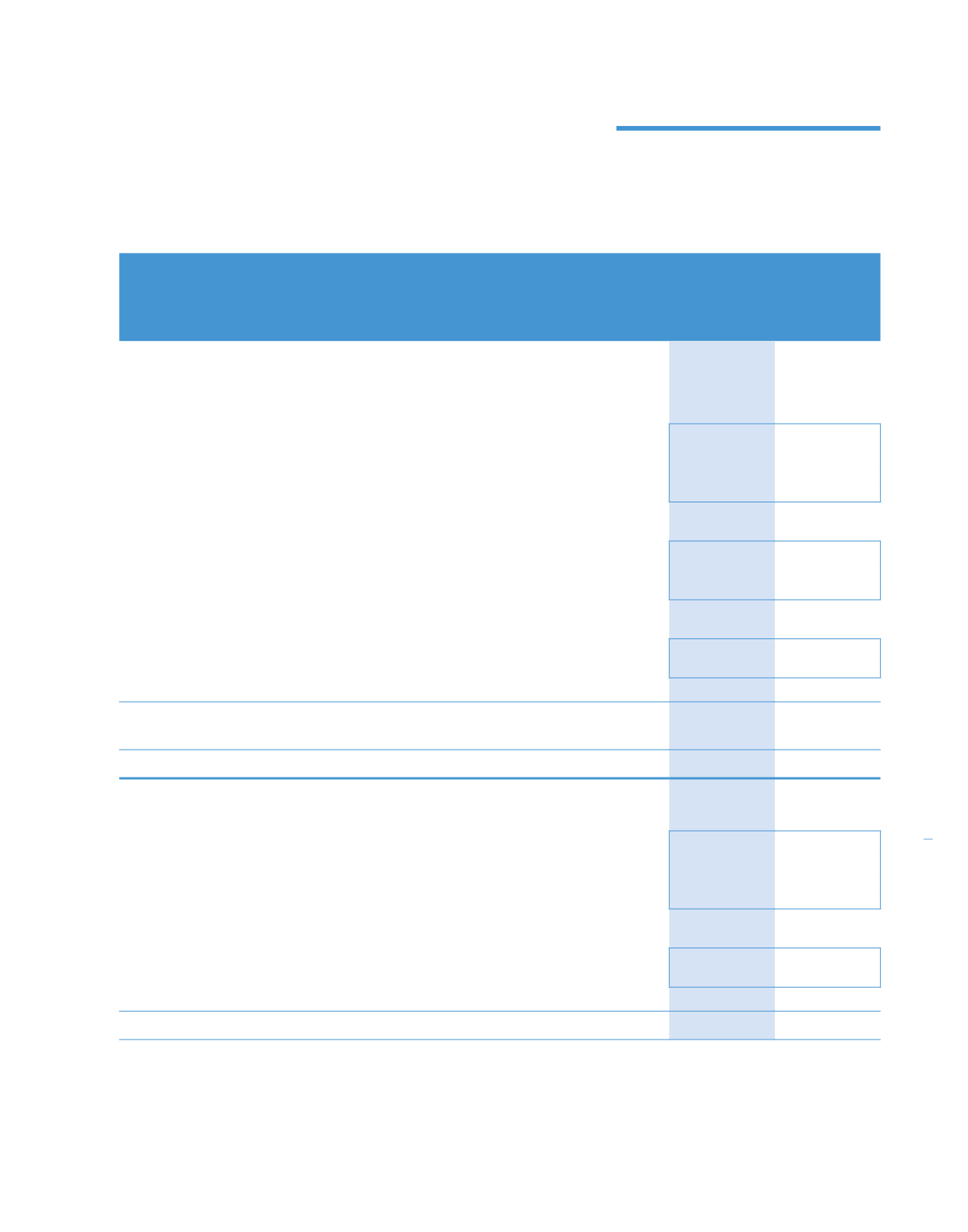

26. BORROWINGS

Group

2014

2013

RM’0

RM’000

RM’000

(Restated)

Current

Bridging loan (unsecured)

449,000

–

Islamic commercial papers/Islamic Medium Term Notes (unsecured)

–

499,000

Term loans (secured):

– Conventional

38,506

2,444

– Hiwalah

11,259

–

– Al-Ijarah

–

4,683

– Murabahah

7,416

–

57,181

7,127

Revolving credits (unsecured):

– Conventional

50,000

55,900

– Al-Amin

252,500

277,027

– Tawarruq

75,000

–

377,500

332,927

Hire purchase and finance lease liabilities:

– Conventional

5,235

1,912

– Bai Al-Inah

11,278

8,516

16,513

10,428

900,194

849,482

Bank overdrafts (unsecured)

15,727

8,140

915,921

857,622

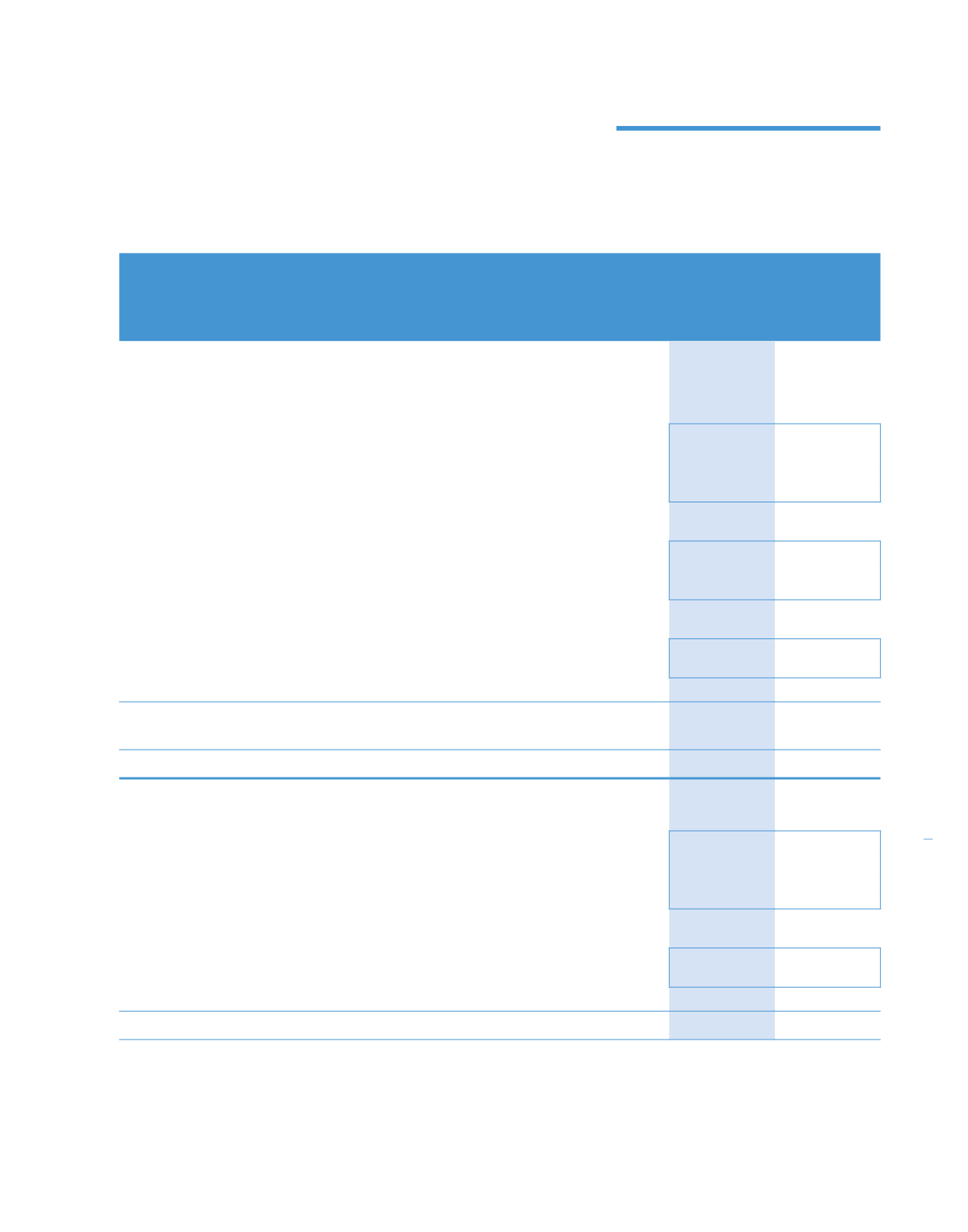

Non-current

Term loans (secured):

– Conventional

42,776

51,561

– Hiwalah

105,561

77,048

– Al-Ijarah

–

8,305

– Murabahah

151,822

–

300,159

136,914

Hire purchase and finance lease liabilities:

– Conventional

16,503

3,383

– Bai Al-Inah

18,805

29,573

35,308

32,956

335,467

169,870

269

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014