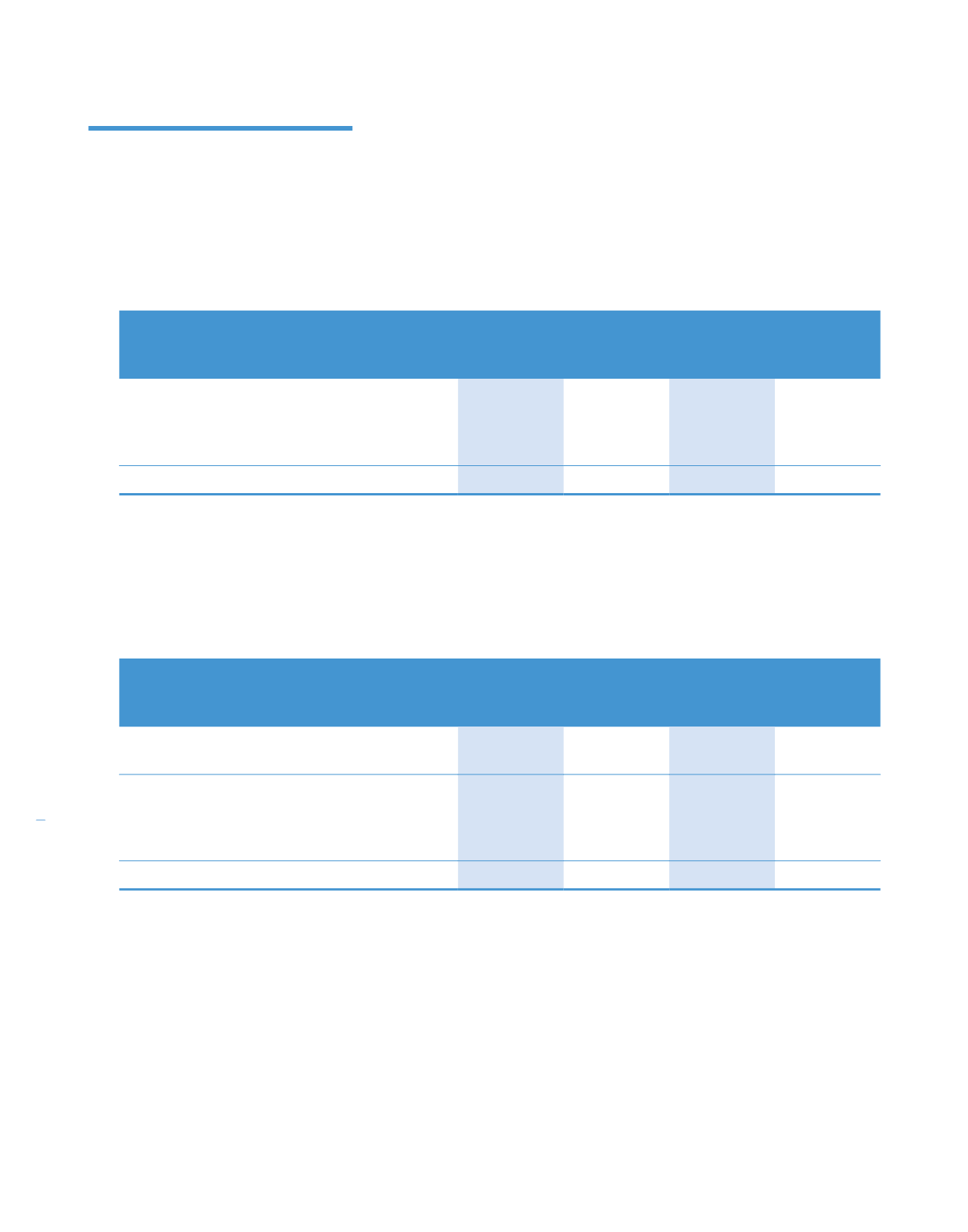

23. CASH AND BANK BALANCES

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Deposits with licensed banks

126,504

157,972

61,332

6,421

Cash and bank balances

178,772

154,993

4,681

2,534

Total cash and bank balances

305,276

312,965

66,013

8,955

less: Bank overdraft

(Note 26)

(15,727)

(8,140)

–

–

Deposits with licensed banks with

maturity of more than 3 months

(10,209)

(6,916)

(528)

(512)

279,340

297,909

65,485

8,443

Bank balances are deposits held at call with licensed banks and do not earn interest.

The weighted average interest rates of deposits with licensed banks of the Group during the financial year were 3.36% (2013:

2.8%) per annum.

266

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)