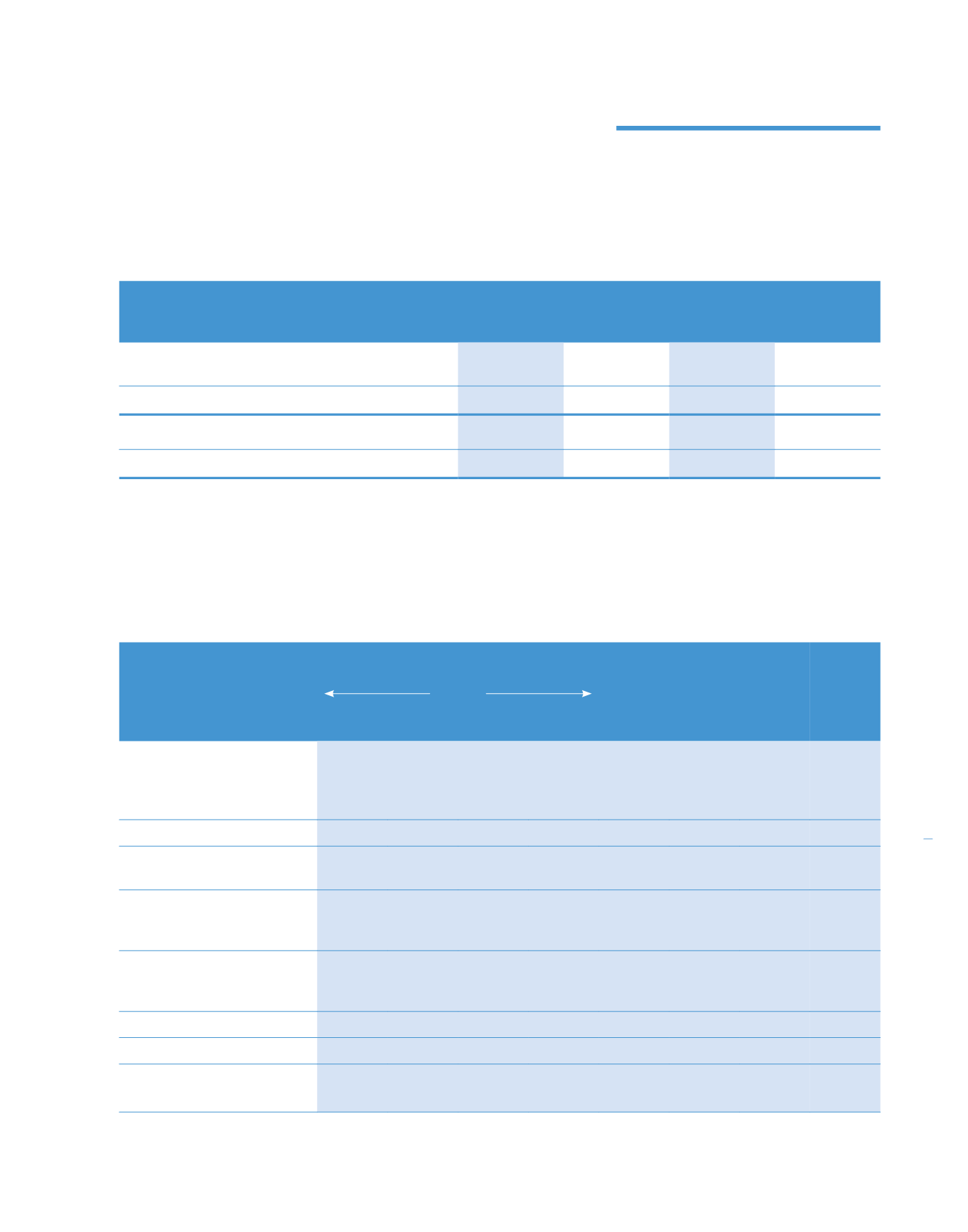

42. CAPITAL MANAGEMENT (CONTINUED)

The Group’s gross gearing ratios as at 31 December 2014 and 2013 were as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Current borrowings

915,921

857,622

250,000

275,000

Non-current borrowings

335,467

169,870

–

–

Total

1,251,388

1,027,492

250,000

275,000

Shareholders’ funds

1,259,360

1,085,636

621,276

514,655

Gearing ratio

0.99

0.95

0.40

0.53

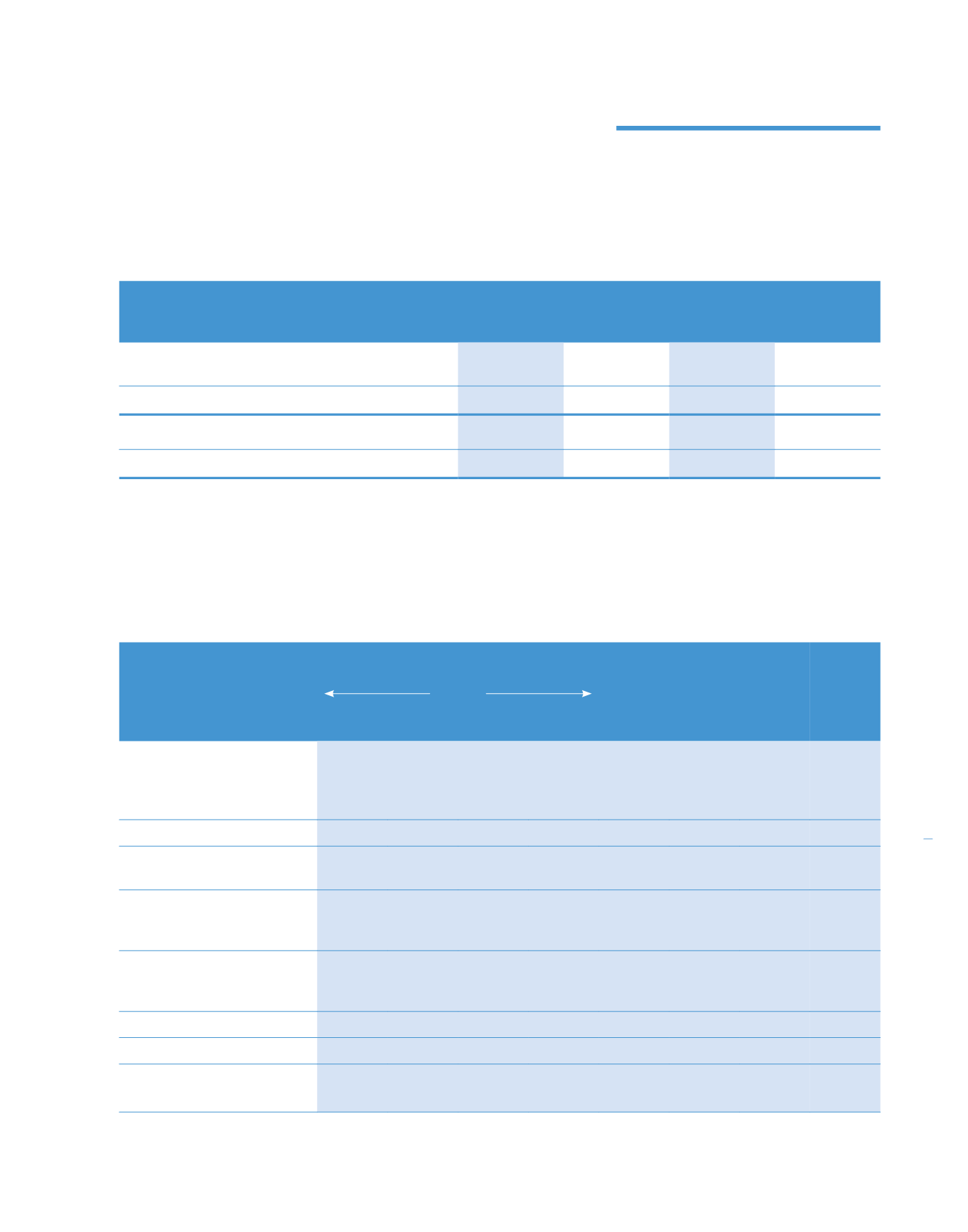

43. SEGMENTAL REPORTING

The Group principally operates in one main business segment namely the operating of specialist hospitals. Support services

of the Group mainly comprise provision of management services and pathology and laboratory services, marketing and

distribution of pharmaceutical, medical and surgical products and operating a private university college of nursing and allied

health.

Support

Aged care services, Adjustments

Hospitals

Facility corporate

and

Malaysia Indonesia Thailand

Total

Australia and others eliminations Consolidated

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

Year ended 31 December 2014

Revenue

Total segment revenue

2,363,392

39,714

– 2,403,106

29,503

810,758 (604,231)

2,639,136

Inter-segment revenue

–

–

–

–

–

(50,115)

50,115

–

Revenue from external customers

2,363,392

39,714

– 2,403,106

29,503

760,643 (554,116) 2,639,136

Results

Share of results of associates

28,740

–

2,426

31,166

3,062

6,187

–

40,415

Adjusted EBITDA*

356,796

240

2,426

359,462

(3,839)

174,681 (161,095)

369,209

Depreciation and amortisation

(93,388)

(2,569)

–

(95,957)

(406)

(11,905)

– (108,268)

Finance cost

(22,921)

(3)

–

(22,924)

(572)

(44,293)

24,932

(42,857)

Profit before zakat and tax

240,487

(2,332)

2,426

240,581

(4,817)

118,483 (136,163)

218,084

Zakat

(2,022)

–

–

(2,022)

–

(250)

–

(2,272)

Income tax expense

(64,893)

–

–

(64,893)

1,619

(10,476)

5,184

(68,566)

Profit for the year

173,572

(2,332)

2,426

173,666

(3,198)

107,757 (130,979)

147,246

Total assets

2,235,486

47,554

– 2,283,040

127,729 4,144,451 (3,219,216) 3,336,004

Investment in associates

366,899

–

68,675

435,574^

35,854

32,515

(28,952)

474,991

Total liabilities

1,231,210

48,088

– 1,279,298

127,963 3,283,657 (2,703,821) 1,987,097

* Earnings before interest, taxation, depreciation and amortisation (“EBITDA”).

^ Related to investment of an associate in Thailand.

293

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014