29 BORROWINGS (CONTINUED)

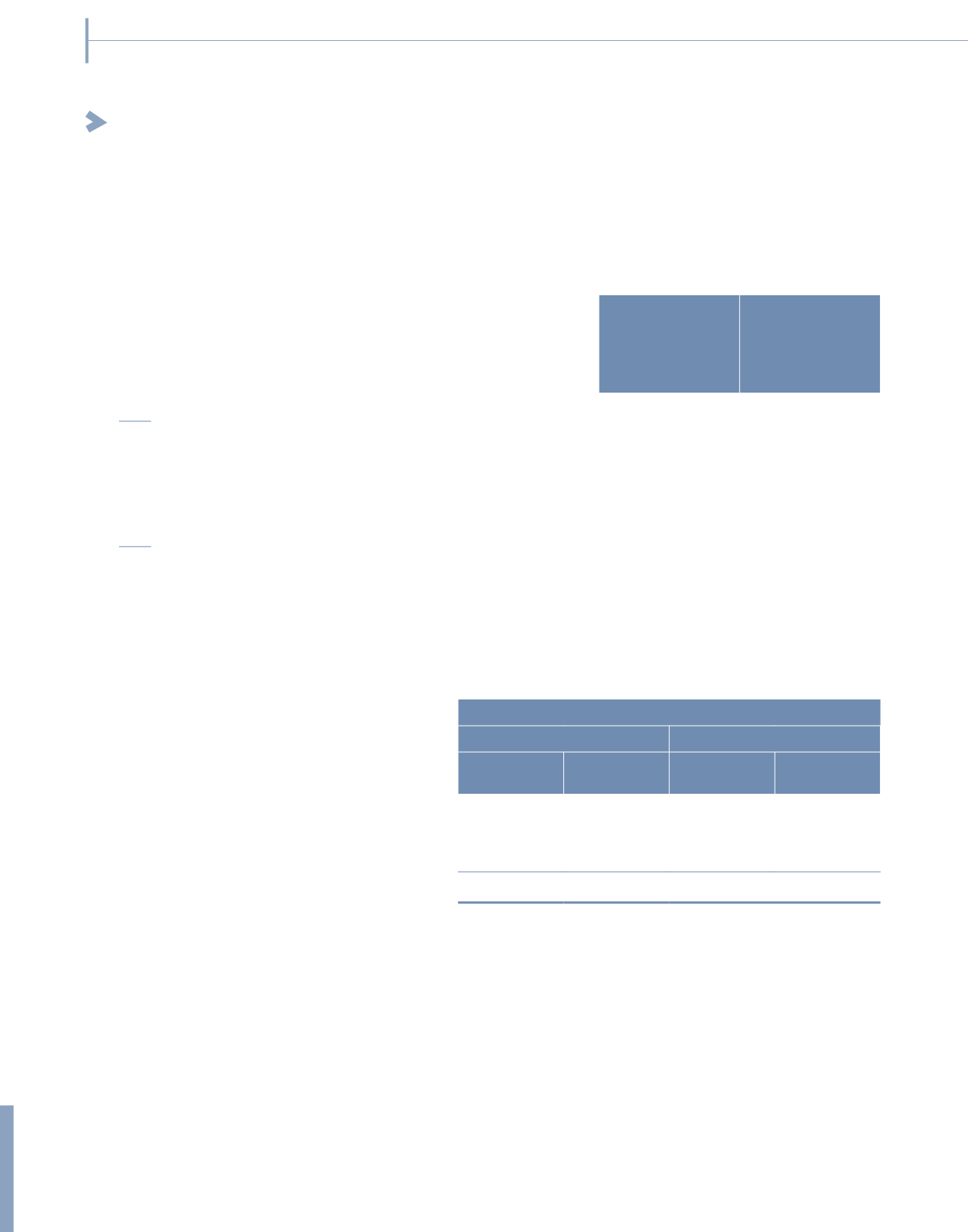

Finance

rate

Effective finance

rate at date of

statement of

financial position

(% p.a)

2015

Term loans

Fixed/Floating

4.50 – 5.70

Finance lease liabilities

Fixed

2.40 – 8.20

Islamic Medium Term Notes

Fixed

5.75 – 5.98

Bank overdrafts

Floating

6.72

2014

Term loans

Fixed/Floating

2.83 – 7.29

Finance lease liabilities

Fixed/Floating

3.12 – 7.77

Bank overdrafts

Floating

7.77

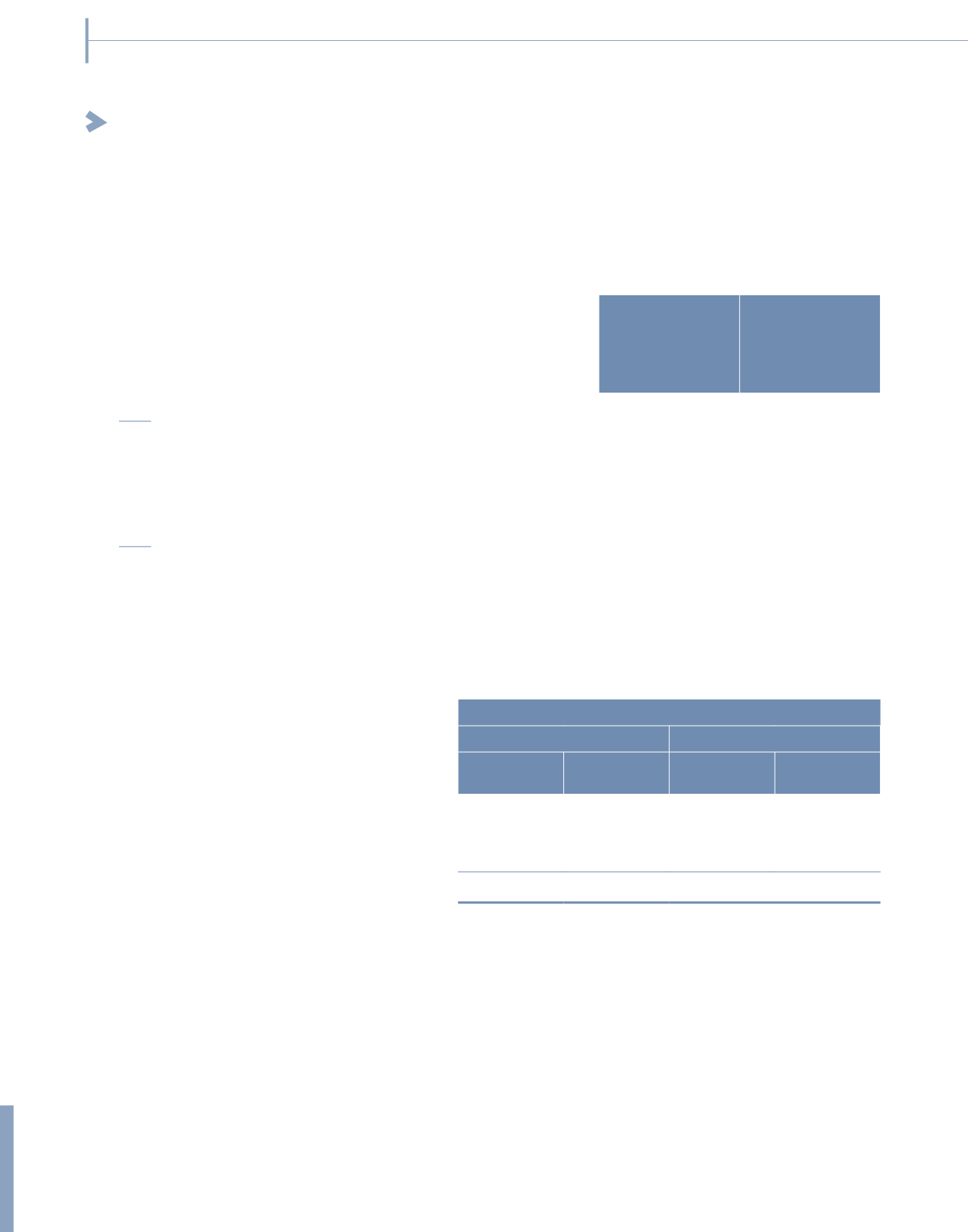

Set below is fair value of the Group’s financial instruments, other than those with carrying amounts that are reasonable

approximations of fair values:

Group

Carrying value

Fair value

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Term loans

162,538

116,820

141,333

99,913

Finance lease liabilities

51,072

51,821

50,898

51,536

Islamic Medium Term Notes

795,219

–

532,489

–

1,008,829

168,641

724,720

151,449

308

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)