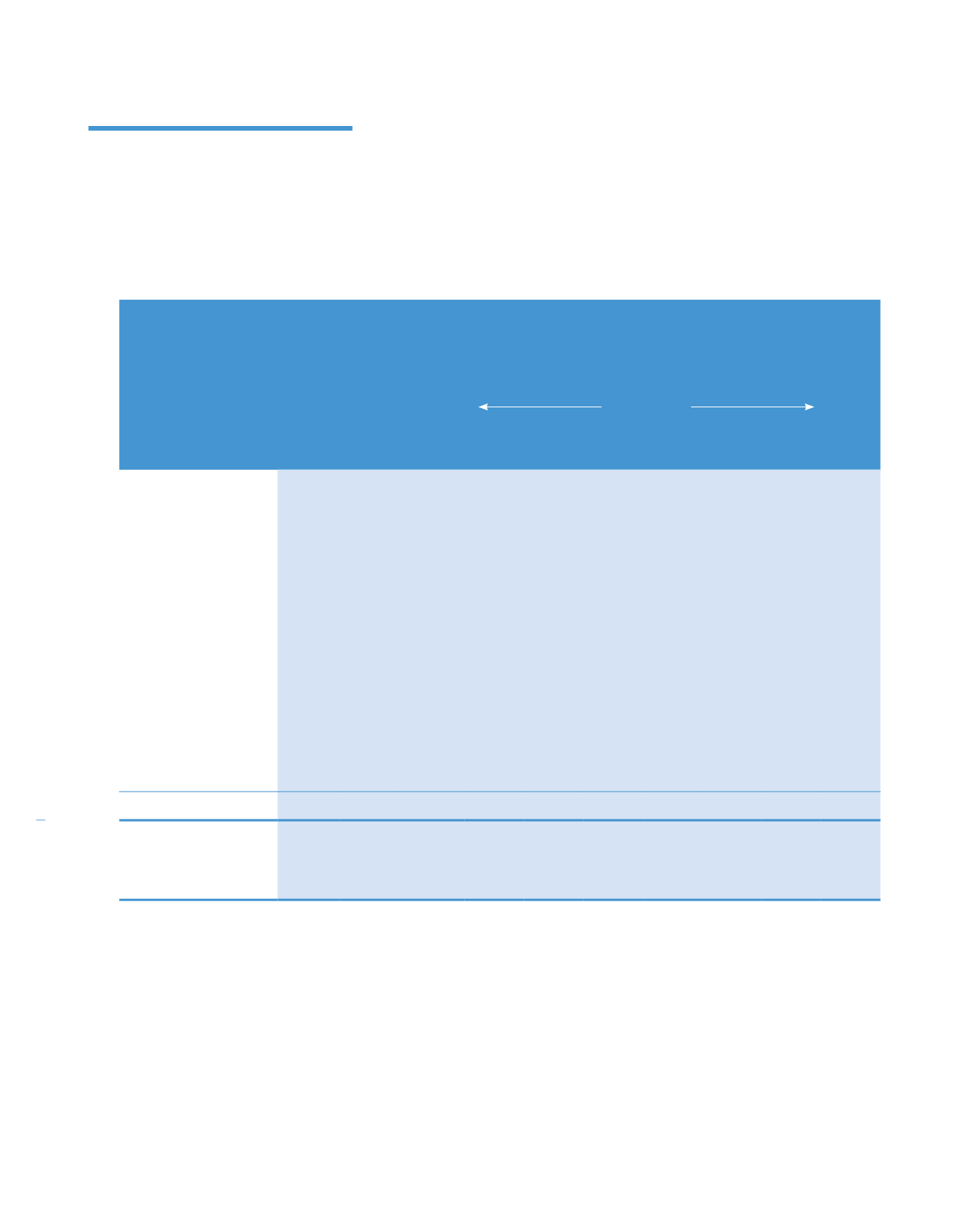

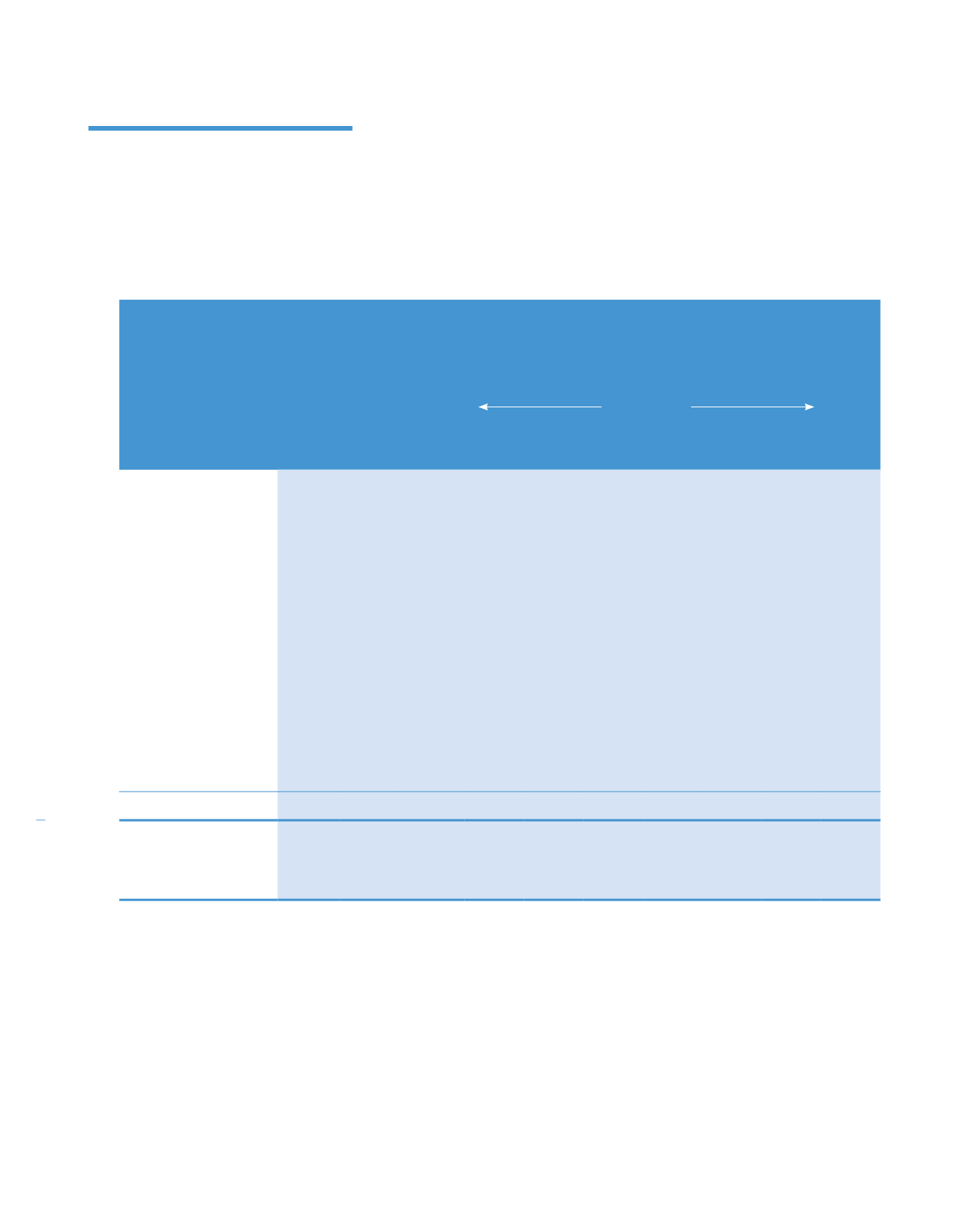

26. BORROWINGS (CONTINUED)

The effective interest rates during the financial year for borrowings, and the remaining maturities of the loans and borrowings

as at 31 December 2014 are as follows:

Functional

currency/

currency

exposure

Interest

rate/

profit

Effective

interest

rate/

profit %

per annum

at the

end of the

period

Maturity profile

Total

carrying

amount

<1 year 1-2 years 2-3 years 3-4 years 4-5 years > 5 years

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

2014

Group

Bridging loan

RM/RM Floating

5.51 449,000

–

–

–

–

– 449,000

Term loans (secured):

– Conventional

RM/RM Floating

5.39 38,506

3,159

3,444

3,494

2,874 29,805 81,282

– Hiwalah

RM/RM Fixed

7.29 11,259 21,900 21,926 21,957 21,986 17,792 116,820

– Al-Ijarah

RM/RM Fixed

2.83

–

–

–

–

–

–

–

– Murabahah

RM/RM Floating

5.38

7,416 10,815 11,948 15,347 16,480 97,232 159,238

Revolving credits (unsecured):

– Conventional

RM/RM Floating

4.04 50,000

–

–

–

–

– 50,000

– Al-Amin

RM/RM Floating

4.63 327,500

–

–

–

–

– 327,500

Hire purchase and finance

lease liabilities:

– Conventional

RM/RM Fixed

4.46

5,235

5,457

5,823

4,479

744

– 21,738

– Bai Al-Inah

RM/RM Fixed

3.12 11,278

8,607

7,564

2,609

22

3 30,083

Bank overdrafts (unsecured)

RM/RM Floating

7.77 15,727

–

–

–

–

– 15,727

915,921 49,938 50,705 47,886 42,106 144,832 1,251,388

Company

Revolving credits (unsecured):

– Al-Amin

RM/RM Floating

4.63 250,000

–

–

–

–

– 250,000

272

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)