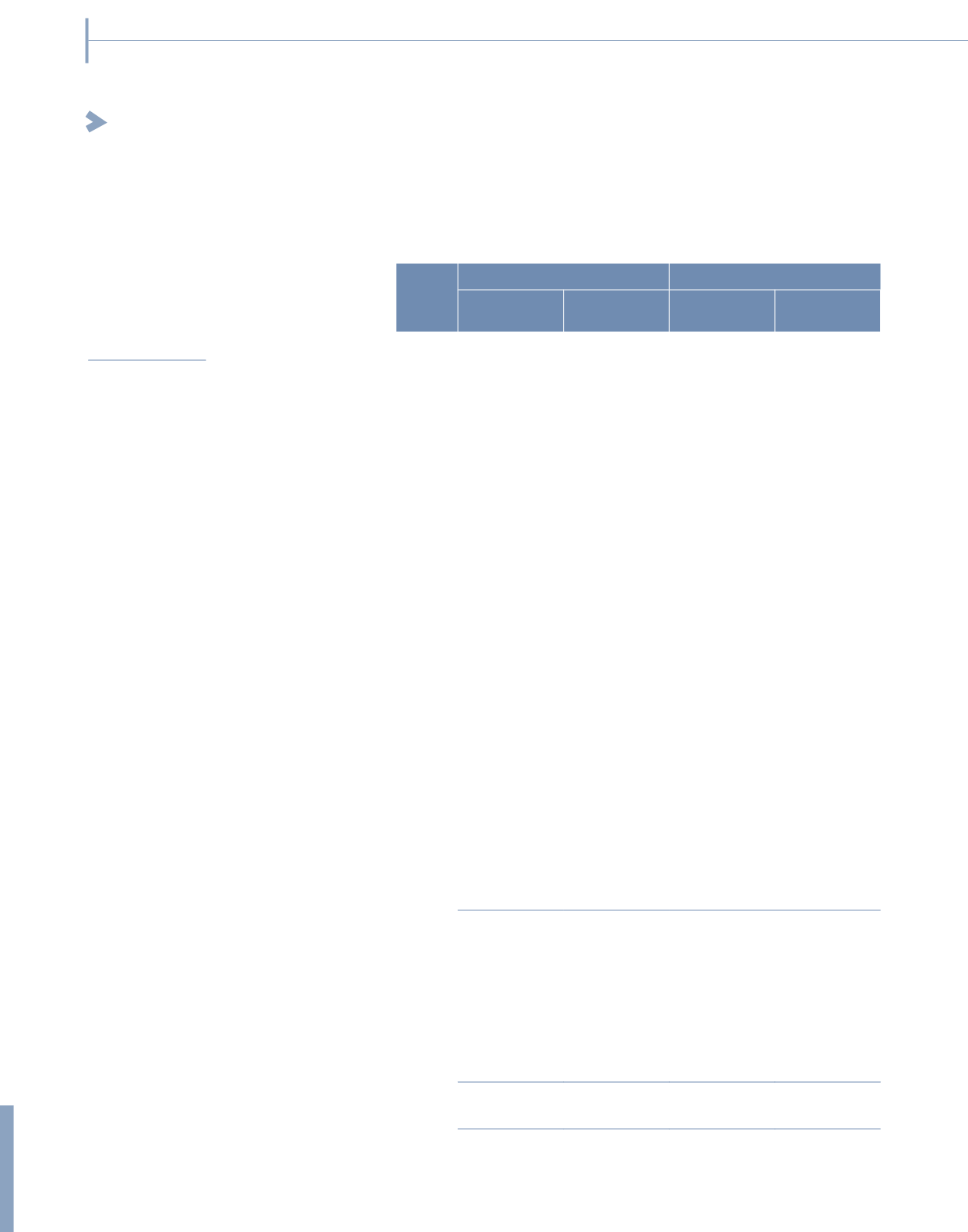

Group

Company

Note

2015

RM’000

2014

RM’000

2015

RM’000

2014

RM’000

Operating activities

Profit before zakat and tax

209,608

218,084

93,197

82,964

Adjustments for:

Share of results of associates

(39,198)

(40,415)

–

–

Finance income

8

(13,731)

(12,982)

–

–

Finance costs

8

64,157

42,857

22,625

22,519

Dividend income from subsidiaries

–

–

(111,482)

(107,118)

Trade receivables:

– Impairment

25

5,814

6,843

–

–

– Reversal of impairment loss

25

(947)

(917)

–

–

Impairment of goodwill

–

728

–

–

Share based payments

26,477

–

3,037

–

Gain on fair value on investment properties

17

(11,421)

(14,461)

–

–

Gain on disposal of investment property

–

(166)

–

–

Gain on disposal of shares in an associate

(1,577)

(1,732)

–

–

Gain on disposal of non–current assets

held for sale

(5,986)

(1,577)

–

–

Property, plant and equipment:

– Depreciation

16

118,713

108,268

–

–

– Written off

6,374

473

–

–

– Loss on disposal

154

266

–

–

– Reversal of impairment loss

–

(3,581)

–

–

Inventories written off

120

96

–

–

Available–for–sale financial assets written off

6

266

–

–

Amortisation of software development

expenditure

456

1,140

–

–

Operating profit/(loss) before working

capital changes

359,019

303,190

7,377

(1,635)

Changes in working capital:

Inventories

(3,606)

8,013

–

–

Receivables

(109,085)

(16,700)

(398)

(54)

Payables

(73,440)

86,708

(2,038)

2,804

Deferred revenue

65,837

6,547

–

–

Related companies

–

–

(27,593)

56,042

Cash flows generated from/

(used in) operations

238,725

387,758

(22,652)

57,157

232

STATEMENTS OF

CASH FLOWS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015