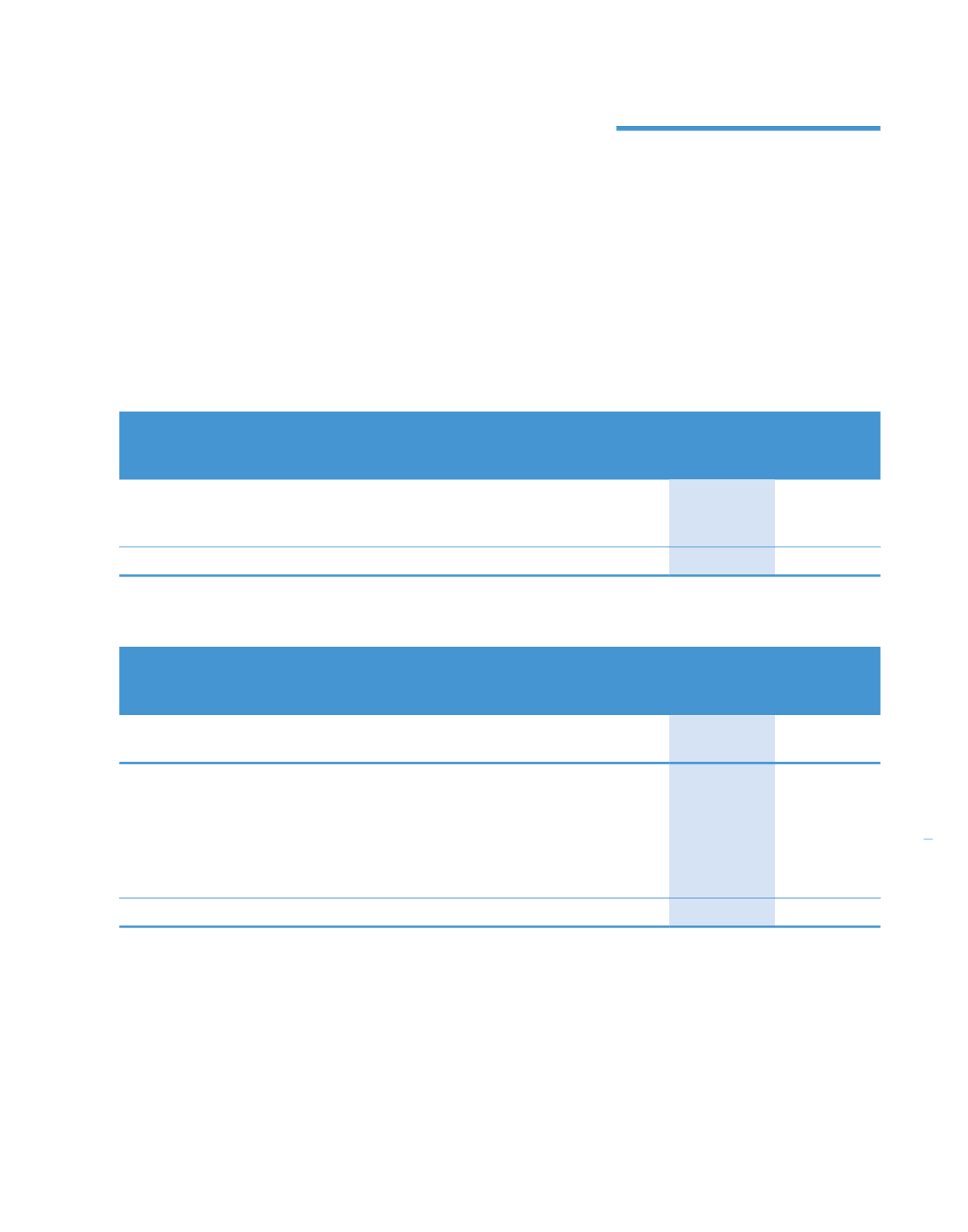

29. DEPOSITS

Long term deposits represent amounts received from consultants, which are repayable on death, retirement (at age 65) or

disability of the consultants. Deposits are forfeited on termination of a consultant’s practice either by the Group due to events

of breach or on early termination by the consultant. However, the deposits may be refunded to the consultants if approval from

the Board of Directors is obtained.

Long term deposits previously measured at cost, are now measured at fair value initially and subsequently at amortised costs

using effective interest method. The differences between the fair value and cash value are recognised as deferred consultancy

income and recognise income over the remaining service period to retirement (at age 65) of consultants.

Group

2014

2013

RM’0

RM’000

RM’000

Represented by:

Refundable practicing deposits

9,625

8,709

Deferred consultancy income

8,371

8,544

17,996

17,253

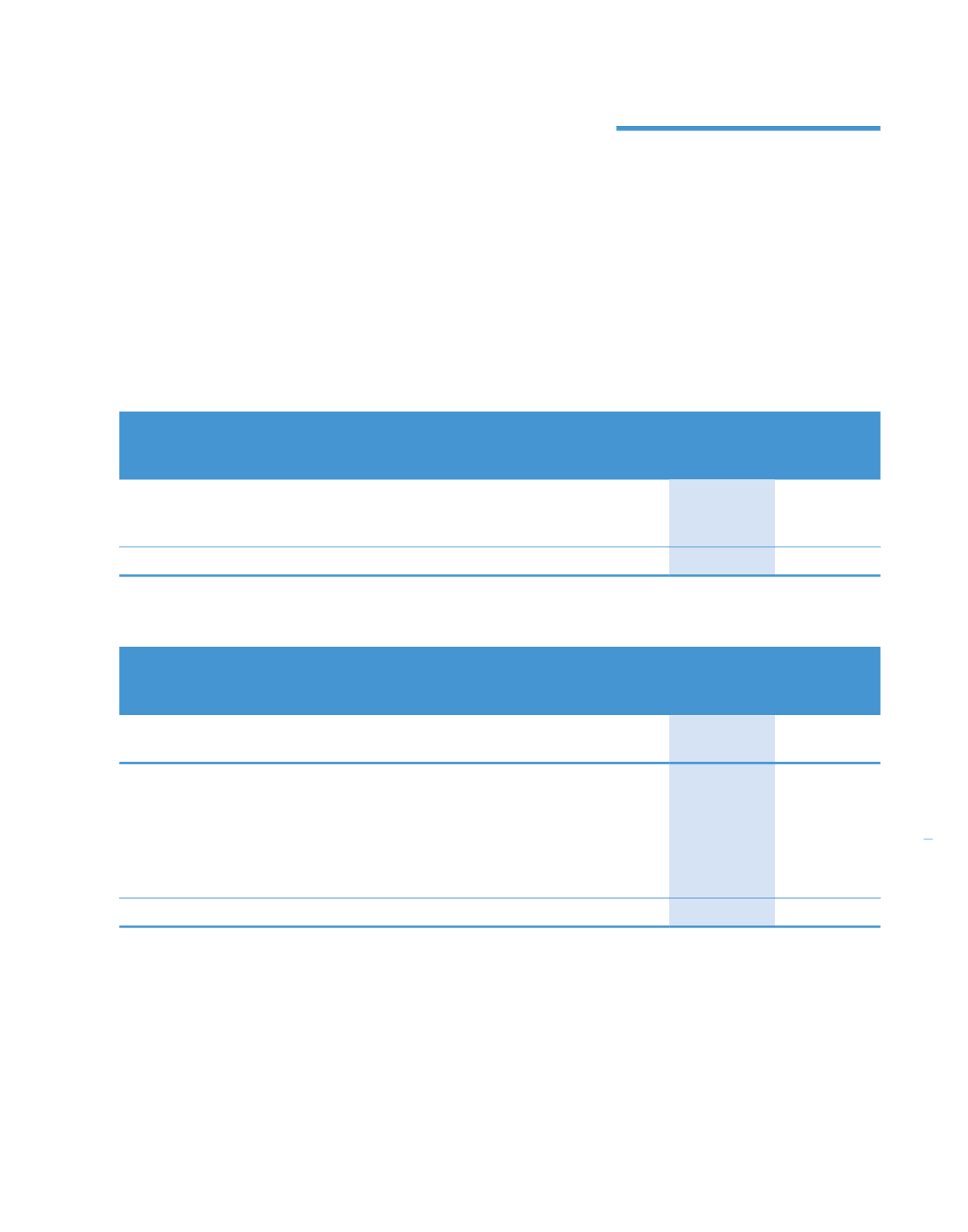

30. SHARE CAPITAL

Group/Company

2014

2013

RM’0

RM’000

RM’000

Authorised ordinary shares of RM0.50 each

At 1 January/31 December

750,000

750,000

Issued and fully paid ordinary shares of RM0.50 each

At 1 January

490,955

323,091

Issued during the financial year:

– Exercise of share warrants

2,600

4,224

– Issuance of bonus share

–

163,640

– Rights issue

21,819

–

515,374

490,955

277

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014