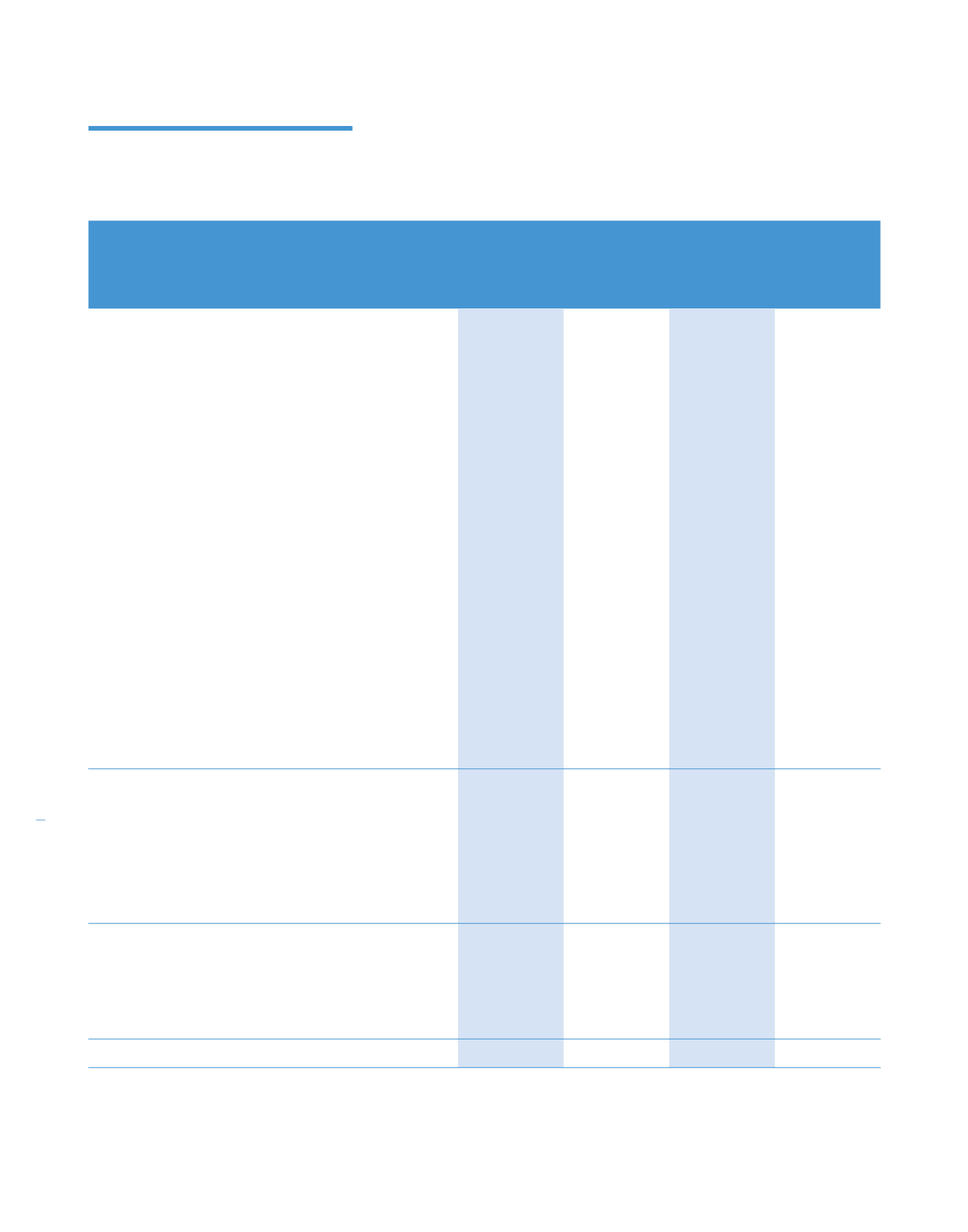

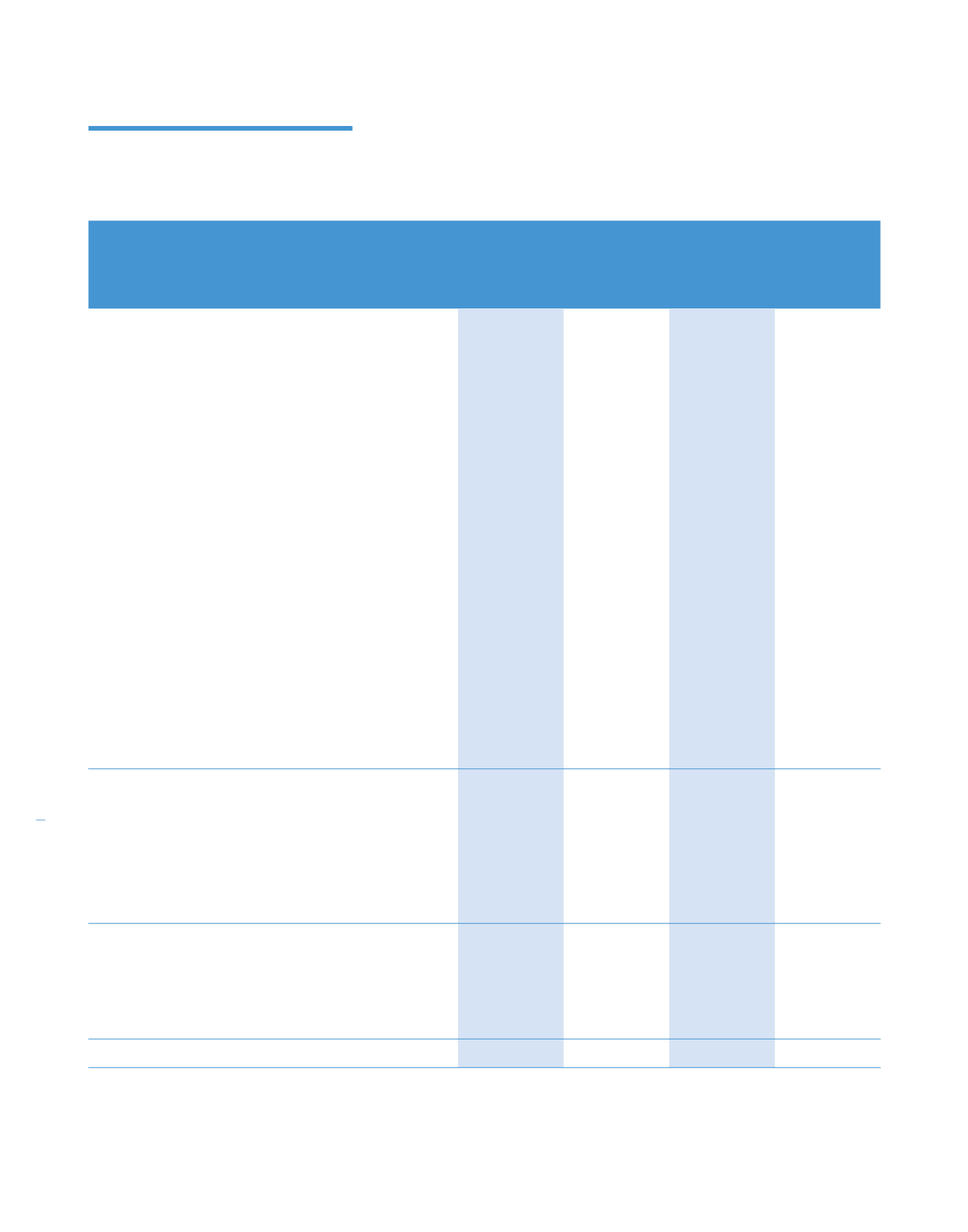

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

(Restated)

Operating activities

Profit before zakat and tax

218,084

159,557

82,964

69,630

Adjustments for:

Share of results of associates

(40,415)

(46,858)

–

–

Finance income

(12,982)

(10,570)

(2,032)

(4,040)

Finance costs

42,857

38,765

22,519

19,653

Dividend income from subsidiaries

–

–

(107,118)

(105,322)

Trade receivables:

– Impairment

(Note 22)

6,843

8,238

–

–

– Reversal of impairment loss

(Note 22)

(917)

(1,754)

–

–

Impairment of goodwill

(Note 18)

728

–

–

–

Gain on fair value on investment properties

(Note 14)

(14,461)

(646)

–

–

Gain on disposal of investment property

(166)

–

–

–

Gain on disposal of shares in an associate

(1,732)

(1,306)

–

–

Gain on disposal of non-current assets held for sale

(1,577)

–

–

–

Property, plant and equipment

– Depreciation

(Note 13)

108,268

93,061

–

–

– Written off

(Note 13)

473

519

–

–

– Loss on disposal

266

104

–

–

– Reversal of impairment loss

(Note 6)

(3,581)

–

–

–

Inventories written off

96

157

–

–

Available-for-sale financial assets written off

266

2,520

–

–

Amortisation of software development expenditure

(Note 18)

1,140

1,049

–

–

Operating profit/(loss) before working capital changes

303,190

242,836

(3,667)

(20,079)

Changes in working capital:

Inventories

8,013

5,061

–

–

Receivables

(16,700)

(101,172)

(54)

294

Payables

86,708

58,041

(5,463)

101,557

Deferred revenue

6,547

1,044

–

–

Related companies

–

–

65,828

(162,338)

Cash flows generated from/(used in) operations

387,758

205,810

56,644

(80,566)

Interest paid on advances from subsidiaries

–

–

(9,713)

(19,653)

Zakat paid

(2,272)

(1,825)

(70)

(20)

Income tax refund

3,482

10,170

–

–

Income tax paid

(70,451)

(70,642)

(534)

(943)

Net cash generated from/(used in) operating activities

318,517

143,513

46,327

(101,182)

208

KPJ Healthcare Berhad annual report

2014

Statements of

cash flows

For the financial year ended 31 December 2014