3. SIGNIFICANT ACCOUNTING JUDGEMENTS AND ESTIMATES (CONTINUED)

3.2 Key sources of estimation uncertainty (continued)

(c) Deferred tax assets

Deferred tax assets are recognised for all unused tax losses and unabsorbed capital allowances to the extent that

it is probable that taxable profit will be available against which the losses and capital allowances can be utilised.

Significant management judgement is required to determine the amount of deferred tax assets that can be

recognised, based upon the likely timing and level of future taxable profits together with future tax planning

strategies. Details of deferred tax of the Group are disclosed in

Note 20

.

(d) Capitalisation and amortisation of software development expenditure

The Group capitalised costs relating to the software development and enhancement of its new and existing facilities

respectively, upon meeting all the criteria for capitalisation as described in

Note 2.9(b)

. Amortisation, which

commences upon commercialisation, is recognised in profit or loss based on a straight-line basis over the products’

estimated economic lives of five years. The Group reviews the amortisation period and amortisation method at least

once a year.

However, if there are indications that the products are unable to meet expected future cash flow, immediate

impairment loss will be recognised. Details of software development expenditure are disclosed in

Note 18

.

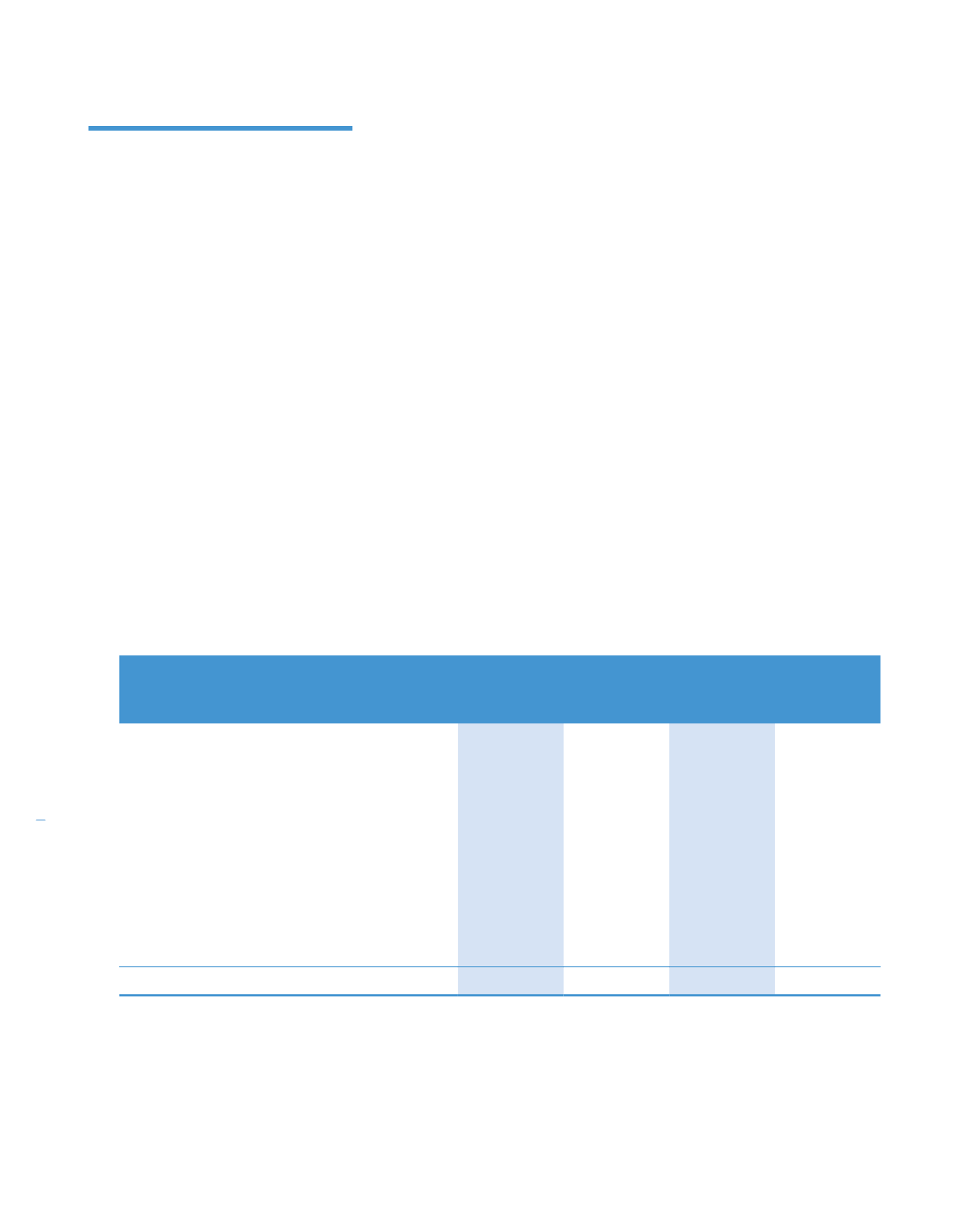

4. REVENUE AND COST OF SALES

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Hospital charges

963,996

874,018

–

–

Consultation fees

760,360

636,074

–

–

Sale of pharmaceutical, medical and surgical products

798,371

716,700

–

–

Other hospital revenue

23,417

22,631

–

–

Wellness subscription fees

13,340

13,440

–

–

Enrollment fees

29,994

27,076

–

–

Registration fees

1,723

1,396

–

–

Deferred management fees

1,603

1,802

–

–

Dividend income from subsidiaries

–

–

107,118

105,322

Interest income charged to subsidiaries

–

–

2,032

4,040

Management fees charged to subsidiaries

–

–

39,029

34,976

Other revenue

46,332

38,511

752

508

2,639,136

2,331,648

148,931

144,846

Cost of sales of the Group consists mainly of appropriation to consultant, cost of medical supplies, direct staff cost, repair and

maintenance on medical equipment and depreciation charged on medical equipment.

232

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)