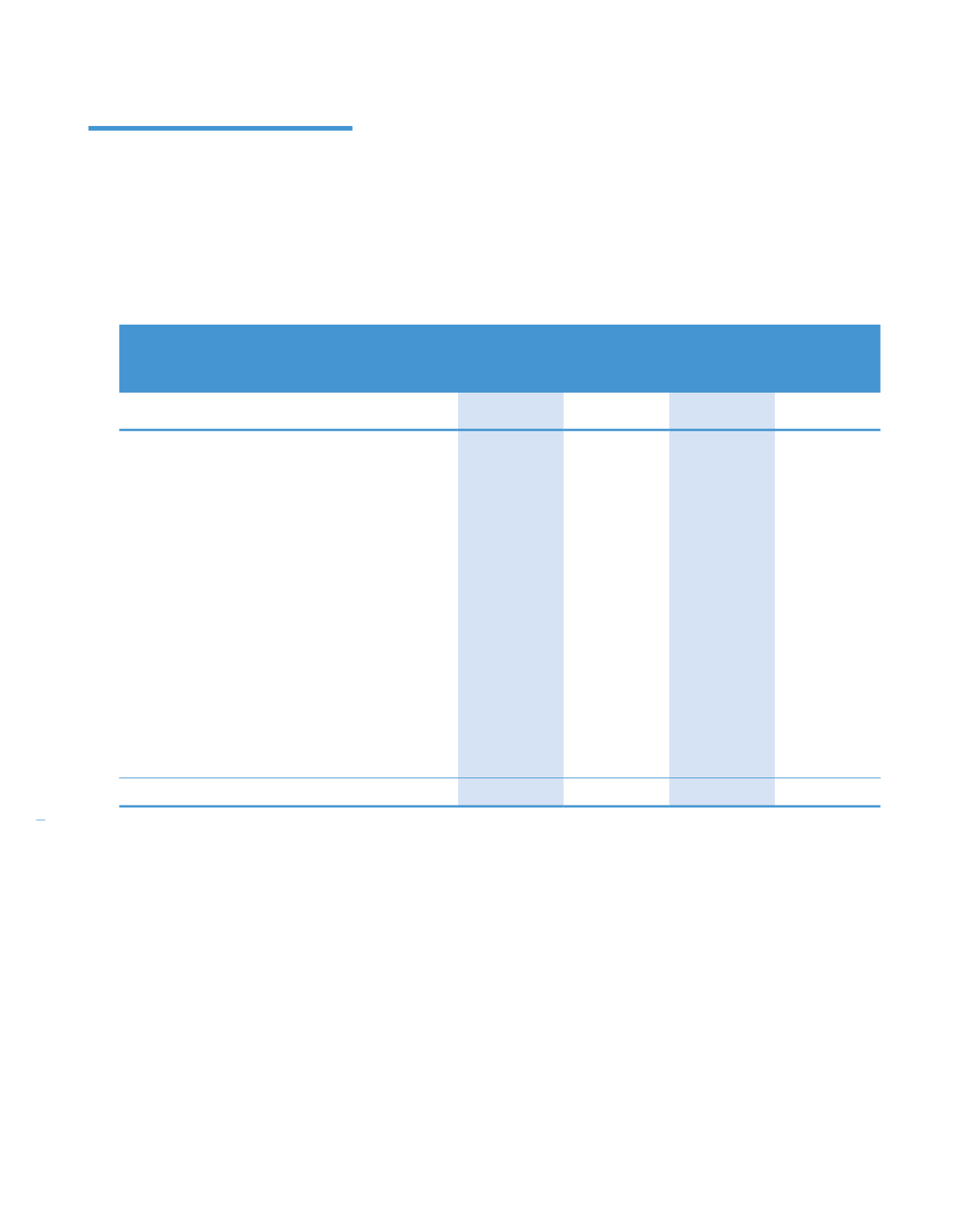

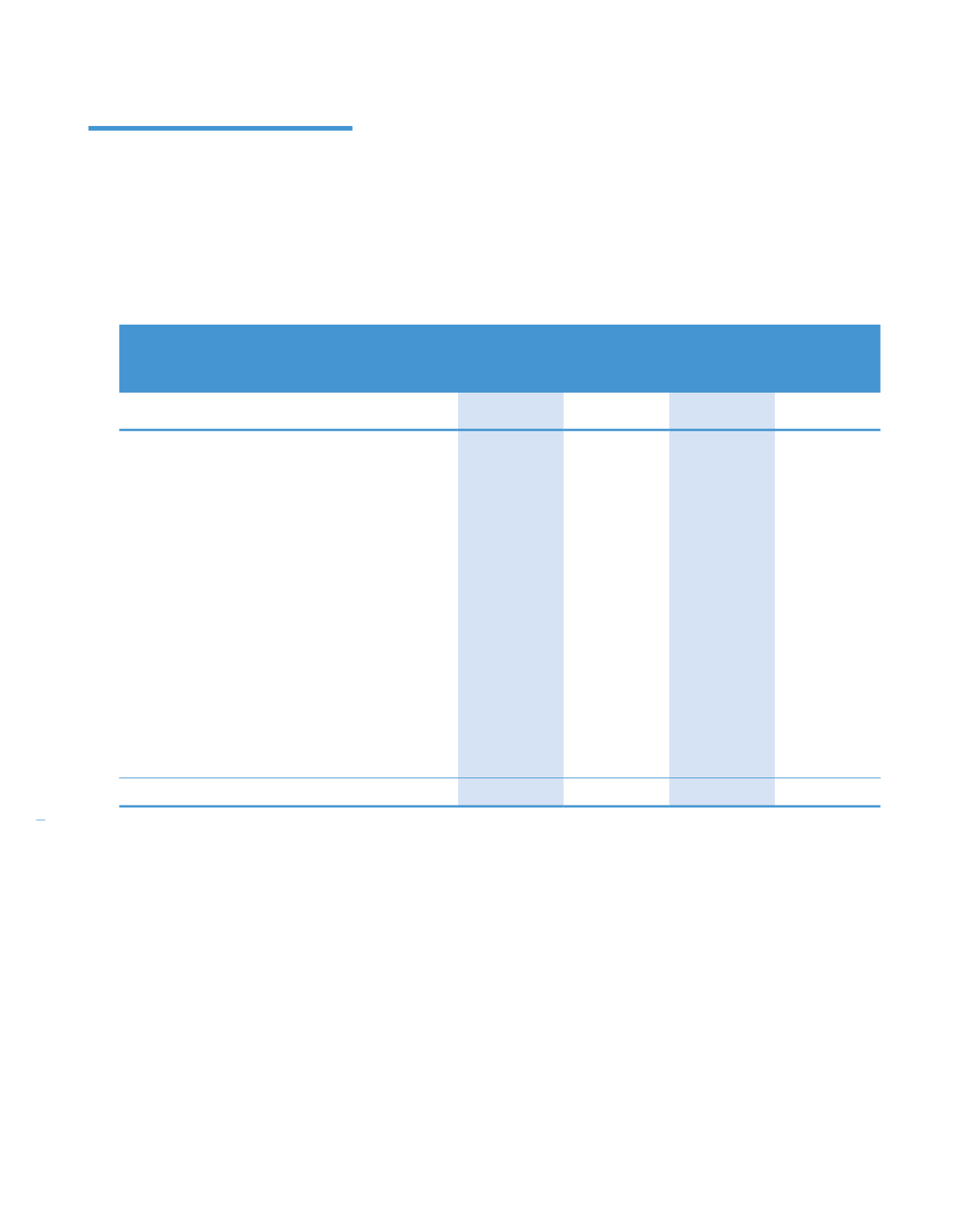

10. INCOME TAX EXPENSE (CONTINUED)

Reconciliation between tax expense and accounting profit

The reconciliation of income tax expense and the product of accounting profit multiplied by the applicable corporate rate for

the years ended 31 December 2014 and 2013 is as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Profit before tax after zakat

215,812

157,732

82,894

69,610

Tax at Malaysian statutory tax rate of 25% (2013: 25%)

53,953

39,433

20,724

17,403

Different tax rates in other countries

(65)

(161)

–

–

Adjustments:

Income not subject to tax

(6,693)

(2,501)

(26,780)

(24,677)

Non-deductible expenses

29,336

28,896

7,036

6,442

Expenses qualified for double deduction

(40)

(146)

–

–

Small and Medium Enterprise tax savings

(25)

(25)

–

–

Share of results of associates

(10,104)

(11,715)

–

–

Utilisation of previously unrecognised tax losses

(1,421)

(10,434)

(980)

–

Utilisation of previously unrecognised capital

allowances

(464)

–

–

–

Utilisation of previously unrecognised temporary

differences

(300)

(1,255)

–

–

(Over)/under provision in respect of previous years:

– Taxation

(4,871)

(3,655)

(1,103)

(1,097)

– Deferred tax

2,404

710

–

–

Current year deferred tax asset not recognised

6,856

8,220

–

2,515

Income tax expense/(credit)

68,566

47,367

(1,103)

586

238

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)