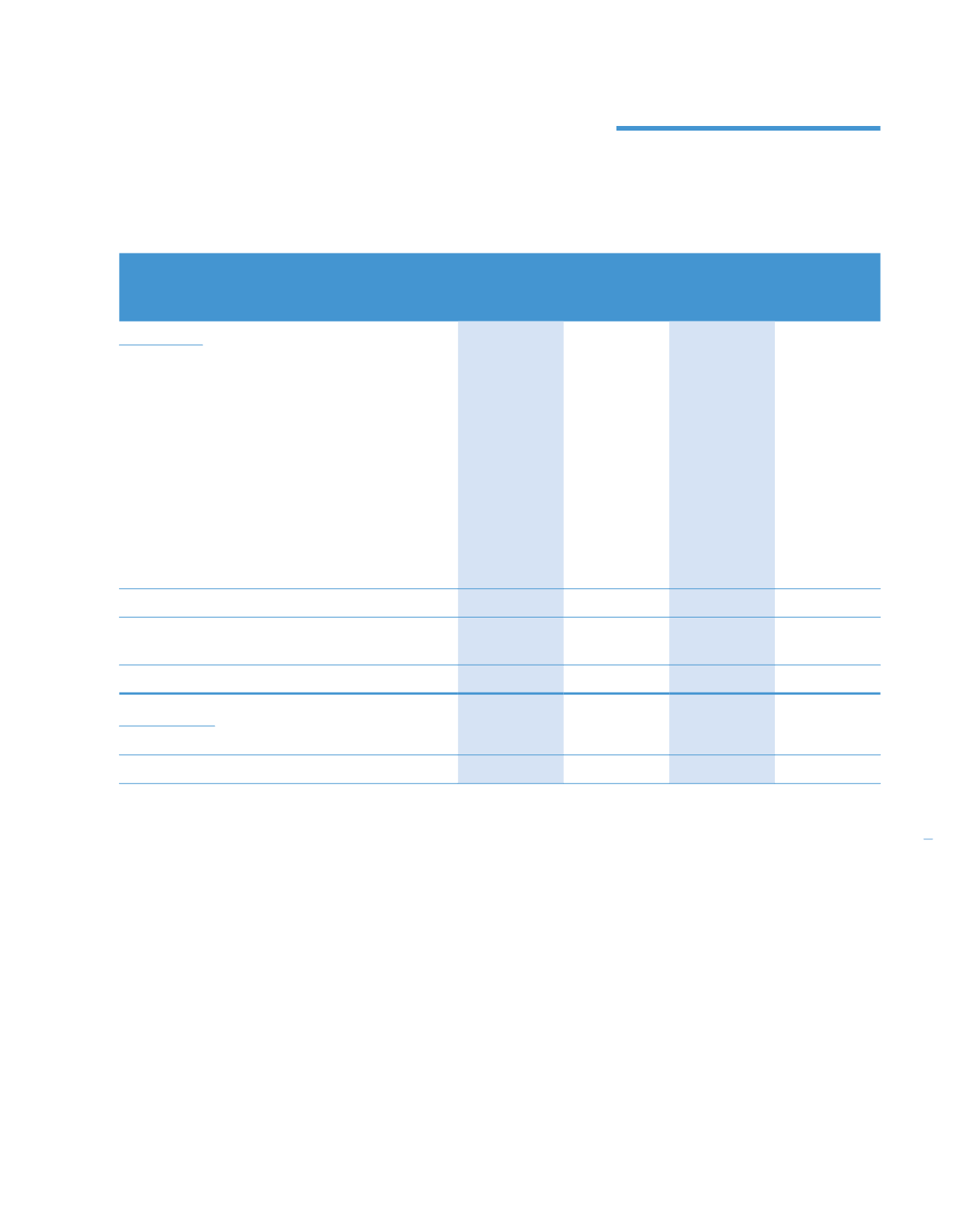

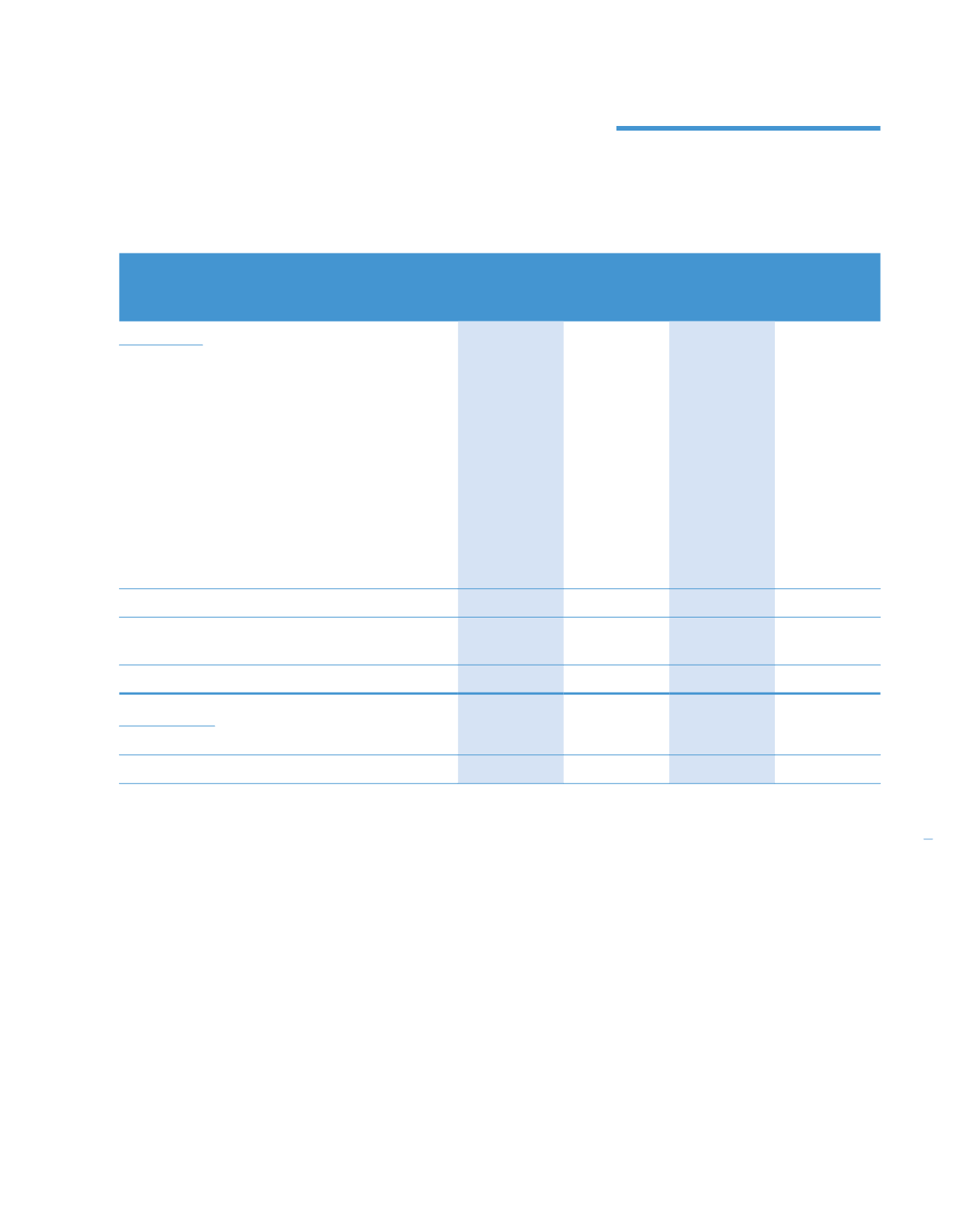

5. FINANCE INCOME AND COSTS

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Finance costs

Accretion of interest

276

278

–

–

Profit sharing from Islamic financing:

– Commercial papers

7,100

18,801

–

–

– Al-Ijarah

713

894

–

–

– Revolving credits

11,646

9,491

11,646

9,491

Interest expense from conventional financing:

– Overdrafts

369

513

–

–

– Interest on advances from subsidiaries

–

–

10,867

9,971

– Term loans

16,498

1,277

–

–

– Revolving credits

2,274

2,258

–

–

– Lease and hire purchase

2,779

1,272

–

–

– Others

2,959

6,706

6

191

44,614

41,490

22,519

19,653

Less: Interest expense capitalised in:

– Property, plant and equipment

(1,757)

(2,725)

–

–

42,857

38,765

22,519

19,653

Finance income

Profit sharing from Islamic short term deposits

12,982

10,570

–

–

Net finance costs

29,875

28,195

22,519

19,653

233

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014