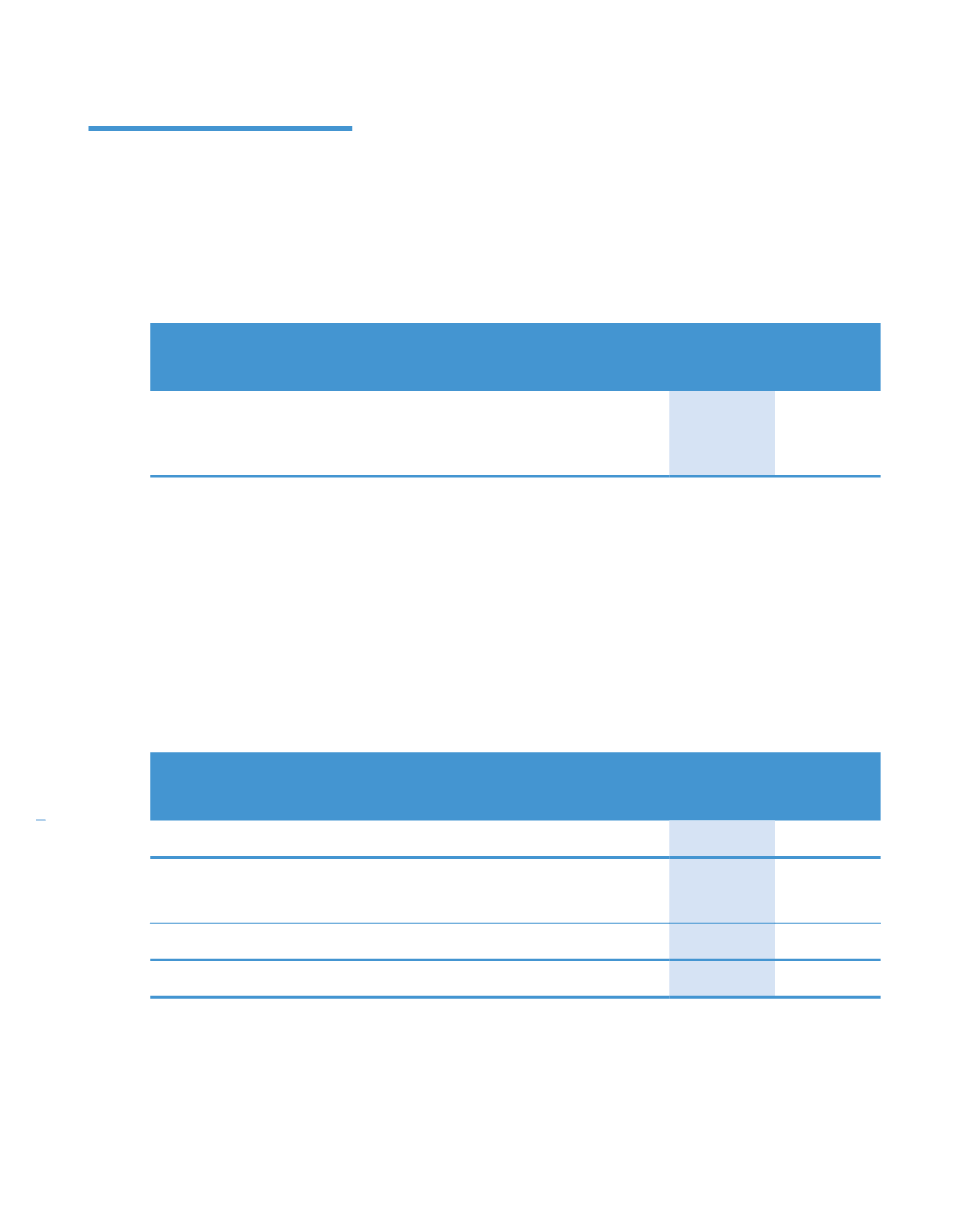

12. EARNINGS PER SHARE

(a) Basic earnings per share

Basic earnings per share of the Group is calculated by dividing the profit attributable to ordinary equity holders of the

Company for the financial year by the average number of ordinary shares in issue during the financial year.

Group

2014

2013

(Restated)

Profit attributable to ordinary equity holders of the Company (RM’000)

143,030

103,114

Weighted average number of ordinary shares in issue (‘000)

1,017,122

991,263

Basic earnings per share (sen)

14.06

10.40

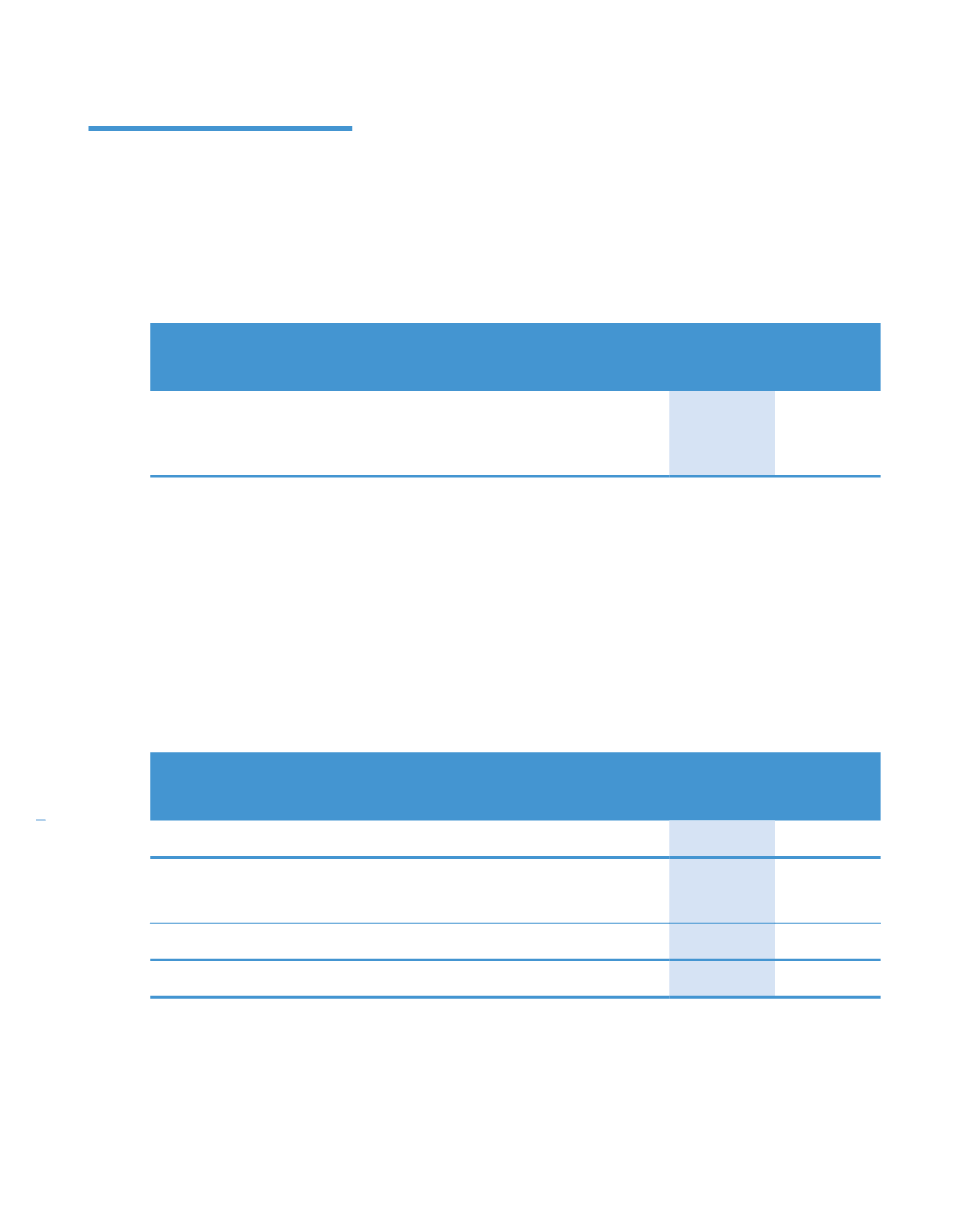

(b) Diluted earnings per share

For the diluted earnings per share calculation, the average number of ordinary shares in issue is adjusted to assume

conversion of all dilutive potential ordinary shares. The dilutive potential ordinary shares for the Group are the warrants

issued.

For the share warrants issued, a calculation is done to determine the number of shares that could have been acquired

at fair value (determined as the average share price of the Company’s shares) based on the monetary value of the

subscriptions rights attached to outstanding warrants. The number of shares calculated as above is compared with the

number of shares that would have been issued assuming the exercise of the warrants. The difference is added to the

denominator as an issue of ordinary shares for no consideration. This calculation serves to determine the “bonus”

element in the ordinary shares outstanding for the purpose of computing the dilution. No adjustment is made to profit

for the financial year for the warrants calculation.

Group

2014

2013

(Restated)

Profit attributable to equity holders of the Company (RM’000)

143,030

103,114

Weighted average number of ordinary shares in issue (‘000)

1,017,122

991,263

Assumed shares issued from the – exercise of warrants

1,583

5,154

Weighted average number of ordinary shares in issue (‘000)

1,018,705

996,417

Diluted earnings per share (sen)

14.04

10.35

240

KPJ Healthcare Berhad annual report

2014

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)