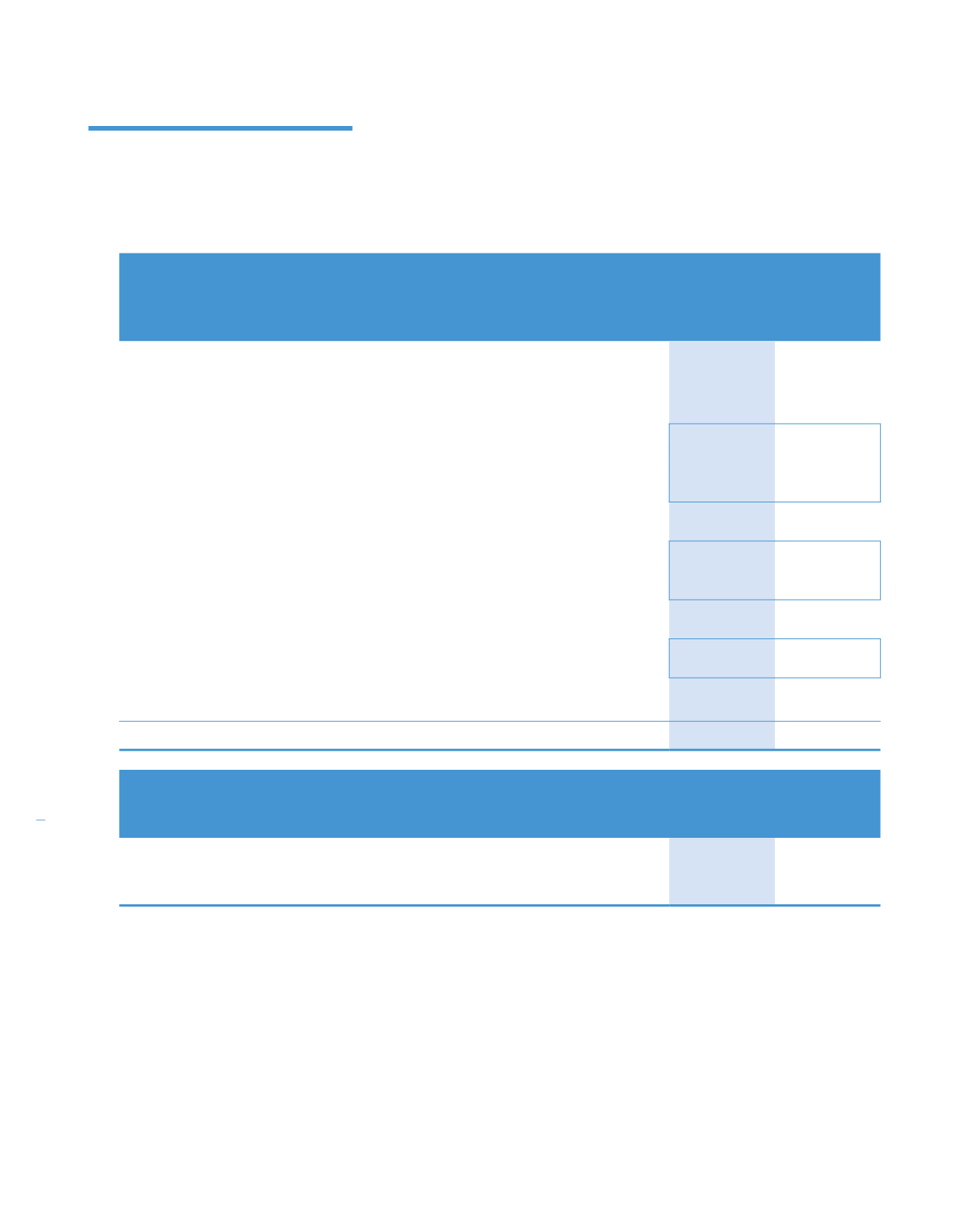

26. BORROWINGS (CONTINUED)

Group

2014

2013

RM’0

RM’000

RM’000

(Restated)

Total

Bridging loan (unsecured)

449,000

–

Islamic commercial papers/Islamic Medium Term Notes (unsecured)

–

499,000

Term loans (secured):

– Conventional

81,282

54,005

– Hiwalah term loan

116,820

77,048

– Al-Ijarah

–

12,988

– Murabahah

159,238

–

357,340

144,041

Revolving credits (unsecured):

– Conventional

50,000

55,900

– Al-Amin

252,500

277,027

– Tawarruq

75,000

–

377,500

332,927

Hire purchase and finance lease liabilities:

– Conventional

21,738

5,295

– Bai Al-Inah

30,083

38,089

51,821

43,384

Bank overdrafts (unsecured)

15,727

8,140

1,251,388

1,027,492

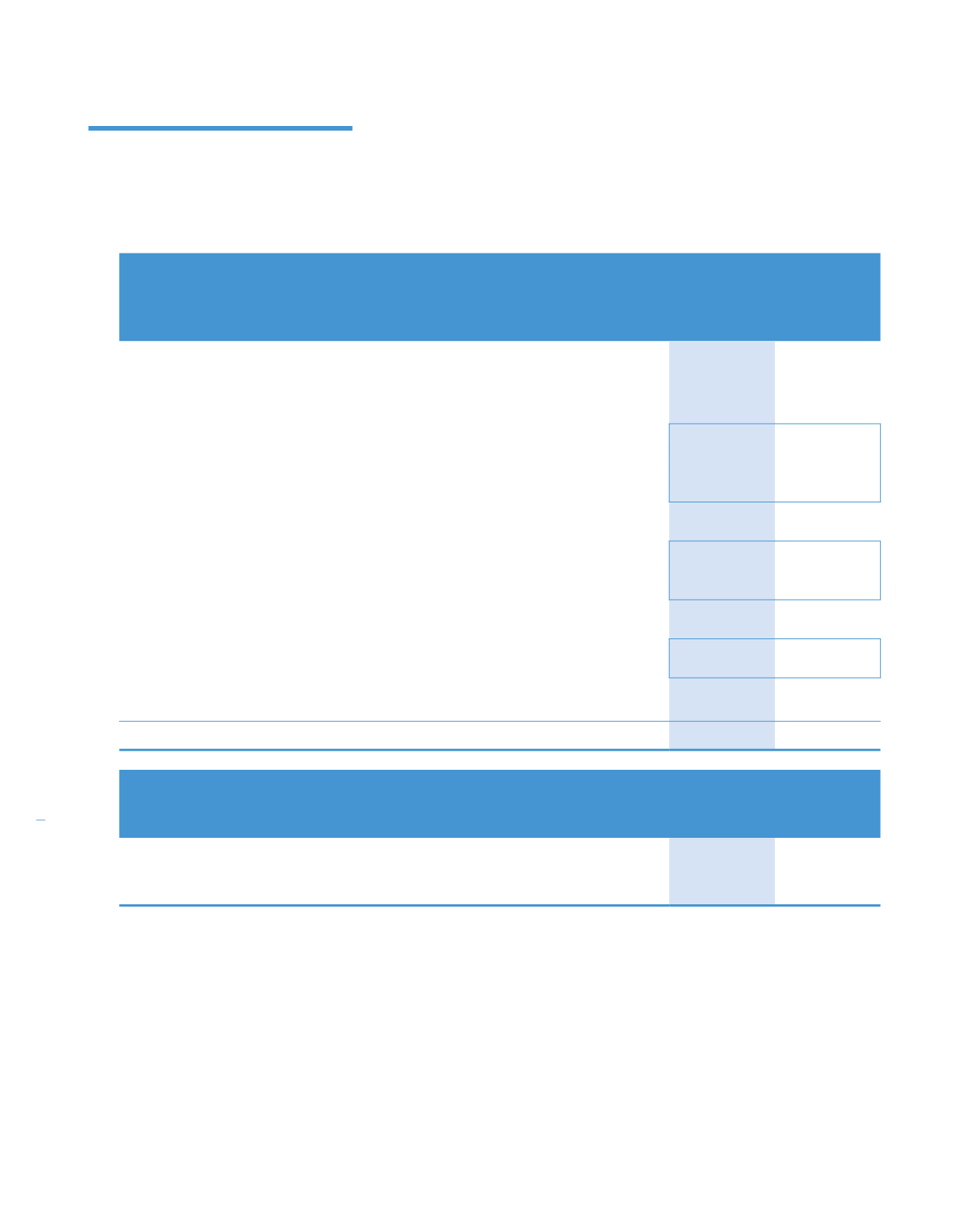

Company

2014

2013

RM’0

RM’000

RM’000

Current

Revolving credits (unsecured):

– Al-Amin

250,000

275,000

Borrowings for the Group and the Company are denominated in Ringgit Malaysia.

The borrowings are secured by:

(a) fixed charge on certain landed properties of the Group

(Note 13)

;

(b) fixed and floating charge on certain assets of the Group by way of debenture;

(c) letter of awareness, letter of comfort and letter of subordinates from Johor Corporation;

(d) a negative pledge over some of the fixed and floating assets of the Group;

(e) fixed first and floating charge over some movable and immovable assets of the Group;

(f) finance leases are effectively secured as the rights to the leased asset revert to the lessor in the event of default;

(g) an assignment of the proceeds to be received from the disposal of the building;

(h) corporate guarantee provided by the Company to its subsidiary

(Note 41)

; and

(i) jointly and severally guaranteed by certain Directors of the Company.

270

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)