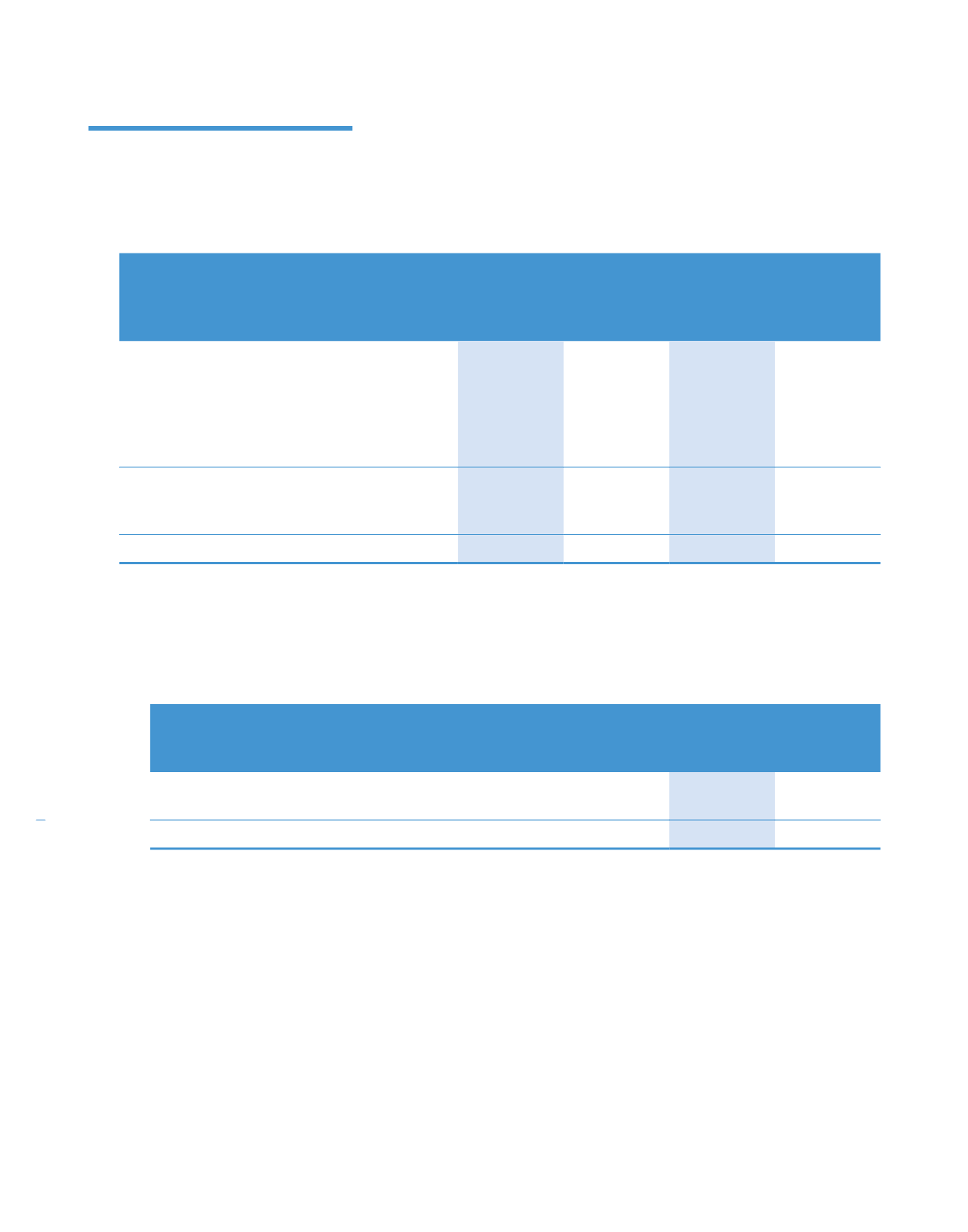

31. RESERVES

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

(Restated)

Non-distributable reserves:

Share premium

(a)

70,507

–

70,507

–

Merger reserve

(b)

(3,367)

(3,367)

–

–

Exchange reserve

(c)

1,895

1,403

–

–

Revaluation reserve

(d)

58,429

50,387

–

–

Warrant reserve

(e)

31,952

–

31,952

–

159,416

48,423

102,459

–

Distributable reserve:

Retained earnings

(f)

639,347

546,622

58,220

24,064

798,763

595,045

160,679

24,064

(a) This reserve comprise the premium paid on subscription of shares in the Company over and above the par value of the

shares.

(b) The difference between the issue price and the nominal value of shares issued were classified as merger reserve.

(c) Exchange reserve is used to record exchange differences arising from the translation of financial statements of

subsidiaries/associate whose functional currency differs from the Group’s presentation currency.

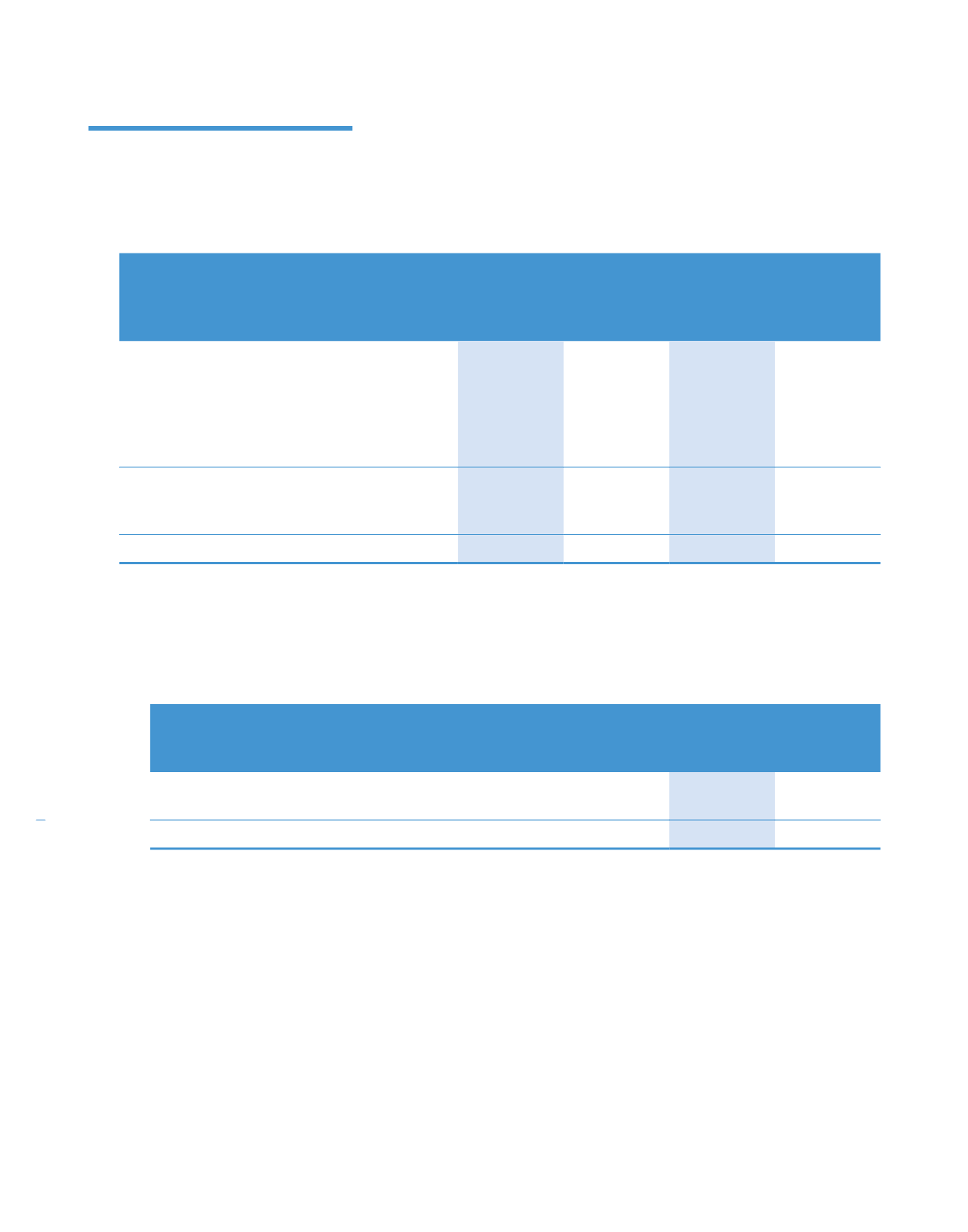

(d) Revaluation reserve (non-distributable)

Group

2014

2013

RM’0

RM’000

RM’000

At 1 January

50,387

50,387

Revaluation surplus, net of tax

8,042

–

At 31 December

58,429

50,387

The revaluation reserve represents surplus from the revaluation of the Group’s land and buildings.

(e) Warrant reserve is a reserve created based on the number of warrants issued to date.

(f) The entire retained earnings of the Company as at 31 December 2014 may be distributed as dividend under the single-tier

system.

32. NON-CASH TRANSACTIONS

The principal non-cash transaction during the financial year is the acquisition of property, plant and equipment of which

RM10,107,650 (2013: RM7,569,000) is by means of hire purchase and finance lease.

280

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)