23 DEFERRED TAX

Deferred tax assets and liabilities were offset when there is a legally enforceable right to set off current tax assets against

current tax liabilities and when the deferred taxes relate to the same tax authority. The following amounts, determined after

appropriate offsetting are shown on the statements of financial position.

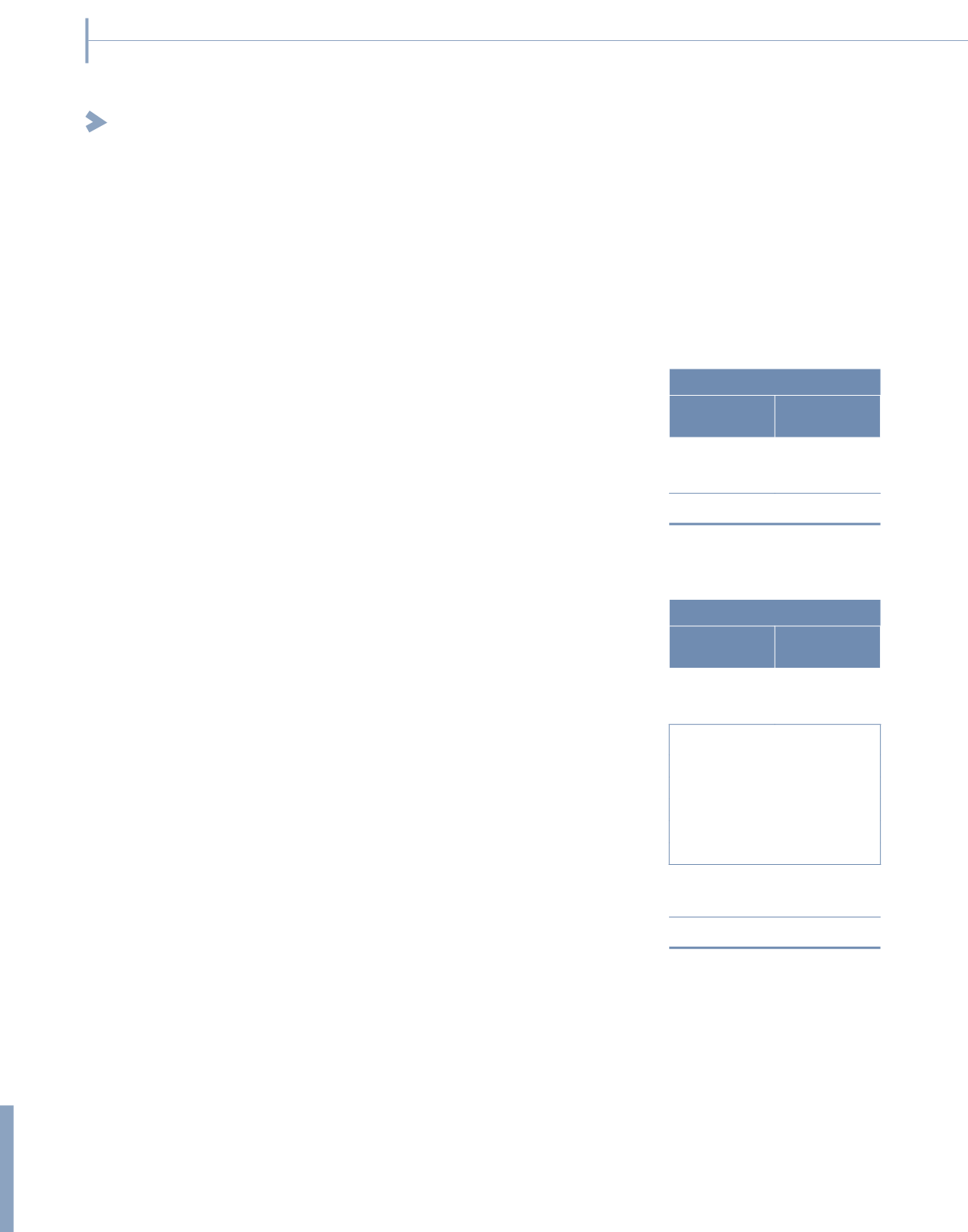

Group

2015

RM’000

2014

RM’000

Deferred tax assets

18,956

27,841

Deferred tax liabilities

(69,177)

(42,673)

At 31 December

(50,221)

(14,832)

The movement in the deferred tax assets and liabilities (prior to offsetting of balances within the same tax jurisdiction) during the

financial year is as follow:

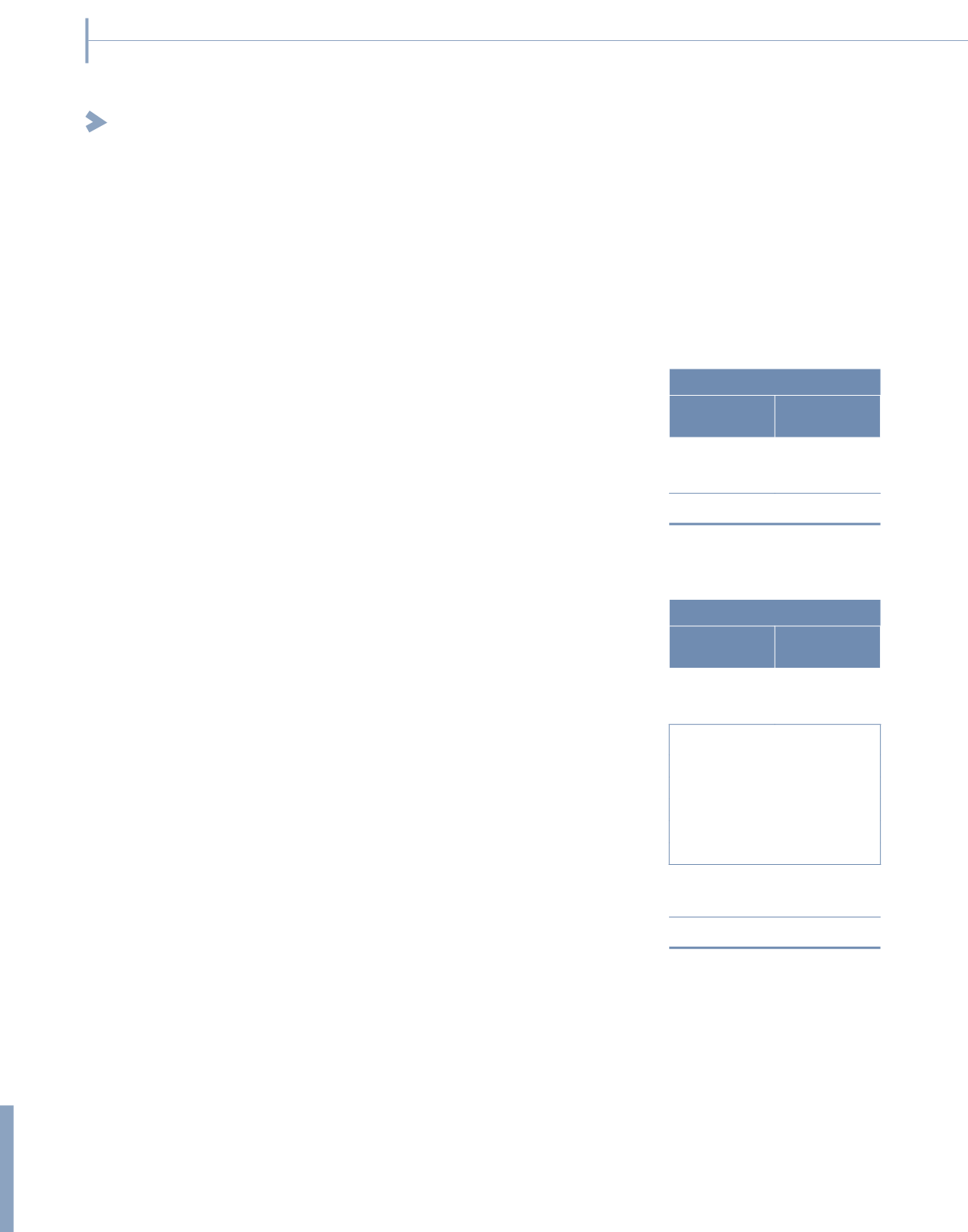

Group

2015

RM’000

2014

RM’000

At 1 January

(14,832)

(22,023)

(Charged)/credit to profit or loss (Note 13)

– Property, plant and equipment

(11,350)

(5,706)

– Investment property

(1,441)

(1,338)

– Trade and other receivables

285

12,573

– Tax losses

(10,487)

2,328

– Deferred revenue

3,800

439

– Trade and other payables

(5,567)

–

(24,760)

8,296

Charged to other comprehensive income

(10,629)

(1,105)

At 31 December

(50,221)

(14,832)

298

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)