41. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONTINUED)

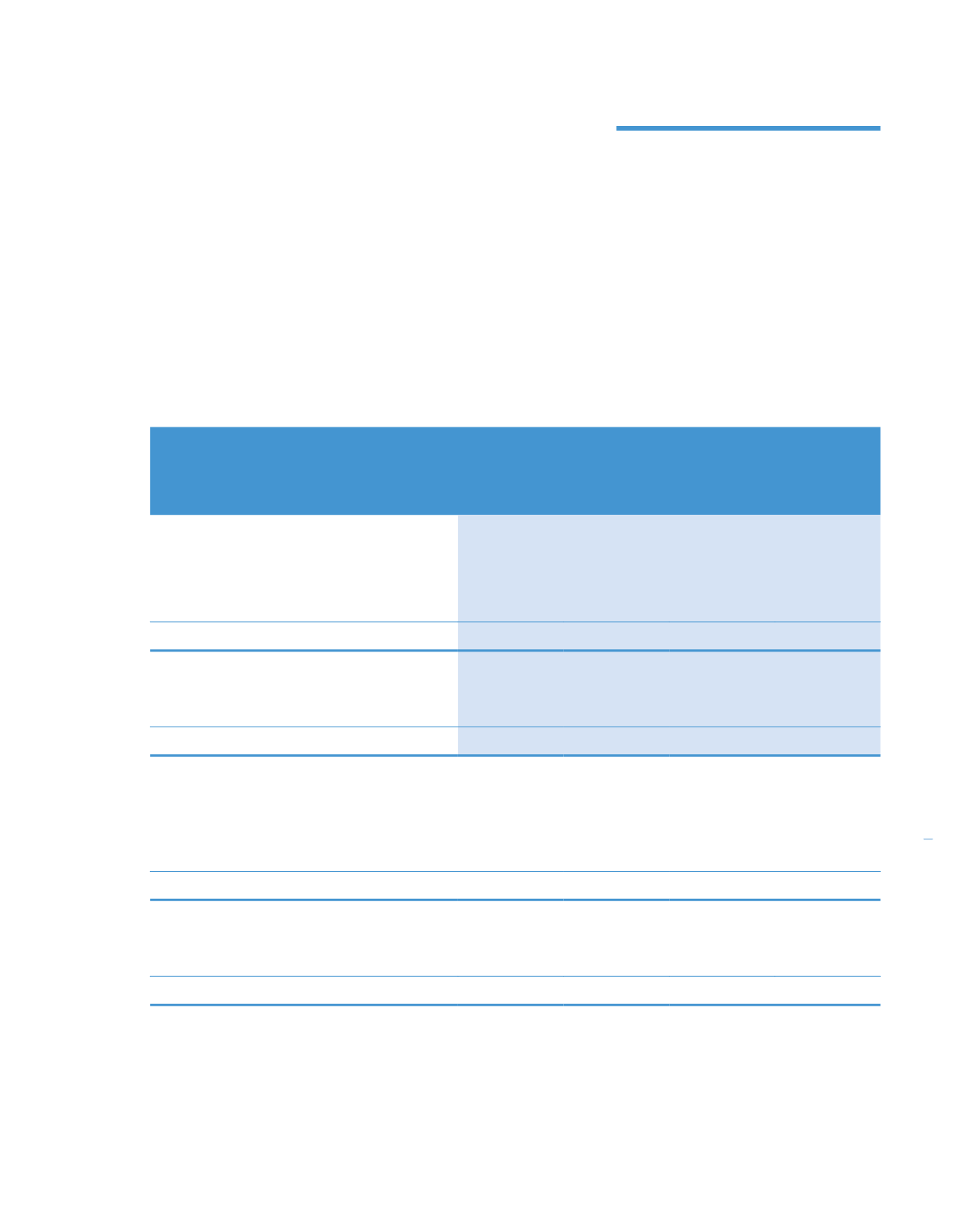

(b) Liquidity risk

Liquidity risk is the risk that the Group or the Company will encounter difficulty in meeting financial obligations due to

shortage of funds. The Group’s and the Company’s exposure to liquidity risk arises primarily from mismatches of the

maturities of financial assets and liabilities.

Analysis of financial instruments by remaining contractual maturities

The table below summarises the maturity profile of the Group’s and of the Company’s liabilities at the reporting date

based on contractual undiscounted repayment obligations.

On demand

or within

One to five

Over five

one year

years

years

Total

RM’000

RM’000

RM’000

RM’000

2014

Group

Payables

565,158

–

–

565,158

Borrowings

960,277

258,140

153,119

1,371,536

Deposits

17,996

–

–

17,996

Total undiscounted financial liabilities

1,543,431

258,140

153,119

1,954,690

Company

Payables

234,853

125,447

–

360,300

Borrowings

260,100

–

–

260,100

Total undiscounted financial liabilities

494,953

125,447

–

620,400

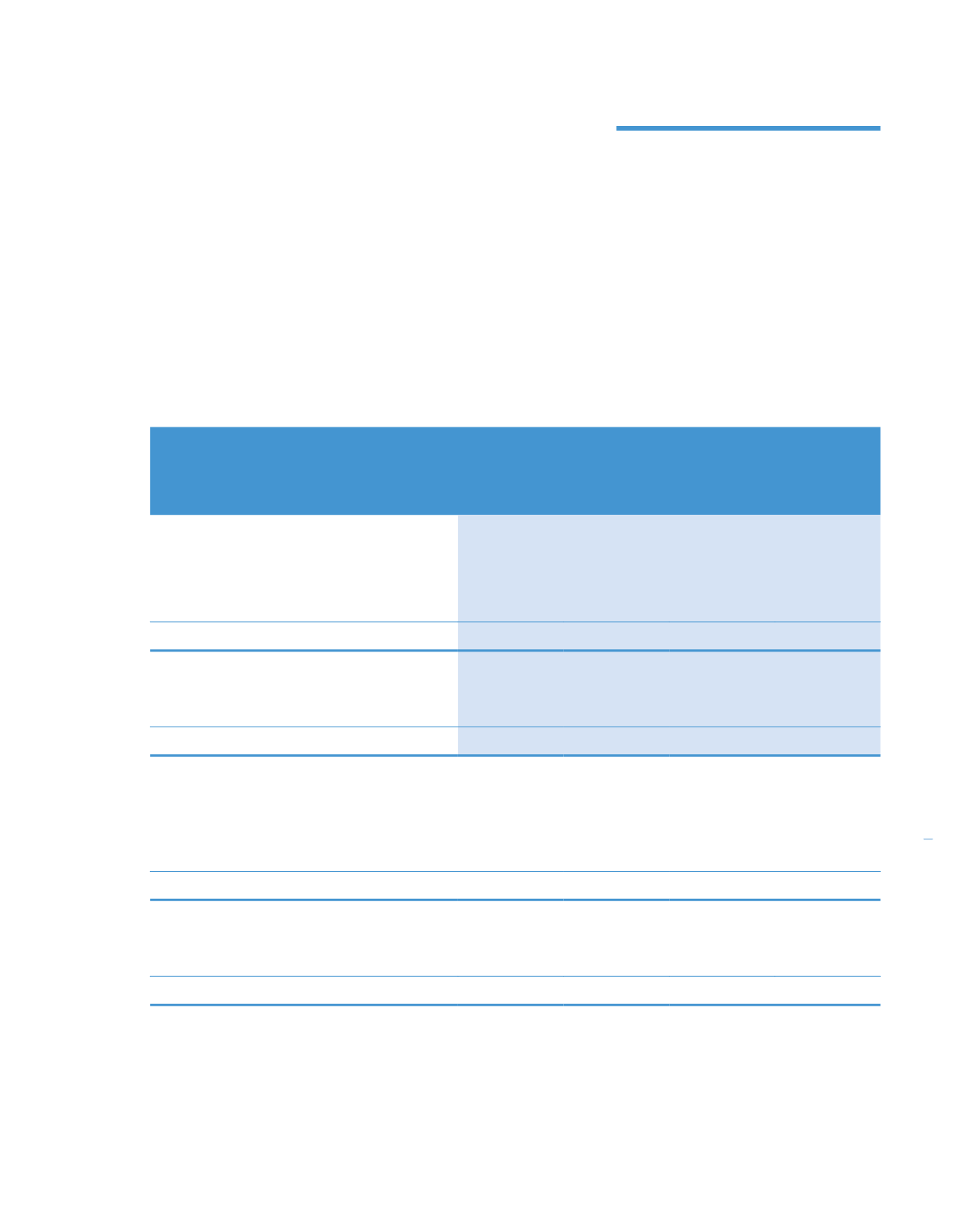

2013

Group

Payables

403,446

–

–

403,446

Borrowings

857,622

128,606

65,288

1,051,516

Deposits

17,253

–

–

17,253

Total undiscounted financial liabilities

1,278,321

128,606

65,288

1,472,215

Company

Payables

85,964

174,282

–

260,246

Borrowings

287,073

–

–

287,073

Total undiscounted financial liabilities

373,037

174,282

–

547,319

291

Notes to the

Financial Statements

For the financial year ended 31 December 2014 (continued)

KPJ Healthcare Berhad annual report

2014