GROUP FINANCIAL HIGHLIGHTS

We are pleased to report that the Group turned in a healthy

13% growth in revenue to RM2.64 billion in 2014 in comparison

to revenue of RM2.33 billion in 2013. This, KPJ’s highest

revenue to date, comes on the back of organic growth as well

as an increase in income from newly completed projects and

acquisitions.

The Group’s profit before zakat and tax (PBZT) registered a

37% increase to RM218.1 million as compared to a PBZT of

RM159.6 million in the preceding year.

For 2014, the Group registered a 33% increase in net profit to

RM147.2 million as compared to net profit of RM110.4 million

in the previous year.

In respect of financial year ended 31 December 2014, a total

of RM76.7 million was distributed to shareholders in dividend

(2013: RM39.2 million) giving a total dividend payout of 51.6%

(2013: 35.6%).

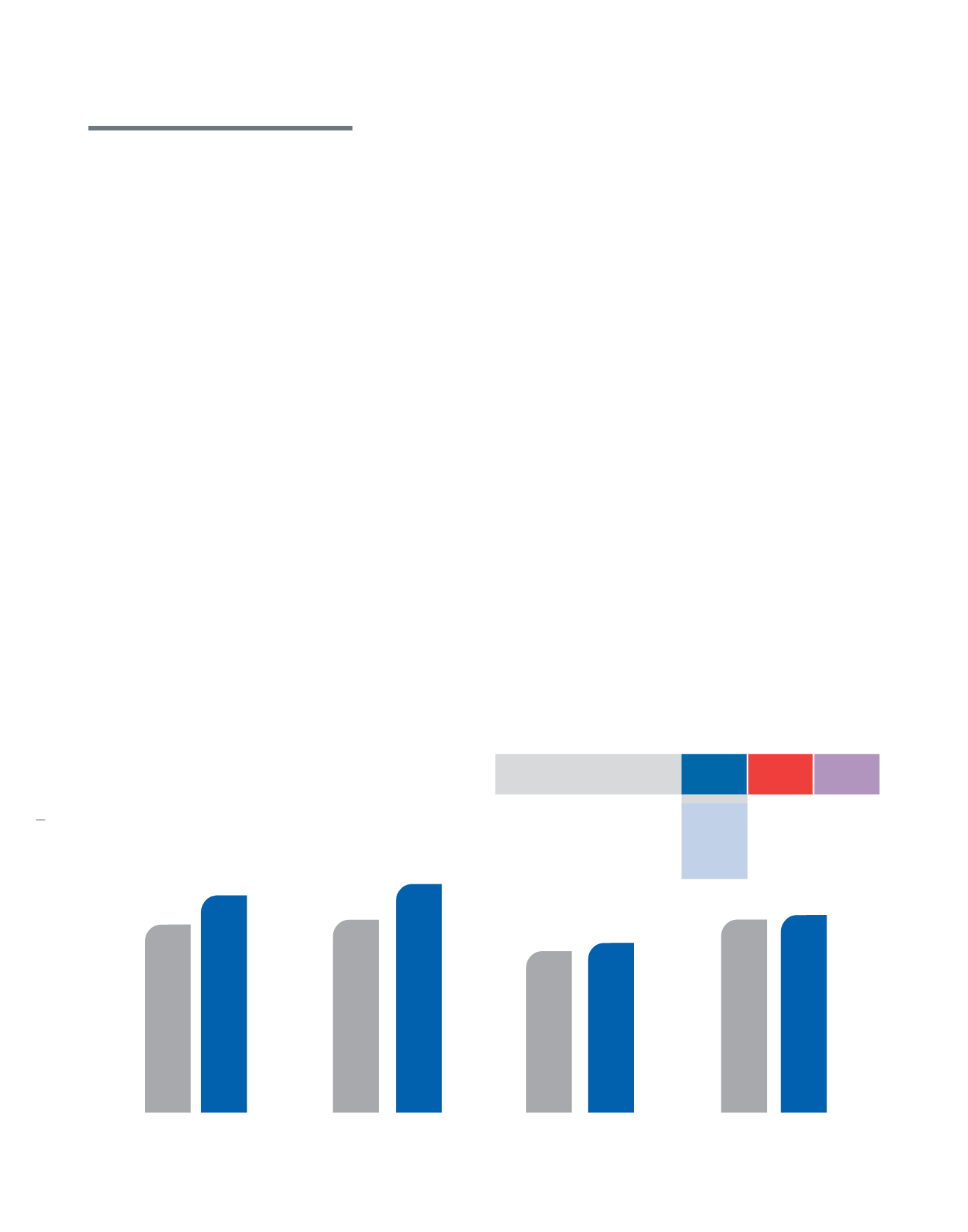

SEGMENTAL FINANCIAL HIGHLIGHTS

The bulk of the Group’s 2014 revenue was derived from the

Malaysian operations which contributed 90% of total revenue.

Revenue from local operations rose 15% year-on-year (YoY) to

RM2.363 billion from RM2.054 billion previously on the back of

higher revenue from existing hospitals and newly opened

hospitals within the Group.

The Group’s hospitals in Indonesia continued to make good

progress in 2014, turning in a 19% hike in revenue to

RM39.7 million from RM33.5 million previously. This increase

in revenue was mainly attributable to the revenue contributed

by RS Medika Permata Hijau and improvement at RS Medika

Bumi Serpong Damai during the financial year.

The Aged Care Facility Services segment recorded revenue of

RM29.5 million in 2014, some 5% higher than 2013’s revenue

of RM28.0 million.

Revenue from KPJ’s Ancillary Services segment improved by

3% to RM760.6 million in 2014 from RM742.0 million

previously. The higher revenue was attributable to growth in

activities connected to the marketing and distribution of

pharmaceuticals, medical and surgical products, as well as

higher demand for pathology and laboratory services. These

activities grew in tandem with the increased revenue from the

Group’s hospitals.

Revenue

(RM‘000’000)

2014

2013 Y-o-Y

Malaysia

2.363

2.054

15%

Indonesia

39.7

33.5

19%

Aged Care Facility

29.5

28.0

5%

Ancillary Services

760.6

742.0

3%

054

KPJ Healthcare Berhad annual report

2014

Group

Financial Review

13’

14’

13’

14’

13’

14’

13’

14’

2.363

2.054

39.7

33.5

29.5

28

760.6

742

Malaysia

Indonesia

Aged Care Facility

Ancillary Services