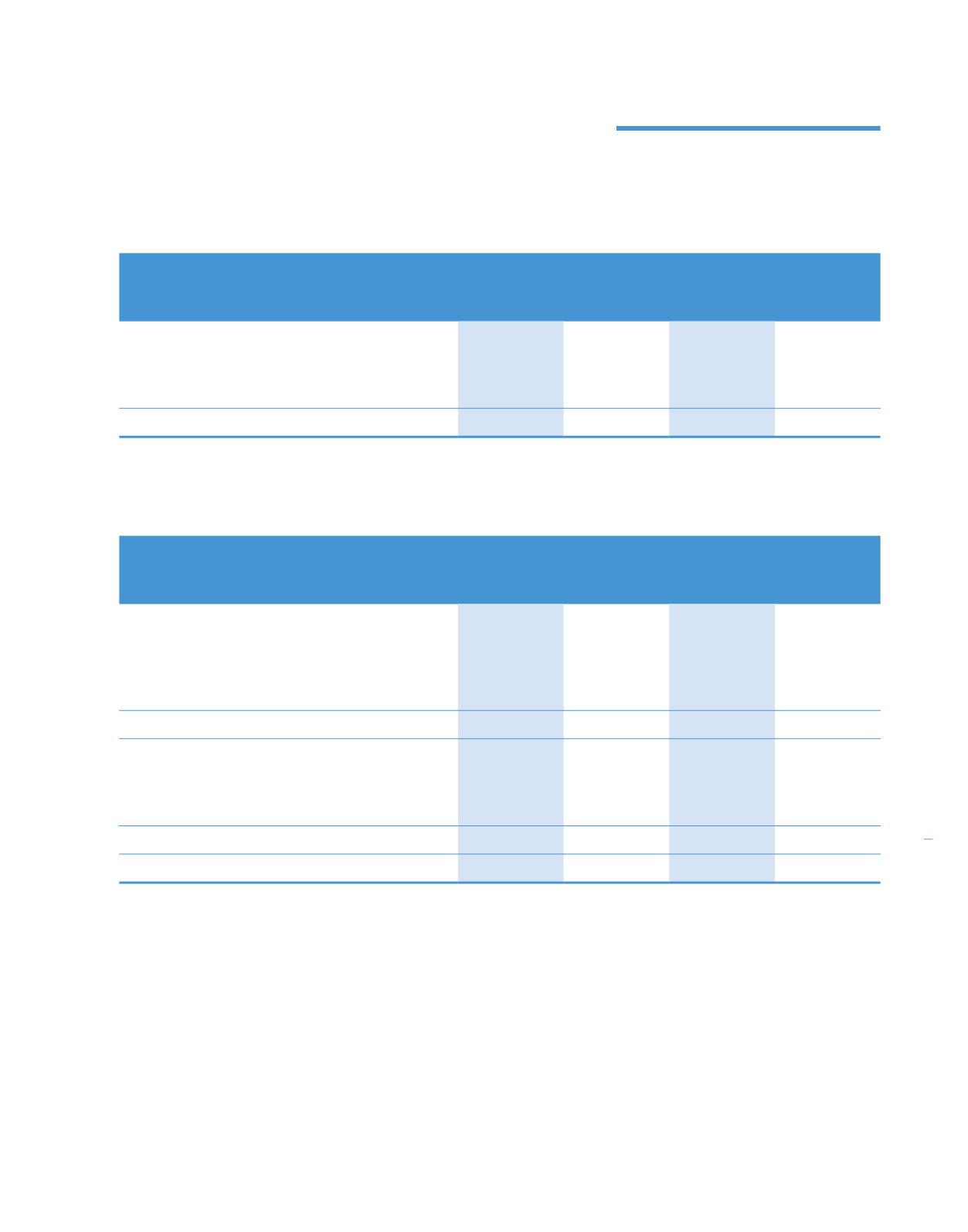

7. EMPLOYEE BENEFITS COSTS

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Staff costs (excluding directors’ remuneration):

– Salaries, allowances and bonuses

514,844

442,722

21,262

20,101

– Contribution to defined contribution plan

52,098

43,878

2,839

2,517

– Provision for retirement benefits

231

274

–

–

567,173

486,874

24,101

22,618

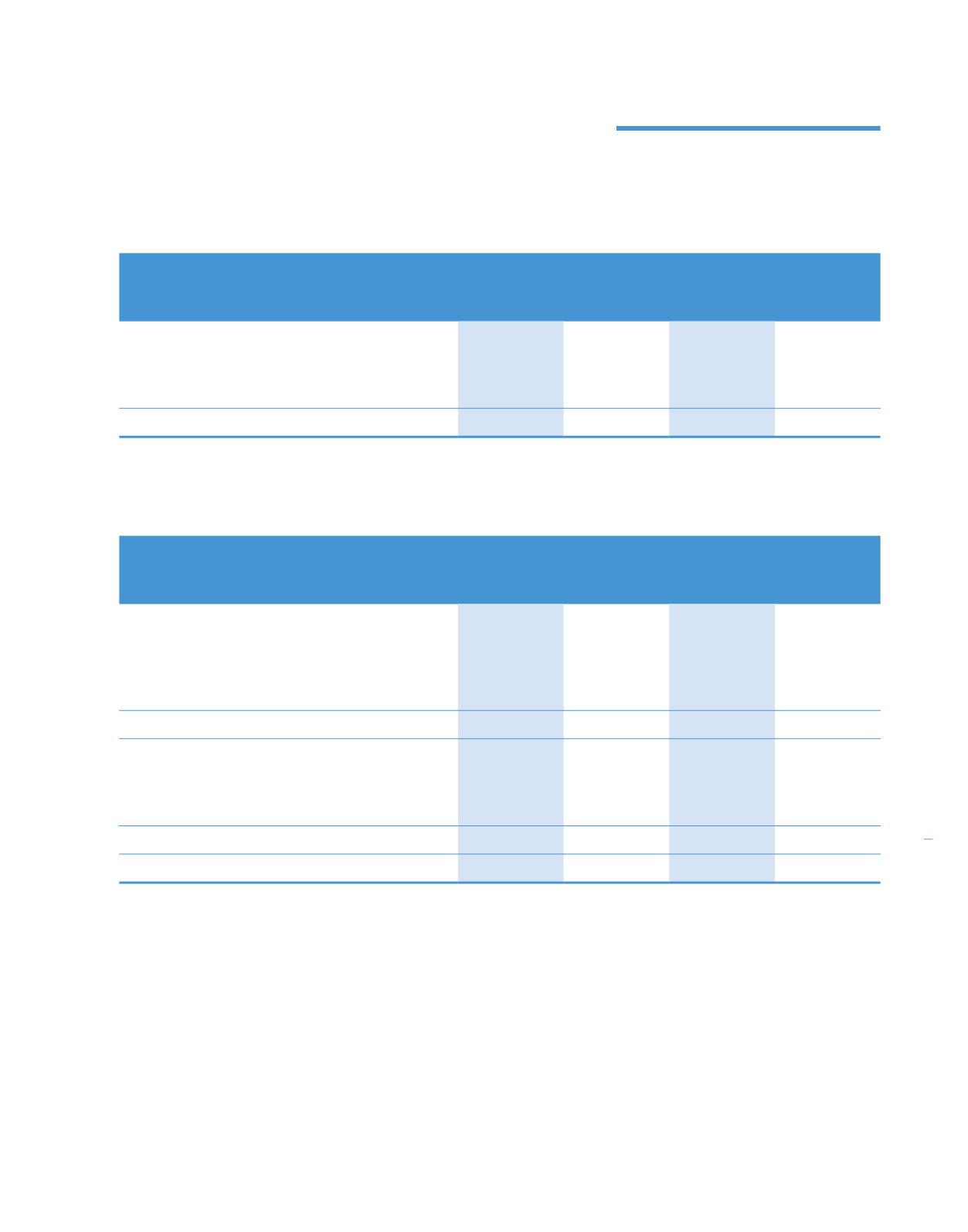

8. DIRECTORS’ REMUNERATION

The aggregate amount of emoluments received/receivable by directors of the Company during the financial year is as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Executive:

– Fees

125

122

75

75

– Salaries, allowances and bonuses

947

863

947

863

– Contribution to defined contribution plan

140

125

140

125

– Benefits-in-kind

22

22

22

22

1,234

1,132

1,184

1,085

Non-Executive:

– Fees

662

643

550

526

– Salaries, allowances and bonuses

739

1,110

423

1,088

– Benefits-in-kind

21

24

21

24

1,422

1,777

994

1,638

Total directors’ remuneration

2,656

2,909

2,178

2,723

235

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014