This is a SEO version of ar2010. Click here to view full version

« Previous Page Table of Contents Next Page »25

Our core focus remains in the delivery of quality care as we continue to strengthen the community’s trust and confdence in KPJ Group’s Medical Consultants and hospitals.

We are pleased to report that the past year has been a successful year on several fronts, where we have delivered positive results to all stakeholders.

FOR OUR SHAREHOLDERS

Continued Improvement in Financial Performance KPJ continues to meet shareholders’ expectations in terms of fnancial performance, delivering robust results in fscal year 2010 as earnings contribution from hospital operations rose amid consistent improvement in services and capacity.

For the year ended 31 December 2010, KPJ posted a total revenue of RM1.65 billion, up 13.0% from RM1.46 billion a year earlier, with pre-tax proft improving by 15.8% on year to RM166.69 million, from RM143.89 million previously. The sterling results were accompanied by strong cash fow and balance sheet.

For fnancial year ended 31 December 2010, KPJ continued to create positive Economic Value Added (EVA) of RM68.65 million, an increase of RM16.4 million or 31.4% over the RM 52.2 million created in 2009.

Provide Stable Returns

The strong fnancial performance enabled us to enhance shareholder value through consistent dividend payout.

For the fnancial year 2010, KPJ declared a gross cash dividend of 15 sen per share of RM0.50 par each, compared with 20 sen per share of RM1.00 par value a year earlier, with a total payout of RM62.21 million after deducting for tax.

KPJ’s corporate exercise of subdividing one ordinary share of RM1.00 into two ordinary shares of RM0.50, followed by a 1-for-4 bonus issue and subsequent 1-for-4 free warrant issue, was completed on 15 January 2010 and thus improved liquidity.

It also enlarged KPJ’s paid-up capital to RM263.81 million, from RM211.05 million previously, and will increase to RM329.77 million upon full conversion of the warrants. With greater liquidity, strong fnancial results, good growth prospects and easy access to information via Investor Relations activities, KPJ shares garnered wider following among the investors.

KPJ’s share price appreciated by 43% over the 12 months of 2010, closing at RM3.72 and outperforming the FTSE Bursa Malaysia KLCI, while its warrants sizzled upon its listing on 15 January 2010 and surged 117% over the year to end at RM1.96.

This elevated KPJ by several notches in Top 100 Companies list on Bursa Malaysia, to rank at 85 at end-2010 with RM2.08 billion in market capitalisation, from the 91st spot a year earlier with RM1.37 billion in market capitalisation.

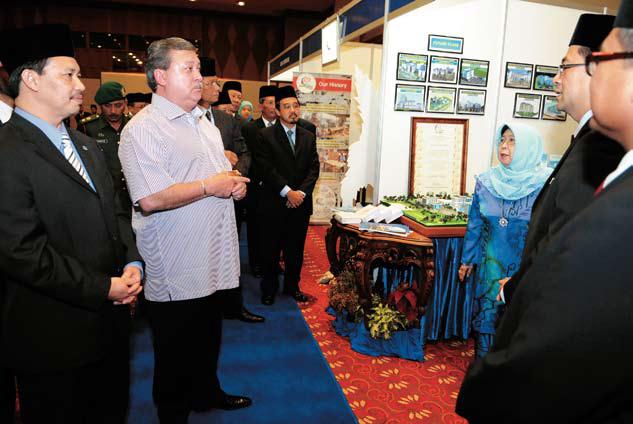

DYMM Sultan Ibrahim Ibni Almarhum Sultan Iskandar, Sultan of Johor, accompanied by JCorp President and Chief Executive, Kamaruzzaman Abu Kassim, visiting KPJ’s booth

This is a SEO version of ar2010. Click here to view full version

« Previous Page Table of Contents Next Page »