28 TRADE AND OTHER PAYABLES AND AMOUNT DUE TO SUBSIDIARIES (CONTINUED)

Advances from subsidiaries are unsecured and bear an effective weighted average interest rate of 5.85% (2014: 3.70%) per

annum and are not repayable in the next 12 months.

Amounts due to ultimate holding corporation, subsidiaries and other related companies are unsecured, interest free and

repayable on demand.

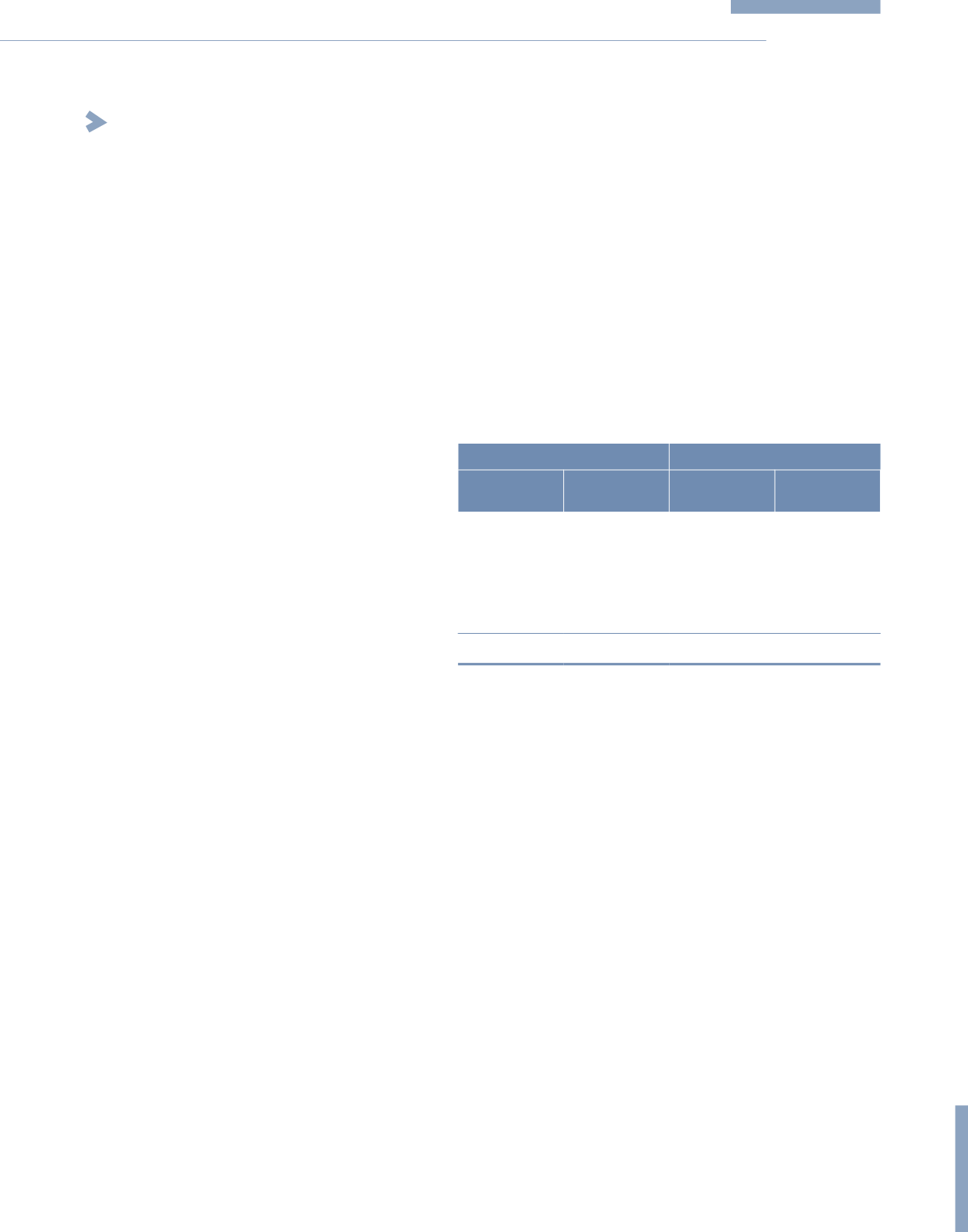

Credit terms of trade payables ranges from 30 to 60 days (2014: 30 to 60 days). The currency exposure profile of payables

is as follows:

Group

Company

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Ringgit Malaysia

506,946

443,532

465,652

360,300

Singapore Dollar

49

210

-

-

Indonesian Rupiah

3,081

2,273

-

-

Australian Dollar

60,100

119,143

-

-

Bangladesh Taka

46,707

-

-

-

616,883

565,158

465,652

360,300

305

KPJ Healthcare Berhad

Annual Report

2015

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONTINUED)