In conformance with the Bursa Malaysia Listing Requirements, the following additional information is provided:

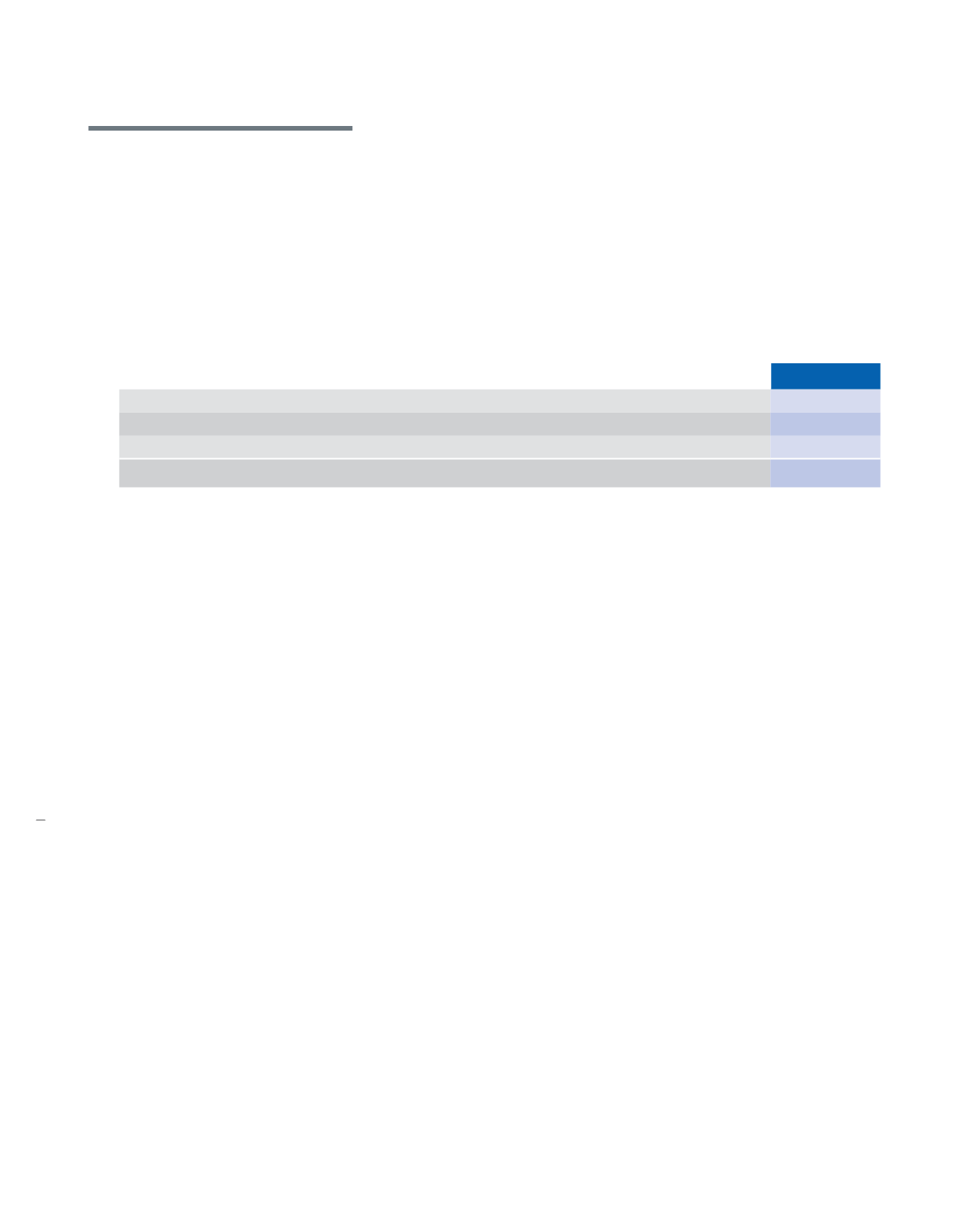

1. UTILISATION OF PROCEEDS RAISED FROM CORPORATE PROPOSAL

The proceeds which were raised from the Islamic Commercial Papers/Islamic Medium Term Notes Programme was fully

settled and cancelled on 16 November 2014 in the following manner:

ICP/IMTN

RM'000

At 1 January

499,000

Full settlement of the ICP outstanding

(499,000)

Issued during the financial year for working capital purposes

0

At 31 December

0

2. TREASURY SHARES

Up to 31 December 2014, 15,520,000 units of KPJ Healthcare Berhad shares were bought by the Company from the open

market, listed on the Main Market of Bursa Listed Securities Berhad, at an average buy-back price of RM3.46 per share for

a total consideration of RM54,413,249 including transaction cost and was financed by internally generated fund. The shares

were retained as treasury shares.

3. OPTIONS, WARRANTS OR CONVERTIBLE SECURITIES

During the financial year, 5,201,000 new ordinary shares of RM0.50 each were issued by the Company for cash by virtue of

the conversion of warrant at exercise price of RM1.13 per share. Adjustment was made to the exercise price if the

outstanding warrants 2010/2015 from RM1.14 to RM1.13 as a result of the Rights Issue and Free Warrants on 29 January

2014.

4. AMERICAN DEPOSITORY RECEIPT (ADR) OR GLOBAL DEPOSITORY RECEIPT (GDR) PROGRAMME

During the financial year, the Company did not issue any ADR or GDR Programme.

5. IMPOSITIONS OF SANCTIONS/PENALTIES

There were no sanctions and/or penalties imposed on the Company and its subsidiaries, Directors or Management by the

relevant regulatory bodies.

188

KPJ Healthcare Berhad annual report

2014

Compliance

Information