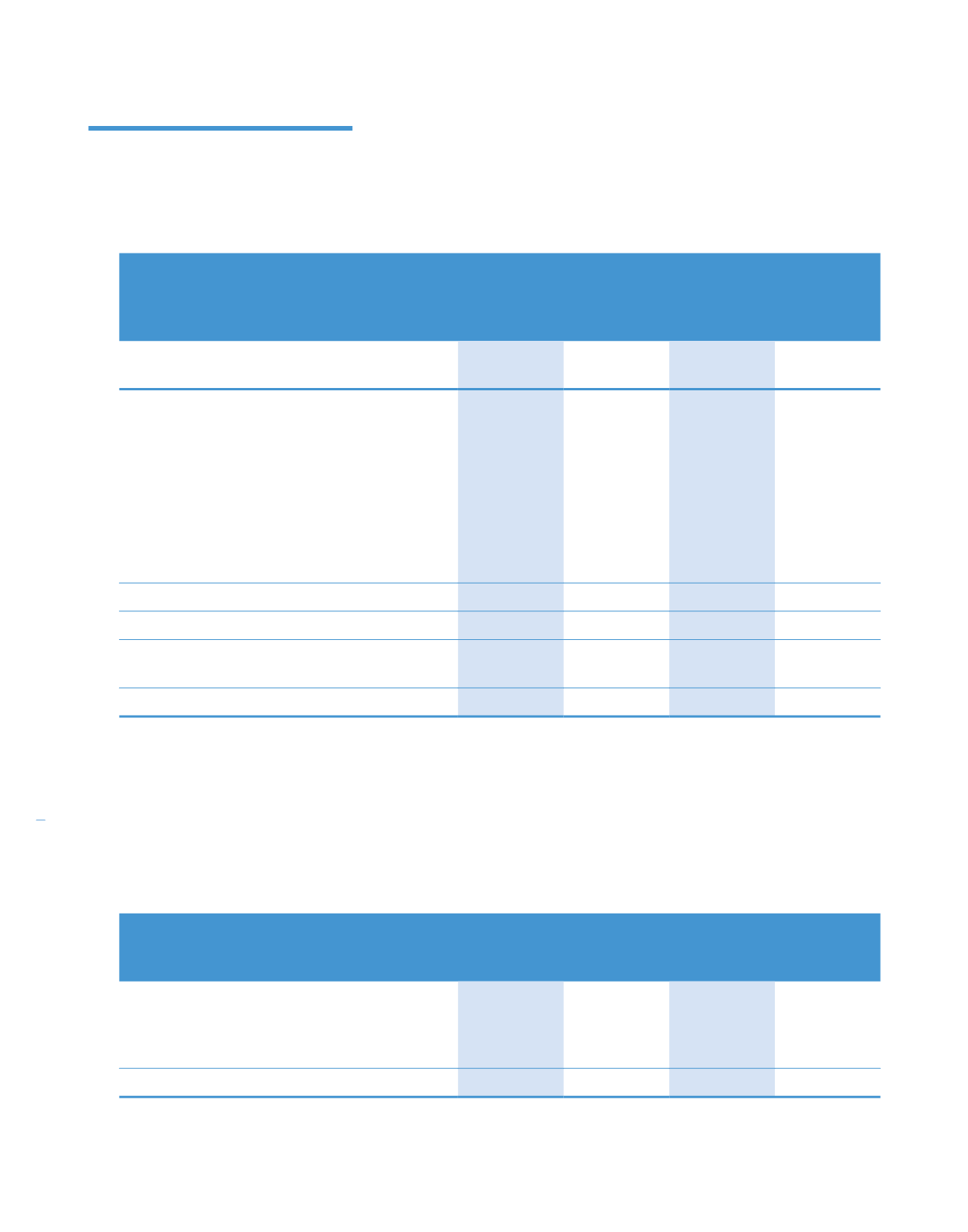

25. PAYABLES

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

(Restated)

Non-current

Advances from subsidiaries

–

–

125,447

174,282

Current

Trade payables

276,291

277,262

–

–

Other payables

135,183

84,103

2,270

1,464

Resident upfront contribution

34,793

46,289

–

–

Accruals

111,509

59,116

8,743

2,205

Amount due to ultimate holding corporation

260

167

219

199

Amounts due to subsidiaries

–

–

222,852

82,046

Amounts due to related companies

1,594

1,986

769

50

Amounts due to associates

5,528

9,624

–

–

Total current payables

565,158

478,547

234,853

85,964

Total payables

565,158

478,547

360,300

260,246

Add: Borrowings

(Note 26)

1,251,388

1,027,492

250,000

275,000

Add: Deposits

(Note 29)

17,996

17,253

–

–

Total financial liabilities carried at amortised cost

1,834,542

1,523,292

610,300

535,246

Included in amount due to subsidiaries are advances from subsidiaries amounting to RM125.4 million (2013: RM174.3 million)

which are unsecured, bearing effective weighted average interest rate of 3.70% (2013: 3.70%) per annum.

Amounts due to ultimate holding corporation, subsidiaries and other related companies are unsecured, interest free and

repayable on demand.

Credit terms of trade payables ranges from 30 to 60 days (2013: 30 to 60 days).

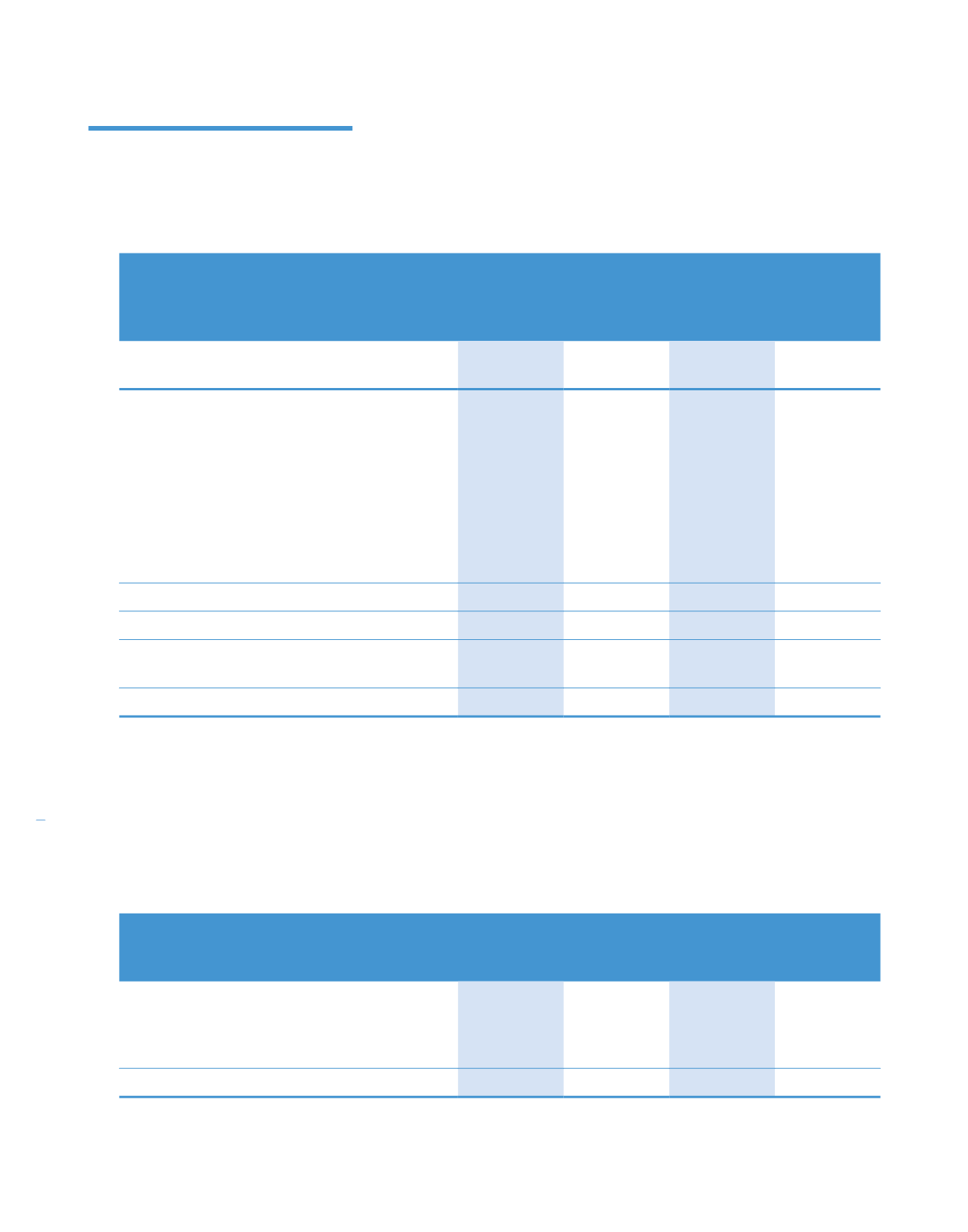

The currency exposure profile of payables is as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Ringgit Malaysia

443,532

376,704

360,300

260,246

Singapore Dollar

210

9,226

–

–

Indonesian Rupiah

2,273

1,775

–

–

Australian Dollar

119,143

90,842

–

–

565,158

478,547

360,300

260,246

268

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)