23. CASH AND BANK BALANCES (CONTINUED)

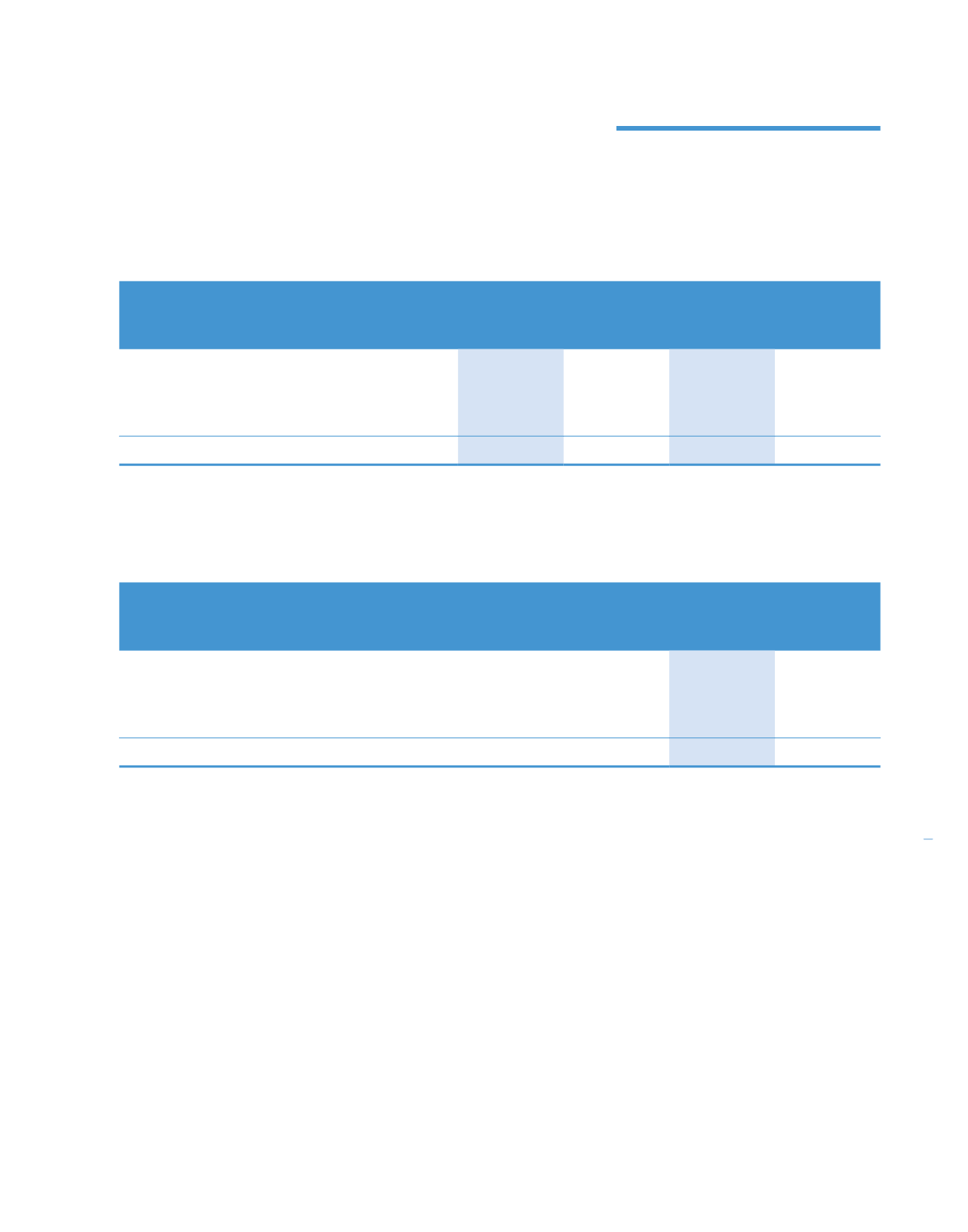

The currency exposure profile of deposits, cash and bank balances as at end of the reporting period is as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Ringgit Malaysia

271,177

287,278

66,013

8,955

Singapore Dollar

7,967

6,095

–

–

Indonesian Rupiah

14,299

12,762

–

–

Australian Dollar

11,833

6,830

–

–

305,276

312,965

66,013

8,955

Deposits of the Group have maturity ranges from 1 to 730 days (2013: 1 to 730 days).

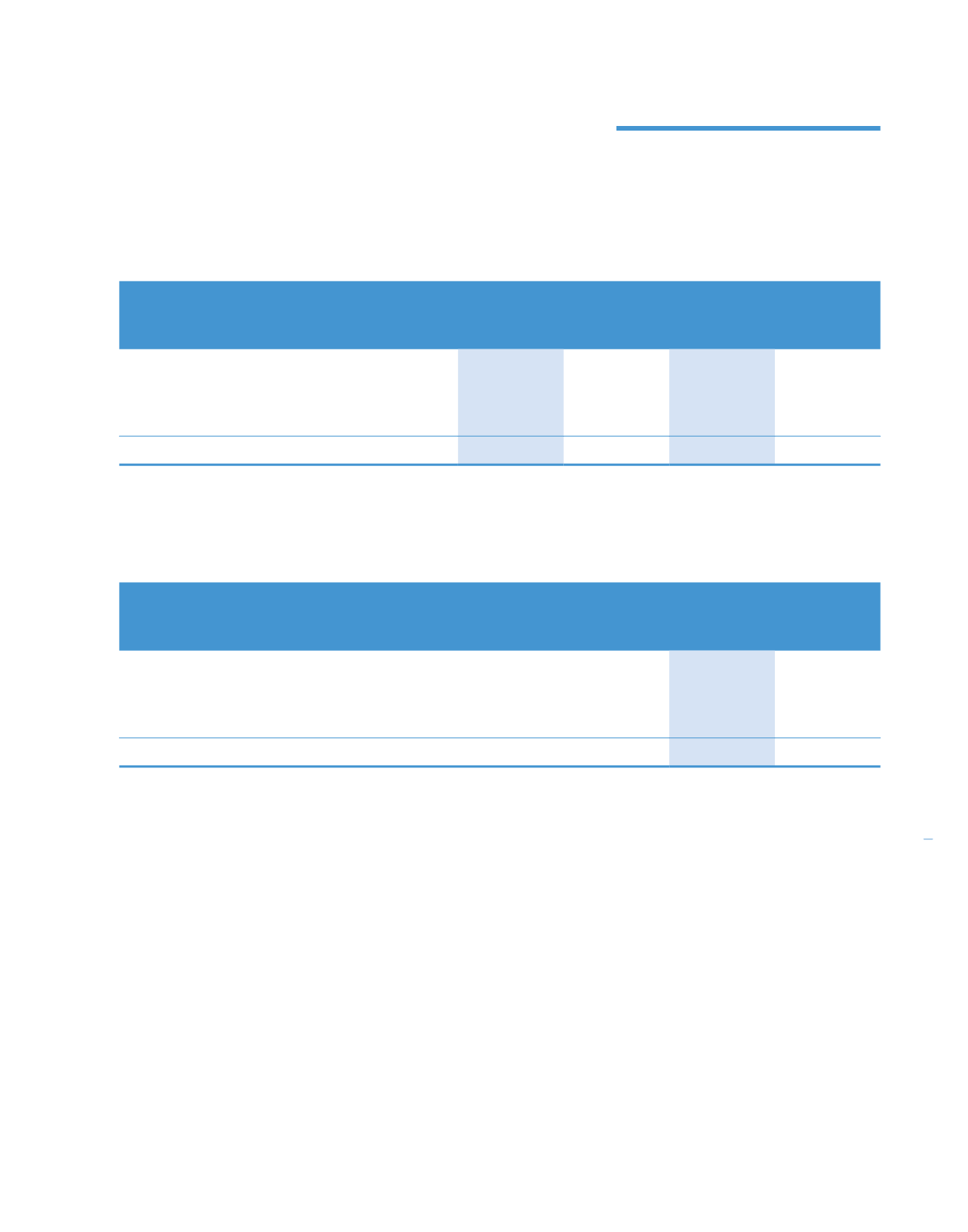

24. NON-CURRENT ASSETS HELD FOR SALE

Group

2014

2013

RM’0

RM’000

RM’000

Land and buildings

At 1 January

2,013

2,013

Reclassification from property, plant and equipment

(Note 13)

57,886

–

Disposals

(2,013)

–

At 31 December

57,886

2,013

On 3 October 2014, Puteri Nursing College Sdn Bhd (“PNC”), a subsidiary of the Group entered into an agreement to dispose

two pieces of lands together with buildings erected thereon, both situated in Nilai, Negeri Sembilan to Al-’Aqar Healthcare

REIT for a total consideration of RM77,800,000. The disposal is expected to be completed in the second quarter of 2015.

In the prior year, Puteri Specialist Hospital (Johor) Sdn Bhd (“PSH”), a subsidiary of the Company entered into an agreement

to dispose two pieces of lands, both situated in the town of Johor Bahru to Al-’Aqar Healthcare REIT for a total consideration

of RM3,590,000 to be fully satisfied in cash. The disposal was completed in the second quarter of 2014.

267

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014