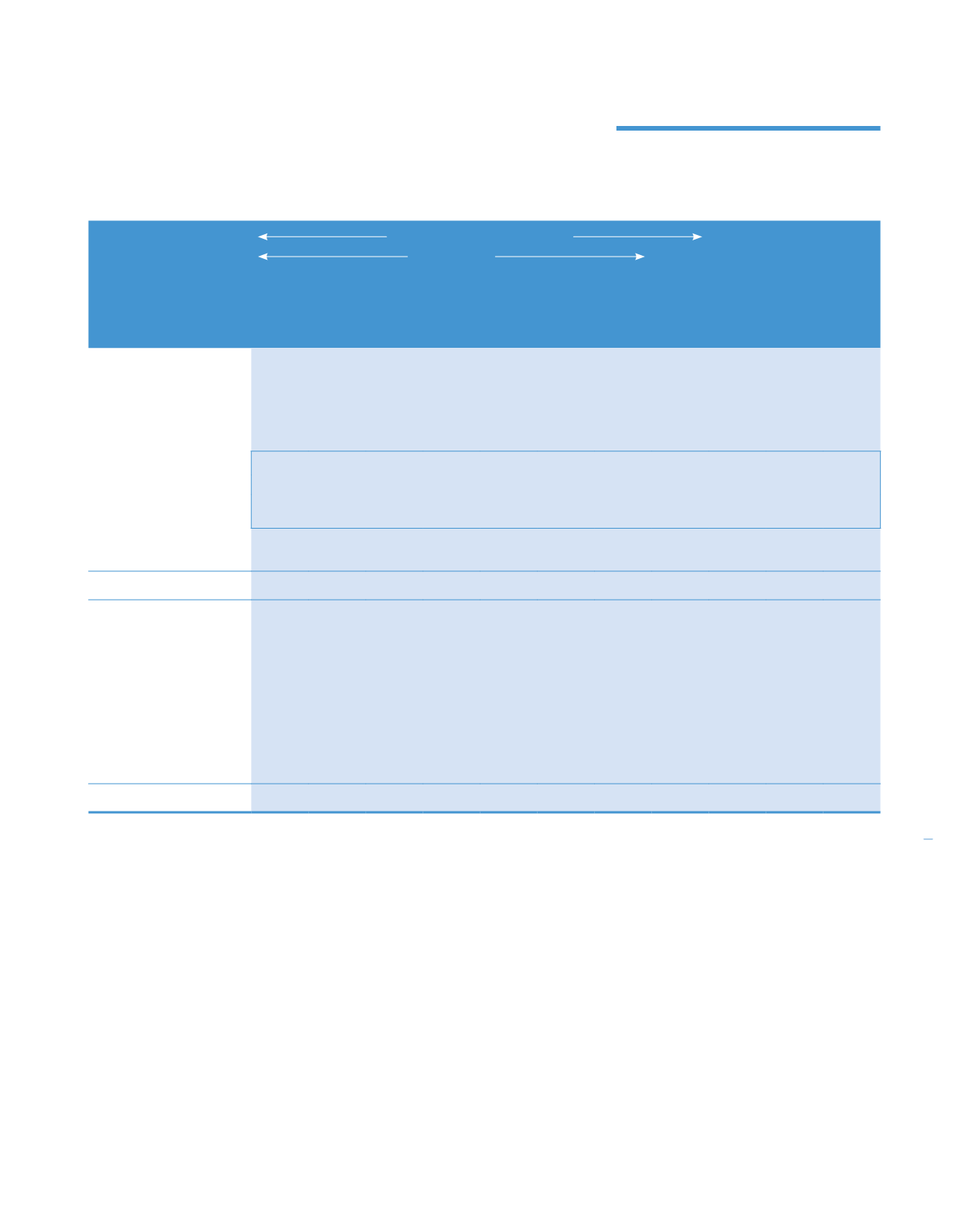

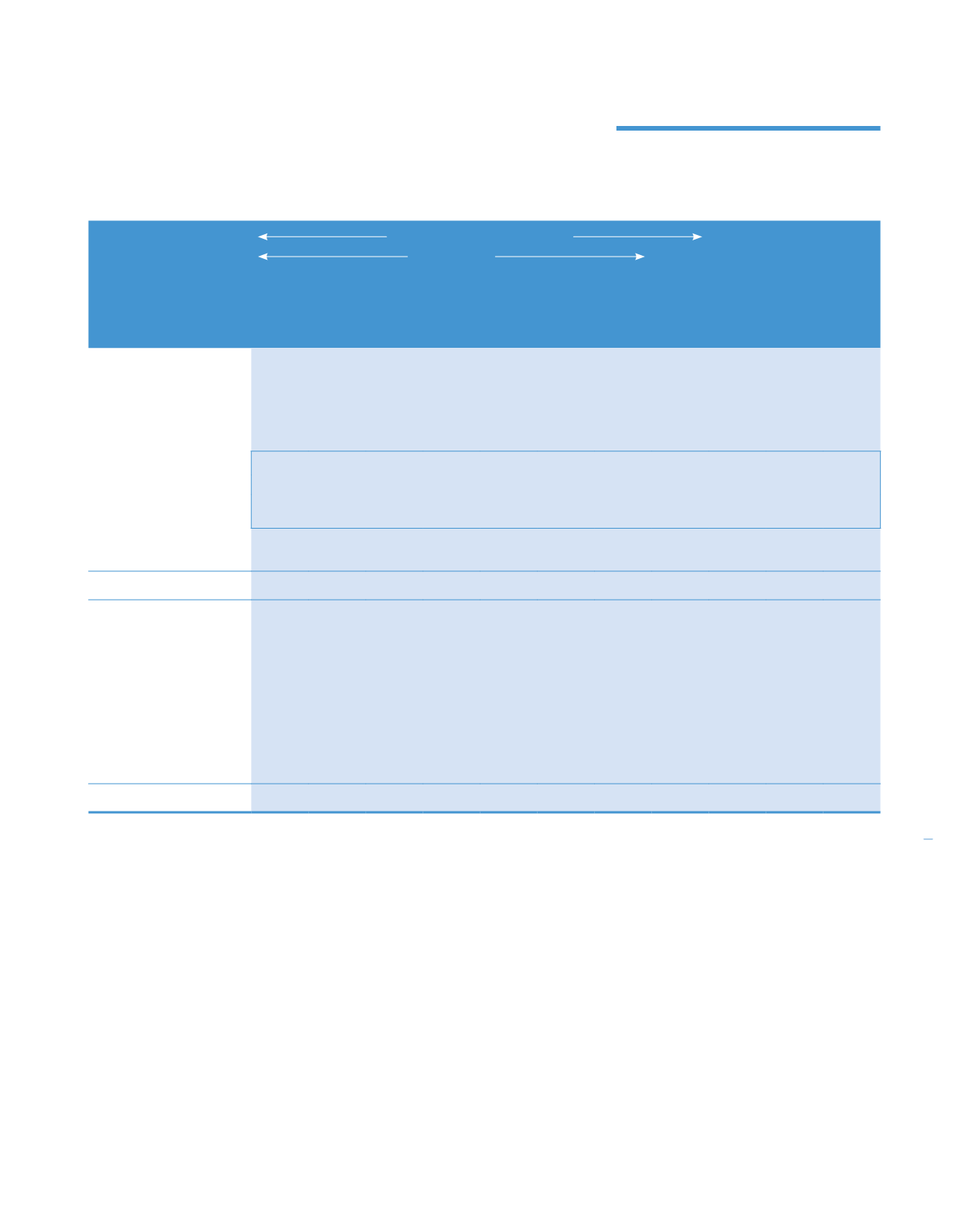

Attributable to owners of the Company

Non-distributable

Non-

Share

Share Treasury Warrant

Merger Exchange Revaluation Retained

controlling

Total

capital premium shares reserve reserve reserve reserve earnings

Total

interests

equity

RM'000 RM'000 RM'000 RM'000 RM'000 RM'000 RM'000 RM'000 RM'000 RM'000 RM'000

(Note 30) (Note 31(a))

(Note 31(e)) (Note 31(b)) (Note 31(c)) (Note 31(d)) (Note 31(f))

Group

At 1 January 2014

490,955

–

(364)

–

(3,367)

1,403

50,387 546,622 1,085,636

84,981 1,170,617

Comprehensive income

Profit net of tax

–

–

–

–

–

–

– 143,030 143,030

4,216 147,246

Other comprehensive income

Translation of foreign subsidiaries

–

–

–

–

–

271

–

–

271

(114)

157

Revaluation surplus

–

–

–

–

–

–

8,042

–

8,042

–

8,042

Share of other comprehensive

income of associates

–

–

–

–

–

221

–

–

221

–

221

Total other comprehensive

income/(loss)

–

–

–

–

–

492

8,042

–

8,534

(114)

8,420

Total comprehensive income

–

–

–

–

–

492

8,042 143,030 151,564

4,102 155,666

Transactions with owners

Changes in ownership interest in

subsidiaries

–

–

–

–

–

–

–

(464)

(464)

697

233

Issue of shares:

– exercise of share warrants

2,600

3,276

–

–

–

–

–

–

5,876

–

5,876

– purchase of treasury shares

–

– (54,413)

–

–

–

–

– (54,413)

– (54,413)

Rights issue

21,819

68,414

–

31,952

–

–

–

– 122,185

– 122,185

Rights issue cost

–

(1,183)

–

–

–

–

–

–

(1,183)

–

(1,183)

Dividends on ordinary shares

–

–

–

–

–

–

– (49,841)

(49,841)

– (49,841)

At 31 December 2014

515,374

70,507 (54,777)

31,952

(3,367)

1,895

58,429 639,347 1,259,360

89,780 1,349,140

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.

205

KPJ Healthcare Berhad annual report

2014

Consolidated statement

of changes in equity

For the financial year ended 31 December 2014