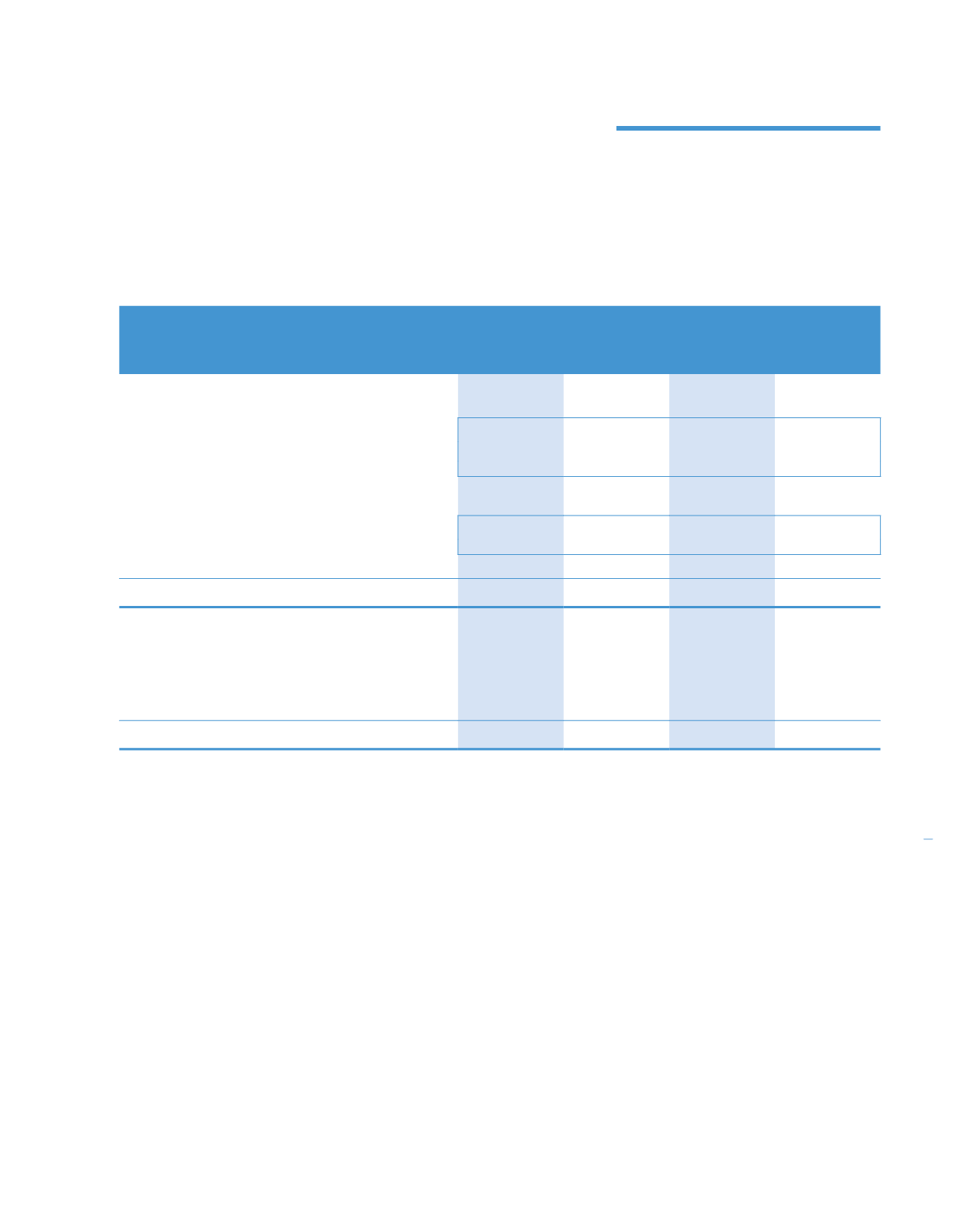

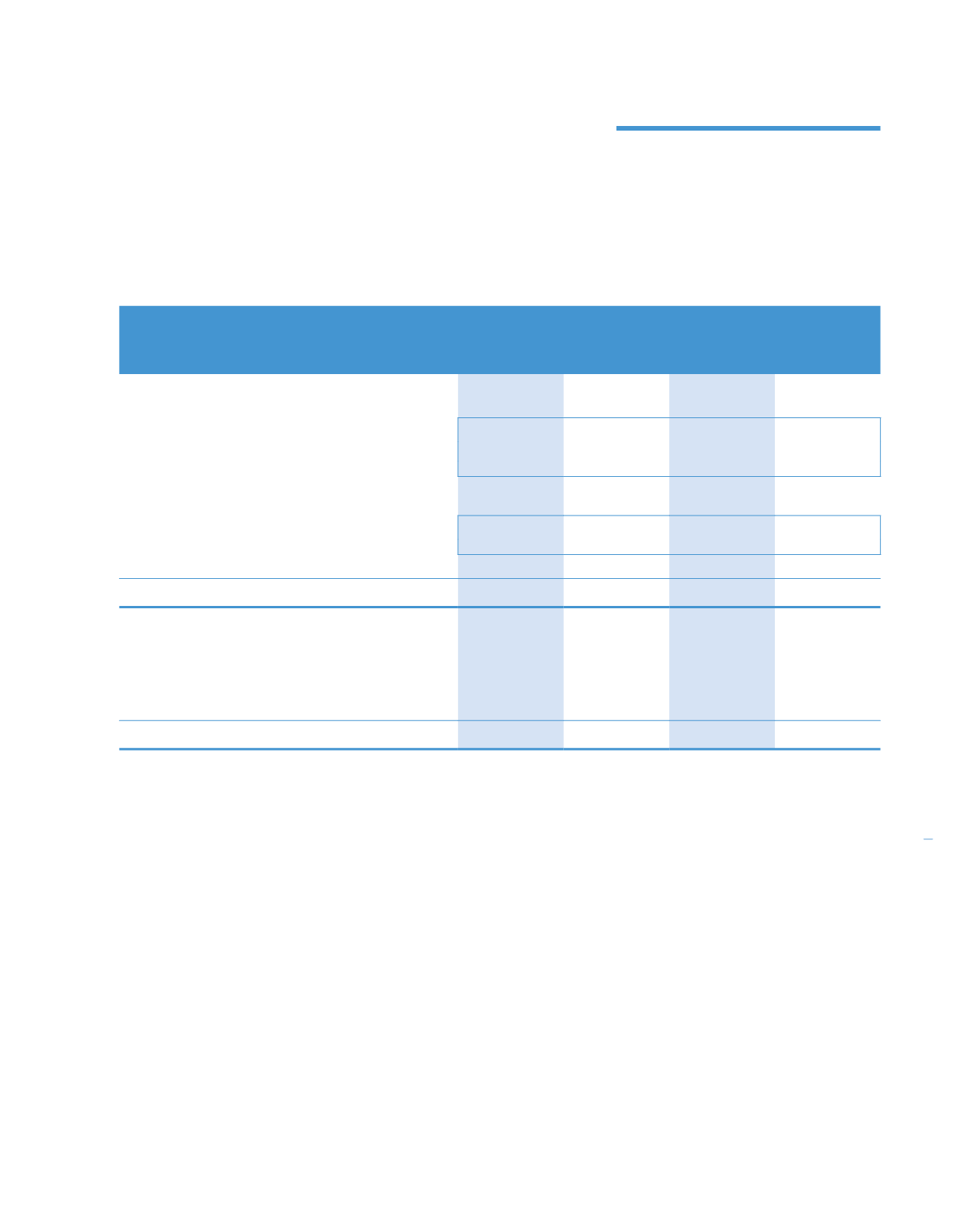

10. INCOME TAX EXPENSE

Major components of income tax expense

The major components of income tax expense for the years ended 31 December 2014 and 2013 are:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Statements of comprehensive income:

Current income tax:

– Malaysian income tax

81,712

57,170

–

1,683

– Foreign income tax

21

633

–

–

– Overprovision in respect of previous years

(4,871)

(3,655)

(1,103)

(1,097)

76,862

54,148

(1,103)

586

Deferred income tax:

– Reversal of temporary differences

(10,700)

(7,491)

–

–

– Under provision in respect of previous years

2,404

710

–

–

(8,296)

(6,781)

–

–

Income tax expense recognised in profit or loss

68,566

47,367

(1,103)

586

Deferred income tax related to other comprehensive

income:

– Net surplus on revaluation of freehold land &

building

1,105

–

–

–

– Acquisition of a subsidiary

–

548

–

–

1,105

548

–

–

The current income tax is calculated at the statutory tax rate of 25% (2013: 25%) of the estimated assessable profit for the

year. The domestic statutory rate will be reduced to 24% from the current year’s rate of 25% effective year of assessment

2016.

237

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014